I know an excellent trader who underperformed today mainly trading PCS. He faded the weakest stock in the market and now sits frustrated, dejected and angry. Pass him on a desk and you would see his cheeks red and the scowl of a defensive end ready to rip the head off of the opposing QB. I do not mean to play trading psychologist as I have no formal training in this discipline. However after many battles in the trading arena one cannot help but learn an awful lot about how we ourselves as traders can get in our own way. More important I have made this mistake before and had to have a long talk with myself about why I would do such a thing. Let me share my theory on why some fade the weakest and strongest stocks in the market. Perhaps this can help your trading game.

You are off-the-charts competitive. The resolution of the debt ceiling debate has been your wish for weeks. If only Congress would get this behind us so there is more directional color from the market. We are starting to get very close to the end and it appears a deal is near. Now it is time for you to pounce. Literally you cannot wait until the bell rings. You now expect big cash taken from the market very soon.

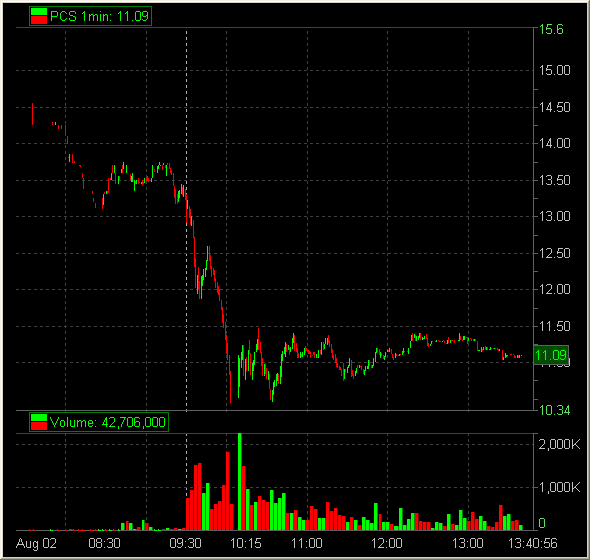

PCS catches your eye. It has gapped down from 16 to near 13 somethingish. A quick check of the 6 month chart in PCS shows some possible support at 12.70ish. We open.

Perhaps you fade the support level and get stopped out. Perhaps you want to watch PCS trade on the Open before making a play and it plummets without you. Perhaps you are short but not with big size. Whatever your attack plan, its 10 minutes into the open and you feel you have underperformed. PCS stands below 12 but you did not make a chop.

Well this is unacceptable. You are a winner. You are an uber-achiever. Your body feels physical pain if you are not succeeding. How do you correct this? You fade the stock and watch it reverse. Now you will not be underperforming. The trend traders will now not be ahead of you. You will now have gotten much more out of the opportunities from this stock as you profit on the reversal. The market will then confirm your excellence.

Does this sound like you? If so you have so work to do on yourself before your trading can improve. But also understand you are not the only trader who does this. You are not the last trader who will do this. And understanding why you do this is a helpful first step in ridding this infection from your trading game.

Bella

One Good Trade

6 Comments on “A theory on why you fade when you shouldn’t”

Boy this post resonates with me….there was a time I could not see a stock move up without thinking of fading it , rather than looking for the pullback to get in…

Andrew Menaker , I suppose, would mention the fact that our emotions rule our actions…we look for comfort…we mised out on a trend trade…we must not be left out..we need revenge…the comfort of being right…

If we understand the emotions that lead us to do things we might be able to keep them in check when they are not productive…

Could apply that to most of the inverse funds today…….”it’s gotta bounce right??”……..uh……..nope…….play the dips…..

Good post MB.

thxs for reading!

Like many, I have only recently picked up on this psychological weakness in myself. It extends to all trading environments. Most commonly, my frustration associated with being stopped out has produced irrational trades. I would often reverse my position at these locations on the premise that I had placed my stop where execution would indicate an invalidation of my original logic. These trades rarely turned out. A triggered stop does not necessarily mean the opposite trade was the “right” one. This often escalates to a situation stated in the post, only the trader would have missed the initial down move altogether. Frustrated that he missed the very move that the initial trade targeted, he looks to fade the nearest support level in an attempt to “carve up” the market, regardless of the original plan or the nature of the price action at hand.

Market kills those who don’t respect her. Just do it

Been there, done that! And if the 2nd reversal trade to “fix the market’s error” gets stopped out, then there used to be a high possibility for me to go on tilt, resulting in even more irrational trades.

So I’ve started to incorporate exercises and steps from Dr. Brett’s lesson to “disrupt old problem patterns” in his Daily Trading Coach book. Walking away from the screen for a 5-10 minute “cool down” after 2 quick stops in the same stock, and taking a time out writing in my journal about the experience and what I was feeling and what I will do better next time has been very helpful.

Bella – great post, thanks.