Yesterday I posted 21 key takeaways from Dr. Steenbarger’s recent Master Class at the TradersExpo.

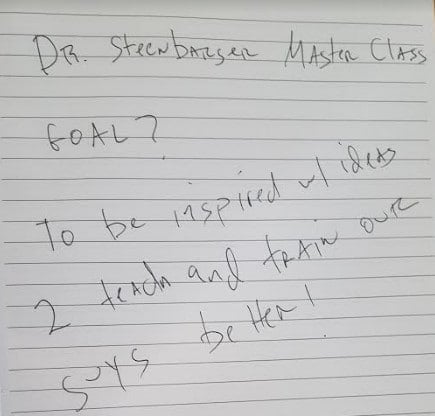

During the introduction of the Master Class Dr. Steenbarger challenged us to write down our goal for our time with him. I wrote, “To be inspired with ideas to teach and train our guys better!” He promised not to stop teaching until each of us had achieved our goal. For me, he delivered.

Today, I would like to share 5 inspirations from the Master Class to train our traders better.

1. Develop a revised checklist for One Good Trade. I developed a template for a good risk/reward trade in One Good Trade. Dr. Steenbarger cited the important work of Etul Gawande in The Checklist Manifesto for improving surgical procedures. Gawande’s work has been expanded to developments of best practices for other high performance activities. I would like to review and revise my original checklist in One Good Trade for our traders on the desk.

2. Place pictures around your desk of what is most important to you. Dr. Steenbarger mentioned this best practice for his own trading. I love this idea. It is hard to take one losing trade too seriously when you are surrounded by pictures like this one:

3. Identify areas to improve and then set specific goals so that you do in fact progress. Dr. Steenbarger shared that too many just identify areas of improvement, but do not take the next step of setting specific goals to progress. One trader, who I am coaching presently, needs to size up on his best trades to take his trading to the next level.

We have made excellent improvement smoothing out his PnL, by focusing on routine over PnL. During this class, it struck me what to work on next with this trader. Next month we will focus on getting bigger in his best trades. Not to actually solve this issue next month. But to begin focusing on how he wants to get bigger. In what setups he wants to size up. Have the trader focus his detailed review on grading his performance for sizing up. With the goal of in one quarter the trader knowing the setups he must size up, not forcing other trades with size, and letting those big trades come to him.

4. To become a distinct trader you must leverage your personality and cognitive strengths. On our desk, we expose our traders to different setups during Trader Development, that they can gravitate towards. They are taught to choose strategies that highlight their cognitive and personality strengths. Asking traders to submit to coaches for review, their personality and cognitive strengths, and how this matches the way they are attacking markets, would be a excellent addition to their training.

5. Find your stable regime and trade bigger. I was fascinated by Dr. Steenbarger’s insight into his own futures trading, where he excels when the market regime is stable. For the intraday trader, we would define this mostly after the period of price discovery- after the open. Traders need to understand those opportunities where they can trade bigger as the risk/reward is better. There are periods where the risk is definable. The risk is stable. It is not that you will be right. It is you know where you are wrong and that that loss is manageable. Are we taking more risk when these opportunities visit? After thinking through this and listening to Dr. Steenbarger’s lecture, my sense is traders should identify and increase risk during their “stable regime” setups.

The point of this post is not solely the 5 inspirations to help our desk. I hope the takeaway is that you want to seek out your moments of inspiration. What are you doing to improve your trading/teaching? Staying in the same place, is not an option.

*no relevant positions