Meet Lance, @TheOneLanceB, and Bella in Chicago May 10th @BarCargoChi for pizza, drink, and networking. This is a Traders4ACause event benefitting @StridesForPeace. You can purchase tickets here. Lance won’t drink because it will mess up his Oura Ring sleep score. Well maybe for a special occasion like this he will. Bella won’t eat the pizza as he doesn’t really eat … Read More

How you bring a better you to each trading session (to increase profits)

In this post, you will be challenged to bring a better you to each trading session to increase profits. I will share one innovative idea a junior trader at our proprietary trading firm in NYC is using to drive his performance. And the nexus between his happiness and good trading. Let’s dive in. SMB Virtual Happy Hour on Happiness Recently, … Read More

Rhino Backtesting Report

Since releasing the Rhino options strategy last week, the number one topic of conversation is related to our 10-year study. Options traders are excited to see that rules which generated a strong profit in the 2008 bear market are also effective for runaway bull markets in later years. This type of out-of-sample data is very encouraging and one of the reasons the … Read More

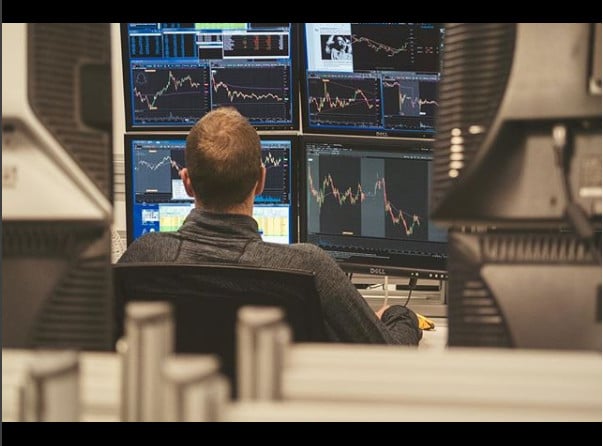

Immerse in a Culture of Success: Experience the Path to 7-Figure Traders

The best learning experience that you can have as a trader is to sit face-to-face and shoulder-to-shoulder with successful pro traders. Imagine listening to the words that traders use to describe the setups and live trades they are in. This is how you learn to speak the language of a profitable trader. Think about seeing the way traders follow … Read More

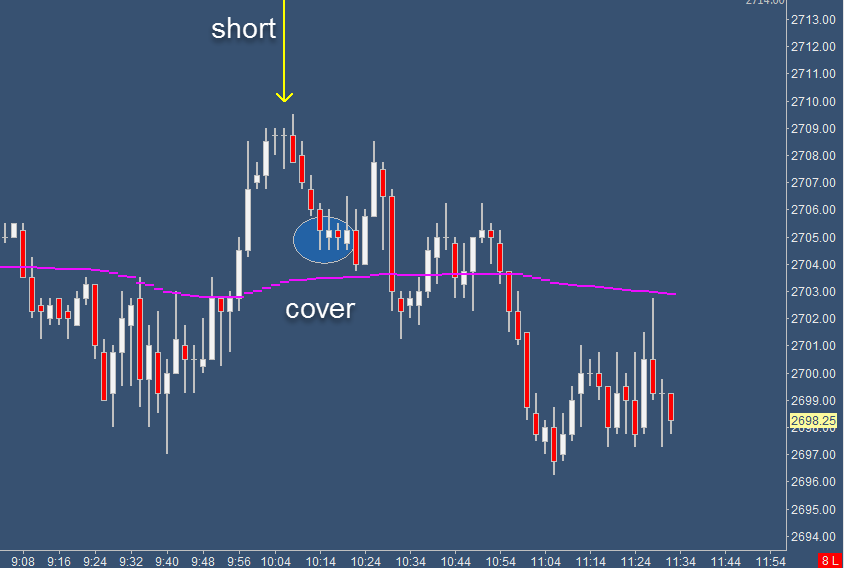

TOTD- Simple S&P Scalp

It’s time for the Futures Desk Trade of The Day! Have you guys noticed one of the key themes of most of the TOTD’s from our desk? For me it’s that the trades are not rocket science, and in fact they are quite simple. The key things I see in the posts so far as I study our own traders … Read More

Build a Better Options Trading Plan

The exercise of building an options trading plan is a very unique breed of business planning. We’ve found over the years that many options traders have career backgrounds as professionals or business owners. Traders with backgrounds like these often bring some of their old business planning tactics into their options trading plan. There are pros and cons to this. Pros … Read More

Traders call this a “frustrating” trading month

If you asked me to search my e-mails and chats for the word most used to describe trading this month it would be: “frustrating”. One trader wrote in an end-of-day review, “Very frustrating day for me due to finishing this red after most of the ideas were working in the AM.” Another trader wrote in his Daily Report Card, “definitely feeling a … Read More

Intro to Probability Based Trading

We’re excited to invite you to register for an SMB Live Online Class next week. Intro to Probability-Based Trading The goal of this class is to help you learn How To Leverage Market Data To Assist Your Trading Decisions. Join us to learn how you can improve your statistical edge by gaining a more complete understanding of probabilities in trading. We’re … Read More