About 18 months after we created SMB I remarked to Mike that one of our key advantages over other trading desks was a trading philosophy that is not broadly shared amongst our peers. The focus of our desk is to trade things that are In Play. We have a set of criteria used to find these stocks before the market Open. We have an AM Meeting to discuss the potential trading patterns that each In Play stock may have. Our focus is not a particular basket of stocks. We aren’t solely reliant on “stock filters”. We have developed a proprietary system to trade stocks that are In Play. This list of stocks is updated on a rolling basis each day.

Regardless of the type of market we are trading in we maintain our edge. The trades that we have identified that have a statistical edge occur more frequently in our In Play stocks. They also have a higher win rate. Traders who are most successful on our desk fully embrace this edge.

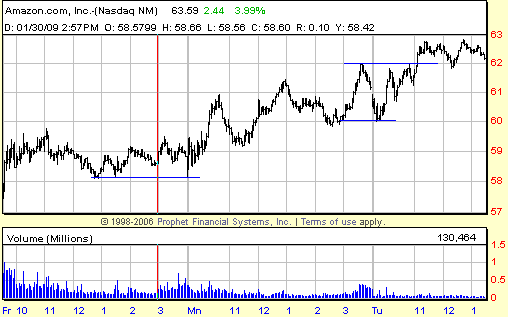

Let’s take a look at a recent example. Amazon (AMZN) reported great earnings last Thursday. But what is far more important than those numbers are the behavior of the stock following the earnings release. Several things occurred: 1) AMZN quickly gapped up several points 2) After the initial gap up it traded several points higher in the after hours 3) the following morning it traded above its after hours high.

When you have a stock that does all of the above you are presented with great intraday trading opportunities the vast majority of the time. On Friday the overall market was extremely weak yet AMZN finished the day up over eight points. Also, with each new selling wave in the market it was easy to see the accumulation that was occurring in AMZN. Admittedly, after AMZN’s initial surge there weren’t many large chops to be made. But there was a lot of information to be gathered.

Monday morning I was armed with the information gathered on Friday. I came in holding a small overnight long position in AMZN. In the premarket the NAS and S&P futures were down significantly. Yet, AMZN was only down a small amount. After the market opened it bottomed exactly where it showed strong support Friday afternoon (58.15). I added to my position and was long for a powerful up move.

On Tuesday morning I had an alert set for 60.10. This was just above the afternoon support that on Monday had led to a powerful up move to 62. AMZN was trading choppily but never dropped below 60. I was long until it had trouble trading above 61.80. I set an alert for 61.95 which was just below Monday’s high. When it traded above Monday’s high of 62 I bid for stock and was long again for another powerful up move. I then set an alert for 61.85. Just prior to running up to 63 an offer couldn’t hold below 61.85. When my alert was triggered at 61.85 I got long again. The bid never dropped 61.80 and there was an up move to the intraday high.

Each one of the above setups offered low risk entry points with a great deal of upside. But what made these trades truly effective was the In Play status of AMZN. That is why SMB’s first choice will always be a stock that is In Play.