Yesterday I wrote a blog post stressing the importance of making the real trades intraday. One of our very experienced traders sent me this question:

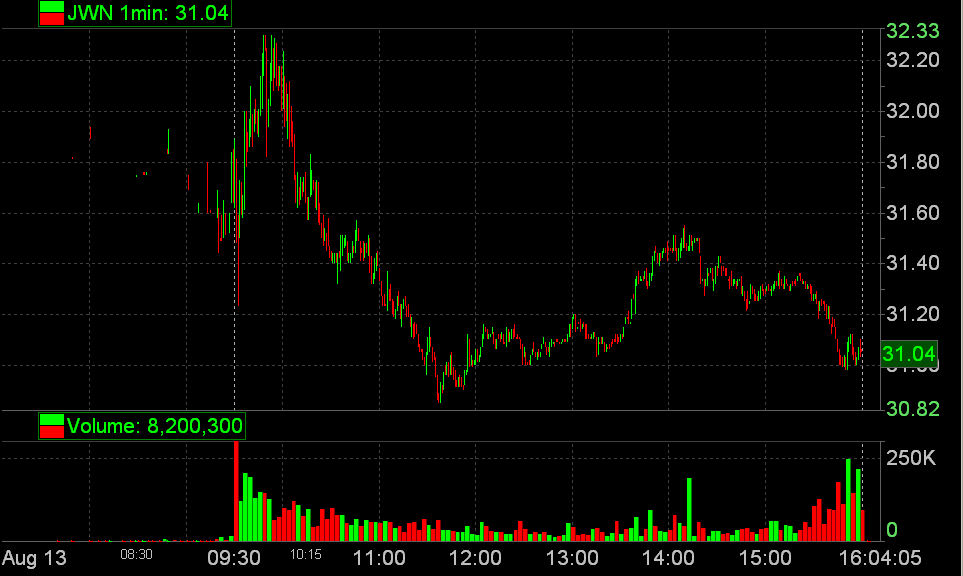

i traded JWN today… why did you want to buy above 32 when it had just closed the gap and showed no signs of holding support? to me, that’s a trade that flies in the face of fundamentally good technical trading. maybe we’re seeing something differently but i dont see how that can be a model trade… it was actually a good short as it lost momentum after closing the gap and dropped support, right?

there was also a textbook pullback to vwap at 2:00 in that stock that i walked the new guys sitting around me through. that is a good and easy trade.

i know different opinions make markets but i just thought the pay above a whole number wasn’t the trade to hold out as THE trade in jwn today.

Bella Responds

Great question by a serious market thinker. And thanks for making my Saturday AM a little more interesting as I consider this trade again.

First, I am not crazy about this trade because it steps outside of the stocks I have been most successful with this trading month. I will try and write more about these stocks tomorrow. In short, I have been trading the stocks with fresh news that were either really good or really bad. And JWN did not fit into that box.

32 was a longer term technical level that we identified in our AM meeting. Above this level was another check in our favor. We spotted a bullish flag intraday before this level. And then a very impressive move above both on the chart and the tape. The impressive move on the tape above 32 sparked my trading intuition that JWN might make a move to at least above 32.50. I formulated a trading plan to buy into the pullback below the whole.

Now one huge advantage of being an intraday trader is that we can use our trading skills to improve our price and thus our win rate per trade. My plan was to buy a pullback below 32 using my tape reading skills to start my position. JWN made a sharp and quick drop below 32, slowed every so slightly to my microscalping eye at 83c, where I placed a bid and got hit. I know some others on our desk got stopped out below 85c. But again I was buying the pullback below the whole and got the low print into the downmove. Hey it helps to have trading skills.

I did not love the downmove below the whole. I was not a fan of the upmove after the downmove. I took off most of my position into the next upmove to 13c and held the rest (I got stopped out of 1/3 at 31.79).

My playbook is more nuanced than most new traders. Most developing traders will just buy the pullback and hope for the best. I have many more if/then statements. So since I was not a fan of the downmove nor the upmove I took off most of my risk. Essentially I aborted a one lot pullback trade into a scalp fade trade leaving a 1/3 Trade2Hold position.

Now admittedly this can get very complicated. And there might never be a way for me to teach the trade that I made. Or readjust midtrade the trade I made. That takes trading intuition built through 12 years of screen time. But the underlining point to my previous blog is still important. I was making one pullback trade. I was not going to pay above 32 for a momentum trade, fade the move to 32.33, bid 32.11 after a sharp return to the whole and kick it out at 32.17, bid 32.01 and sell 32.11. We may have done this in some stocks in 08. And these were all trades that would have worked.

We make trading decisions based upon three factors: intraday fundamentals, reading the tape, and technicals. The weakness with my JWN trade for me, even though I turned into a profitable one because of my trading skills, was that the news was not bad enough or good enough for JWN to trend cleanly in one direction yesterday. This lowered the win rate for my JWN pullback trade such that it may not have been a trade that was best for me in this market environment.

In this market there are only real trades to be made, at excellent prices, waiting for real moves. We must focus on the real trades.

Finally I love you finding a VWAP trade that made sense to you with this same trade. If the SMB Training Blog is getting readers to think about these set ups and find such trades that make the most sense to them, then we are really making a significant contribution to the trading community. And that puts a huge smile on my face.

Mike Bellafiore

Author, One Good Trade (Wiley)