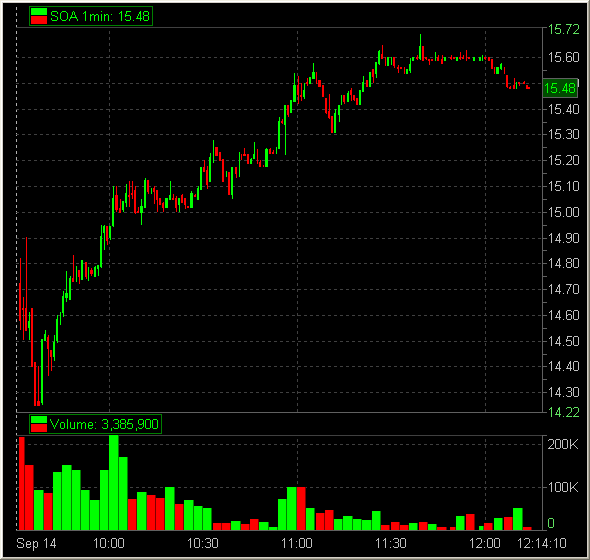

This Open I kept saying,”For some reason SOA is working.” Above 14.62 the top of the opening range was my first entry. And above the consolidation at 15.10 was my second. “SOA continues to work for some reason.”

Steve quipped SOA was the best stock we mentioned in our AM meeting. Like many traders he then found a moment of regret, “we should have killed SOA.” I am not sure I agree as the way it moved is not my favorite set up (perhaps a discussion for another blog.) It was just too slow and didn’t move away from prices as much as makes me more comfortable in a position. But that is just me and the slow uptrending stock can be the favorite of others.

So I am in this position, well in the money, and the question becomes when to sell. I am sure no one has every struggled with this issue 🙂 @howardlindzon on a Bloomberg TV spot remarked selling is more of an art. And SOA is one very good example of how.

A mentee and I took a quick look at the 5 day in SOA and found some ugliness at around 15.60-65c. SOA had failed from there miserably before and you couldn’t help but trade with caution as SOA approached this level. Now for the art. So do you sell when SOA gets to 15.60? Do you sell when SOA gets to near 15.60? Do you sell when SOA takes out the 15.44 on price after consolidation near the level? Do you sell when SOA tests 15.60 and fails? If have you multiple positions do you sell one and hold the other as DOA reaches near 15.60? Or both? Or none?

Ok you get my point here I hope. There are many decisions to be made. For me I want to take off one of my lots when SOA approaches 60c and then hold the other for it to clearly fail at 60c or stop me out on price. But those are my rules. I have internalized my rules so when SOA approaches then level then I know how I want to exit MY position. Reading this blog does not make them your rules. Reading this post and then thinking about rules that make the most sense to you, internalizing them, working on executing them, tweaking them, and then internalizing these improved rules will.

What is wrong is not thinking about how you will exit SOA. What is wrong is thinking too late when to exit SOA. What is wrong is blindly following some other trader’s exit. What is wrong is not having subsets for how you handle an approach to 60c. The high volume move to the level is very different than the low volume spike to the level. Both are very different with a very strong SPY versus a flat SPY.

And so goes the game. Hey if it were easy it wouldn’t be so much fun.

Keep working on your trading game!

Bella

3 Comments on “When do YOU sell (SOA)”

Hi Michael,

I figured I’d break this down and see if I follow your logic well…

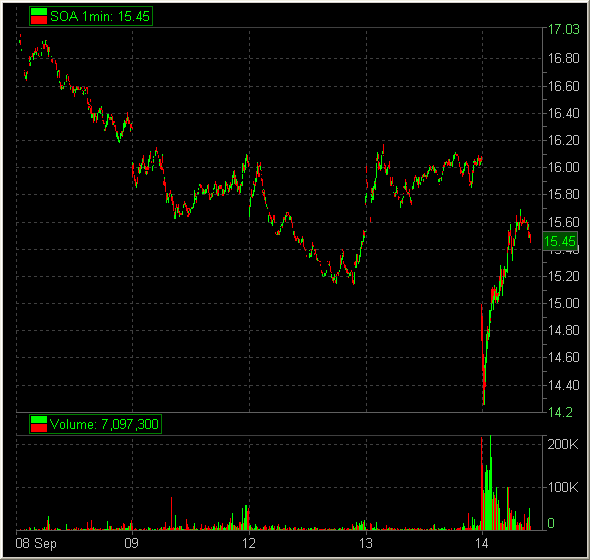

I’m looking at this chart here and I’m noticing:

1. On the 9th, SOA bottoms near 15.60

2. On the 12th, SOA does a little jiggle by 15.60, then goes lower, then closes near 15.60

3. On the 13th, SOA gaps up from 15.60, then tries to fill the gap but resumes the trend up.

4. On the 14th, today, SOA gaps way down due to news, then reverses and goes for a big climb which is what you rode up.

You assumed that the earnings related gap down was not sustainable (the market by comparison hardly made any gap), and so you played for a ‘mean reversion’. Your target was the previous support level of 15.60

On the long term chart, SOA appears to be in a range after a down trend, and the daily range seems to be on its down leg. So in a sense this was a counter trend trade, even though you went along with the immediate 1 minute trend.

I’m imagining as per reading about your method that the clue to get in was the tape, not the price per say. The price for you gave you the framework for the action.

wasn’t it also mainly because the range was broken? even though it was a sorta counter trend play as you mentioned. Breakout from a range is a nice trade on any timeframe and in any situation isn’t it? How would you have played that trade?

good job here. yes 15.60 is an important price b.c of all the activity after touching this level. for whatever reason this price is important to more traders based on its price action after touching.