Let me share actual trading events from our prop desk this week. It’s Tuesday, the market is selling off hard and Trader A thinks the market should bounce and VXX decline. He fades the market and VXX all day for a net result of -10k. Let’s call this The Sloppy (in his trading). It’s Thursday, the oil has sold off … Read More

Oracle Had A Fundamental Catalyst That Made It A Good Short

ORCL reported disappointing earnings after the Close on June 17th. The next morning it traded lower before rallying back $2 with the market. I had two reasons why I thought it would roll over again the next day. One, I believed the large market rally the prior day was the primary driver of its bounce from 41 to 43. Two, after large … Read More

Forex Training: How Long Does It Take To Get Good?

I get this question all the time and it is a good question. People these days don’t have the time to invest years in this business unless it proves to be financially rewarding along the way. There are so many educators and so much information available today, yet it doesn’t seem to change the well known failure rate. So what … Read More

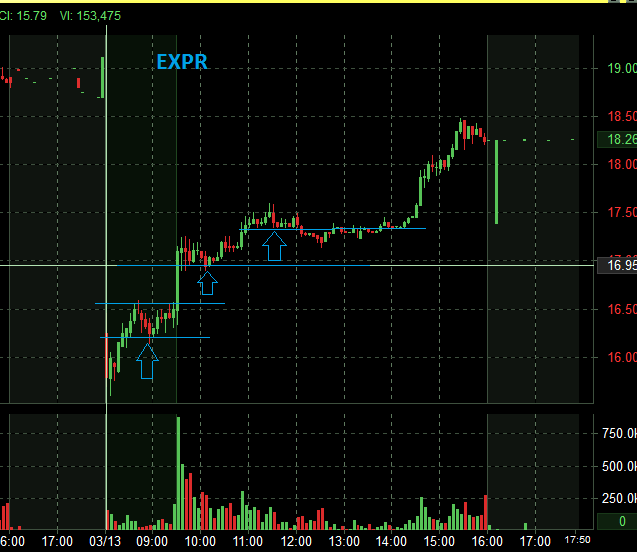

Two Good Trades

There wasn’t much In Play this morning. EXPR was gapping lower in reaction to an earnings release. When a stock has a large gap from an earnings release the first thing we do is look for clues during the pre-market session for whether it will be a gap fill candidate or a continuation play. EXPR was trading actively in the … Read More

How Do You Distinguish a Good Trade From a Loser?

Hi Bella, I just read your recent post talking about the “All-In” trade on the SMB blog. Although my trading experience is limited (less than 3 years), I have on occasion seen these types of SEE IT trades. The most recent example was this past Friday in $LIFE. I know Steve kept the community in the loop that day & … Read More

“One Good Trade” Review by Jeff White

Jeff White of The Stock Bandit Trading Blog recently reviewed Mike Bellafiore’s book One Good Trade: Inside the Highly Competitive World of Proprietary Trading.

My Book is Sold Out: A Social Media Tale

My book One Good Trade is sold out. This took three weeks. A rush reprint will be underway soon. Save a few exceptions, it is now only available on the Kindle. I was told, “This has never happened before with a trading book.” This is a social media tale. I considered hiring a PR firm to rep my book before … Read More

Reformed Broker Reviews One Good Trade

Joshua Brown from the Reformed Broker believes One Good Trade by Mike Bellafiore, currently the number one trading booking in the country, is more than just a trading book. He says the book is about process, the value of focusing on methodology in your daily tasks and allowing the end results to take care of themselves. Read the full review … Read More