Hi Mike,

I am a beginning stock trader. As I have another job to support me during my learning curve, I cannot trade intraday and instead I focus on swing trades that can last a couple of days.

My problem is that during those couple of days, you can have all kind of news that can reverse the trend and make the trade fail. What I am struggling with is when to change my initial plan and when to just leave the trade with its initial stop loss/target profit? (I can amend a trade just after the open and a bit before the close.)

BTW, I loved you book! Before that I didn’t know there was a difference between a prop trading firm and a hedge fund :-). And also, it’s good to know what the benchmark is for serious traders in this business (in term of work ethic).

For all this, thanks a lot Mike!

@mikebellafiore

I appreciate the kind words about One Good Trade.

You have some work to do. You might want to add some nuance to your trading. Often I sit in my office and talk to our traders about adding nuance to their trading. Let me give you one example of nuance you might consider with trading examples from this week.

From the information you provided you have to figure out which positions you are in are most sensitive to breaking news. For example, this week we were trading $FIO (chart below) on the short side. It was down a ton and in a downtrend. I was short. All of a sudden it spiked. Why? It was defended midday by Lazard. This completely changed the psychology of the stock as it spiked higher, traded higher, and opened up higher the next day. I was able to cover as I was at my seat and saw the sudden change. For the swing trader, you might have gotten blown out of the position points higher.

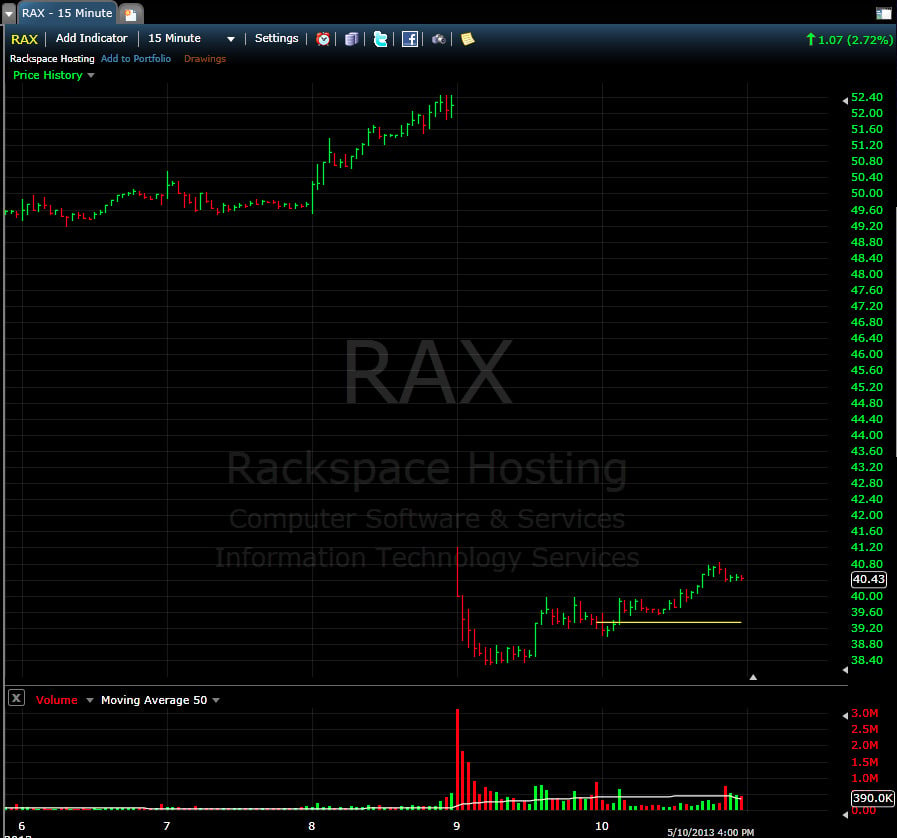

On a related note, I was trading $RAX the first day after its earnings. It was down a ton and in an intraday downtrend. I was short. I was considering my risk of another intraday defense by a research firm.

The takeaway here is that you might develop a system to lighten up for stocks that have moved too much in one direction as they could be more sensitive to breaking news. As you gain experience you will develop more nuance to lighten up in trades, cut them, or aggressively add to them.

Please also consider whether breaking news helps your swing trades as well. It could be entirely possibly that you are overvaluing the positions you are stopped out of because of breaking news and under-remembering the times when breaking news fueled further gains.

You can be better tomorrow than you are today!

Mike Bellafiore

Long $RAX