Hi Mike.

Yesterday in you webinar you showed us a chart on Toyota that dropped nicely on bad news.

After that initial drop the stock began a sideways move.

The question is: Do you continue to trade that stock during the day even though its going kind of sideways, or do you wait for it to brake the lows or S/R again?

Do you continue to read that stock and trade of intraday levels and volume levels being created during the day, or do you wait for bigger picture setups before you step in and read the action closer?

I guess this is personal from trader to trader, but do you use som kind of guidelines regards to this?

Bella Responds

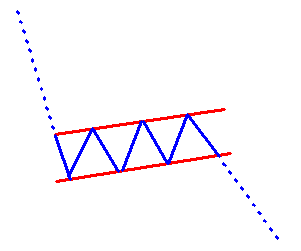

We call the trade that you have described a bearish flag pattern technical trade. In the TM trade you referenced 75 was an important technical level, and then broke. When a stock breaks an important technical level, trades lower and then trades sideways, we stay short. We will add when the stocks breaks to the downside again (see example above). This is a Trade2Hold high probability technical trade awesome for all traders to master. We encourage our traders to place A trade risk, their max intraday risk, for such setups.

Mike Bellafiore

Author, One Good Trade

7 Comments on “Traders Ask- How Do I Trade a Bearish Flag Pattern?”

“We will add when the stocks breaks to the downside again (see example above).”

If you missed the initial down move and decide to initiate a position when the flag breaks, where would you place your stop loss? Above the upper trendline of the bear flag? What if there is a seller holding the offer a little bit above the lower trend line and then the bear flag breaks? Would you place your stop loss above this seller if he lifts or would you stick with the upper trendline of the flag? Which stop loss placement would you say is more reliable (upper trendline or the seller close above the lower trendline)?

To the person asking the Q: If you check out MON from yest you will see this bearish flag pattern.

Dax: check out Adam Grimes blog on how he traded RIMM. He analyzed the bearish flag pattern and talks a bit about stops.

Adam is the man of all things technical on the SMB Blog. Next time I will just refer such a question to him 🙂

Dax,

I am a pro trader and have been for many many years. What is important is how you would handle those trades. So how would you? I would guide that the answer depends mainly on how much you expect to gain if you are correct on the trade and how confident you are in the trade.

Bella

Bella,

I typically place my stop loss above the seller on the offer. I try to aim for a 1:5 risk/reward ratio on my trades and I find that easier for me to achieve when my stops are tighter. The more volume the seller does, then the more confident I am in the trade. However, there are some occasions where my stop would be above the upper trend line of the flag. This usually happens when I see a mini bear flag on a 1 minute chart and the potential reward justifies having a wider stop loss.

Mike, if you weren’t yet in the trade and spotted the pattern would you ever consider entry near the top channel line in expectation of the downside break (given you stated you were confident of the pending break), or do you prefer to wait for the break?

I like finding a way in and then adding on the break.