Mike,

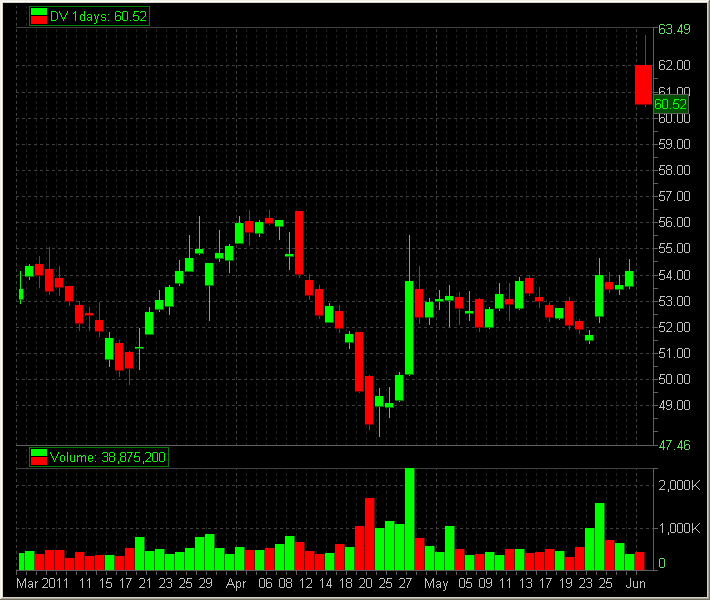

I have a quick question today about a setup I was in… After a great run-up from this AM and yesterday the education stocks were starting to come back to life and making fresh intra-day lows (around 11AM)… I saw APOL, STRA and ESI making these intra-day lows (the spys were making lows as well)… while cycling through the whole sector I shorted (first SS at 11:08 AM) 2 tiers of DV because it was still in the middle of it’s range and holding the $60.00 level… usually i risk no more than 5-10 cents in my plays but I was willing to give DV a little extra room just because I know it was very thin and that I believed my probability of success in this play was very high (80-85%)… DV traded a little higher and then came back down to the $60 level where I shorted another two tiers at (11:17)… At this time APOL, STRA, ESI, and the market were making lower lows…I thought I was golden… As you can see from the chart DV held this $60 level like a champ and never looked back… I ended up missing my out and taking a 50 – 60 cent ripper on a fairly large position for me. I practice a lot of trading psychology and always try to never beat myself up over what I think to be is a good trade that just doesn’t work out…however I still can’t get over this one…

Was this maybe not as good of a setup as I think/thought it was? Did I just get unlucky/unfortunate? Should I have maybe just gotten one tier as 60 was holding and shorted the other 3 tiers once the level broke?

Bella Responds

A few observations:

1) Are you assuming DV is an intraday downtrend and thus shorting the bearish flag? Be careful about confusing an opening drive for a stock trending. Stocks do not trend in the first 30-45 minutes of trading. They trend AFTER the open.

Edit: You were making a relative strength trade as the sector was weak. This can work if the sector is very weak and In Play and has some room to run to the downside.

2) I do not like you adding those extra two lots. I suspect you were making a chart play with the bullish flag pattern. That is one trade. DV is still in this pattern. There is no new information that would get you longer here. It is still just trading around the 60 level. Yes you are spot on that if it moved away from 60 and held lower this then would be a reason to add some size.

Edit: I have since learned you were making a relative strength play. If DV held below 60 this could be a reason to add some size after you started your initial positions as relative strength plays. Also an area of resistance holding below 60 as it moved away from this price would be the better trade.

3) You are big at a time of the day that may not offer the liquidity to handle this position for you.

4) You cannot miss your stops. If you did then you cannot trade with all that size.

5) When you trade with that many lots use automatic stops for some of your size. For example, some automatic stops above 25c and 30c would have been appropriate.

Hope that helps!

Mike Bellafiore

Author, One Good Trade