The market doesn’t care about your opinion. If you have a problem with this, get over it. Today during our After the Open Review one our Newbs got a harsh tongue lashing for thinking he knew better than the market. This is a learning experience for us all.

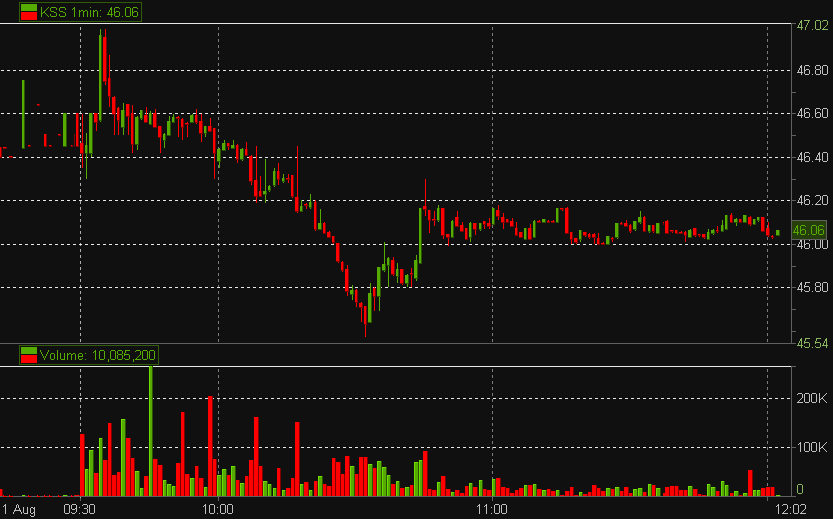

Iron Mike Mike made a great trade in KSS on the Open. KSS had earnings. KSS could not trade below 46.42. And then it did. Iron Mike Mike got short for a Trade2Hold. His target was 45.40ish. Perfect!

“Where is your out for KSS?” asked the balding (ok let’s be honest… bald) veteran trader from the back of the training room.

“46.43,” responded Iron Mike Mike.

“But you shorted KSS because it started an intraday downtrend. Don’t you need to cover if KSS breaks the intraday downtrend?”

“I had conviction that it would reach my target.”

Cue Coach Bella and an expletive deletive response, sure to be remembered by all in the roon. As it should be. Critical feedback is an important element to how all new traders learn.

I exploded: “The market doesn’t (expletive deletive) care where you think the stock is going. You are trading a pattern. It just so happens that your bias is being confirmed with the price action. But when the intraday trend is broken it is a cover.”

@alphatrends mocked those who make predictions on the twitter stream last week. Professional traders make good risk/reward trades and are not concerned with the outcome. Nor are they under the delusion that they really know where a stock or the market is headed. Those who will be pushing paper around at some dead end job in the near future are new traders who trade seeking to fulfill some narcissist need to be correct. Or smarter than the market. Or your trading neighbor. Or a friend. Get over yourself. You have no idea where the market or stocks are really going in six months. All there is are favorable risk/reward trades to make with the outcome uncertain and controlling your risk paramount.

Mike Bellafiore

Author, One Good Trade (Wiley)

2 Comments on “The Market Doesn’t Care About Your Opinion (KSS)”

The market tells you where your trade is going. Let your eye off that ball, and whammo. If the market gives you evidence that your trade is working and is continuing to work, then you stay in. If not, you reevaluate. The market may show you that you may need to reverse or get out and just sit on your hands for a bit.

Knowledge based from identifying what the market is telling you is not conviction. Conviction is set in stone, while the market is fluid and always changing as is your knowledge of it. Recognition of patterns, fundamentals, and tape reading is not conviction; it is just listening to the ever-changing market so you can have an edge enough to mint the coin.

If this trader’s reason to get in this trade was because a level could not be held, once that level is broken, he now needs some other handle to keep him in the trade in order to not give away his profit. Keeping his eye on the downtrending pattern is one such handle.

Just want to clarify:

Iron Mike Mike said his stop loss was 46.43, so wouldn’t he get stopped out when the 46.42 level initially broke at around 10:00 AM but then there was no follow through and price traded back above it? Or perhaps this was not a hard stop and he gave it more flexibility/room?

I was in this trade too. I hit the bids when 46.42 initially dropped but covered soon when there was no follow through. I re-shorted again below 46.20 when the mini bear-flag between 10:19 and 10:21 broke to the downside.