For every trading decision we consider three factors: Reading the Tape, Intraday Fundamentals, Technicals. Let me explain how we do this while discussing RIMM from today.

Tehnicals

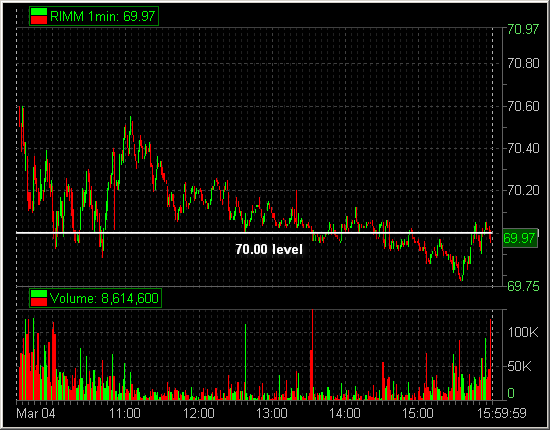

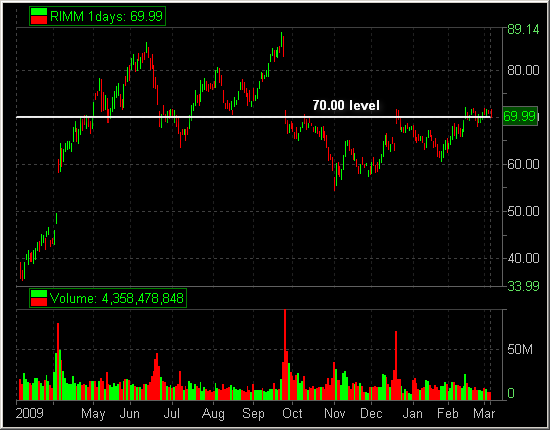

GMan has been pounding the table about RIMM 70 for a few days (GMan actually started his position at 70.50 so he was in a position of strength near this level). We draw all these fancy lines on our charts during our AM Meeting representing trend lines. Adam and GMan had some lines glittering on our 65inch Flat Screen TV highlighting the 70 level. The idea was if RIMM trades near 70 than this is a trading opportunity for us. This is not an automatic short or long. We focus our attention on RIMM at this moment and look for excellent risk/reward opportunities.

So when RIMM traded below 70 it received our full attention.

Intraday Fundamentals

There was no major news on RIMM today. Joe P did make the interesting point that EVERYONE has this 70 circled on their charts for RIMM. So below this level may bring out the selling and shorting. Also since this is such an important level we knew to be careful about the HFT’s playing their games, stopping us out of excellent risk/reward trades just because they can. So we had nothing from this element to aggressively short RIMM.

Reading the Tape

RIMM dipped below 70. Spencer and I treaded lightly because RIMM was clearly not below this level. And then we both started saying the same thing with different words.

I began with,”I don’t see the selling below 70 yet.”

And then five minutes later from Steve,”There is no seller below this 70 level.”

We didn’t see the bids getting smacked. We didn’t see offers holding and then stepping lower. We didn’t see bids dropping out quickly. We didn’t see an increase of speed with the order flow.

So we both were short, but not for size since only one of our factors, technicals, called for a short. We were ready to pounce if we saw selling. We did try and stay short as long as RIMM was below 70. But we were not willing to risk significant losses until we saw the tape showing weakness.

These are the three factors that we consider before every trade. Perhaps some of them can help you.

Best of luck with your trading! Don’t forget to follow us on Twitter!

4 Comments on “Making a Trading Decision”

i was short RIMM too under 70.50 per your AM idea. RIMM was showing relative weakness off the open, however, i had to cover and re-evaluate after the futures dropped 5 handles in a straight line around 10:35am and RIMM could barely make a new low.

i was short RIMM too under 70.50 per your AM idea. RIMM was showing relative weakness off the open, however, i had to cover and re-evaluate after the futures dropped 5 handles in a straight line around 10:35am and RIMM could barely make a new low.

Thanks for trading this for me. I almost did this myself, but looked back at other charts. RIMM is not making lower lows…and is holding 70……

Thanks for trading this for me. I almost did this myself, but looked back at other charts. RIMM is not making lower lows…and is holding 70……