Almost five years ago two of the better traders ever trained by SMB asked for risk with longer term positions. We loved these guys and had all the confidence in their trading ability. After a period of huge gains the firm had had a particularly bad month and these two traders were not trading their intraday accounts well. Bad timing by them definitely plays as much of a part of this story as poor decision-making by us. We declined their ask for more risk on a strategy outside our expertise. That was a mistake. A mistake we try to not make today.

There are many different ways to attack the markets. As a P&L prop firm (as opposed to an arcade where traders front risk capital and do not have access to a proprietary trading platform) you almost always must give your most talented traders access to more products and risk and trust that they will find a way to develop an edge.

Fast forward to the present and meet former SMBU student and intern Weekly Young Blood. Below is an example of our prop firm greenlighting different ways to attack the markets from Weekly Young Blood. This trader was trained by SMB in options and stocks. This trader has found opportunities where the R/R is best using weekly options with some of the equities setups that we teach in SMB Foundation. Below is an example in MSFT better traded with weekly options, with commentary and a marked-up chart, from Weekly Young Blood.

The Weekly Options MSFT Trade

37 weekly call overnight/38.50s overnight

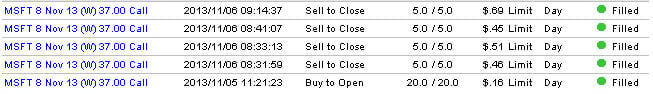

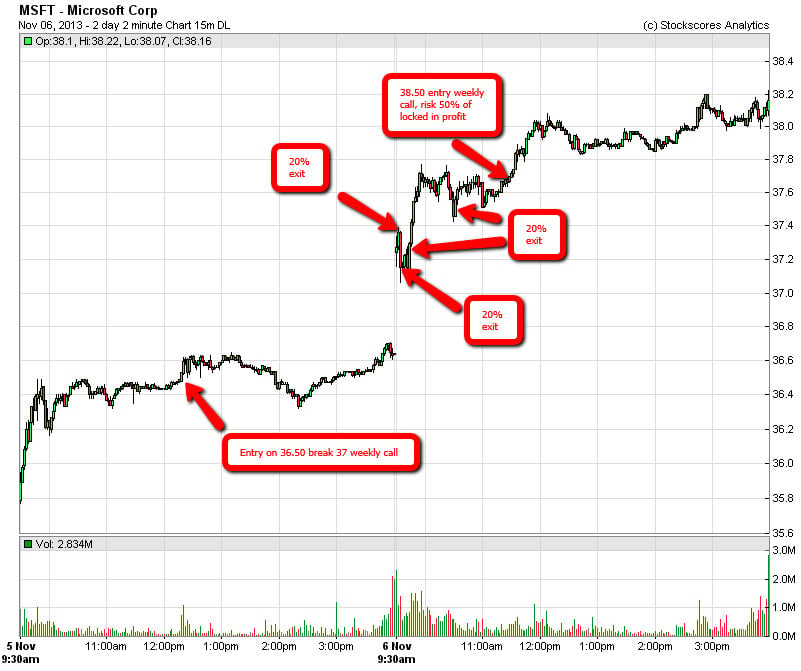

I was looking at MSFT around 10am and really liked the five-minute action, almost all green candles a rare sight for a giant stock such as MSFT. I hawked it for the rest of the day and determined if it broke above its daily resistance I would get long. When it broke 36.50 I grabbed the 37 calls, I was slow, I wanted to get the .11s but had to grab the .15s. After sideways action it pulled back and I decided to stop looking at it, put an alert for 36.20 to take an exit if it really puked. It rallyed end of day, I was considering adding more but decided otherwise since my risk profile was sufficient Pre-market it gapped up on an upgrade, I determined that I would take a partial exit very quickly as I have witnessed MSFT gap and trap quite often usually eviscerating the option premium. I took partial exits early around 9:30/9:40 and an hour later into the open. After my exit I re-assessed the stock and determined it was still a long so I took the 38.50s when it started to breakout to new highs. I held the position through the rest of the day and I am holding it overnight due to the strong EOD with suitable risk; 50% of my profits from my prior 37 call trade.

Related blog posts:

“Going to School” on Experienced Options Traders

Traders Ask: Does Every Options Strategy Work With Every Stock or Index?

You can be better tomorrow than you are today!

Mike Bellafiore