*****Editor’s note: Here’s the latest post by Jake Huska, who is a college student working on his trading game.*****

With earnings right near their peak, there have been many opportunities for the intraday trader. Earnings season will start to wind down in the next two weeks, so enjoy the increased volatility in individual stocks while it lasts.

In this post I will share three recent intraday trades of mine. I don’t want to make this post too long, so I will try to include only the most essential information. I have also accompanied each explanation with at least one chart detailing my entries and exits.

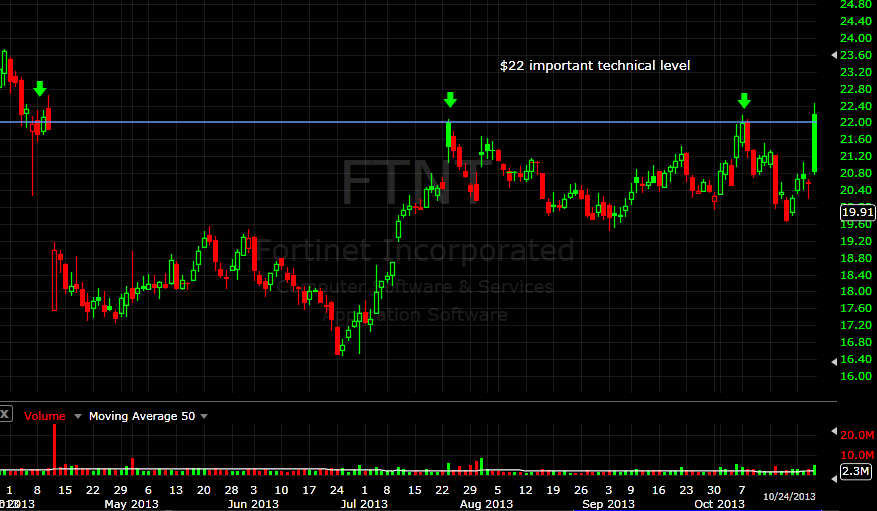

1. FTNT: When I was game planning last Thursday morning (10/24/13), I had two simple scenarios for this particular name. The stock was gapping up to an important technical level at $22. For me, I knew that if it was after 10am and the stock was above the $22 technical level, it should see a decent up move (assuming it didn’t just see a parabolic up move right on the open). In contrast, I told myself that if the stock was still below $22 after 10am, there was a likelihood of seeing an intraday reversal off that level. While 10am is an arbitrary time, I felt that if the stock couldn’t manage to hold above that level 30 minutes after the open, it probably just wasn’t going to happen. The five-minute chart below details my executions in this trade.

2. TKR: This would have been a really nice short last Thursday as well, but unfortunately it just wasn’t on my radar that day. On Friday, though, I was watching it as a Second Day Play. It drove below the prior day’s low and consolidated lower below VWAP. Based on the nice price action the day before, I felt this was a nice Second Day Play trade. I covered ½ of my position into my first target, which was $50.80 and was later stopped out of the rest. For a complete view of my executions in this trade, see the five-minute chart below.

3. BA: This is an example of a good trade (IMHO) that wasn’t profitable. BA was gapping up about 3% on the open. After the open, the stock formed an opening range between $127.30 and $128.80. Once the stock drove above the top of this range, I got long for a Break of the Opening Range Play. Just as a side note, it was sort of funny because I remember making the remark I couldn’t believe this thing was at $130; apparently some others thought the same thing, as I was later stopped out for a loss. The five-minute chart below details my entry in this trade.

I hope this post isn’t too brief, but I just wanted to share a couple of quick examples of some recent setups and trades that I’ve made intraday. With earnings season still underway, I’m sure I will be sharing some more trades of mine in next week’s post. Please let me know if you have any questions or comments: @MarketPicker (Twitter & StockTwits)

Related blog posts:

How I Categorize My Intraday Watchlist

Knowing Your Risk on Multiple Time Frames

No relevant positions