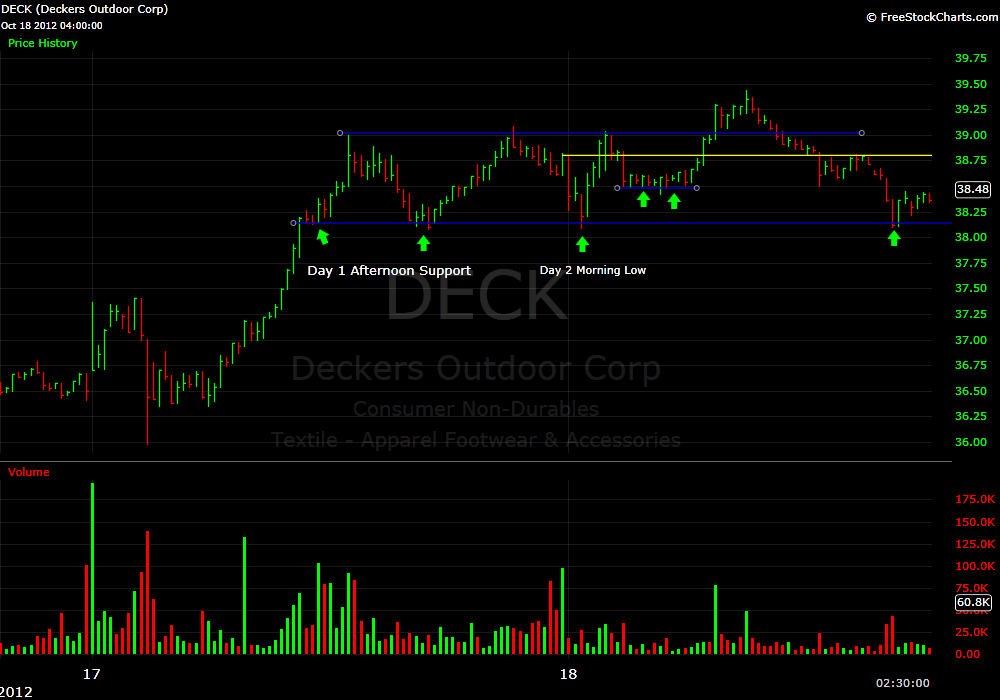

About a year ago I wrote Trading Lesson #1 offering a safe way to buy stocks that had shown strength the prior trading day. Let’s take a look at the price action from DECK today, which was discussed in a separate post yesterday on information flow.

DECK showed huge relative strength yesterday to the market taking out two important resistance areas from the prior two weeks. So it was on our watch list for more upside today. We set price alerts at yesterday afternoon’s support and resistance.

On the Open DECK had a quick drop out to 38.10 which triggers our price alert. It doesn’t stay down their long so only an opportunity for a 1/4 position. A buy on a quick dropout on the Open can be extremely difficult for a less experienced trader. At the time it is a position counter to lower time frame trend.

Whenever I buy into this sort of move I remind myself that the higher time frame trend is still intact. I also will keep the position small until the stock starts to move higher or has a consolidation. But it is very important to initiate a long into this down move as it will keep you focused on building a larger position when the stock shows signs of strength again.

Add this technique to your day trading game.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

No relevant positions

2 Comments on “Trading Lesson #1 (Again): Buying A Strong Stock At Prior Day’s Afternoon Support”

Steve,

On the first buy into afternoon support how much per share are you realistically risking? Would 15 to 20 cents and/or a hold below 38.10 for a reasonable amount of time be accurate? Thanks in advance.

dave,

that is exactly right.

steve