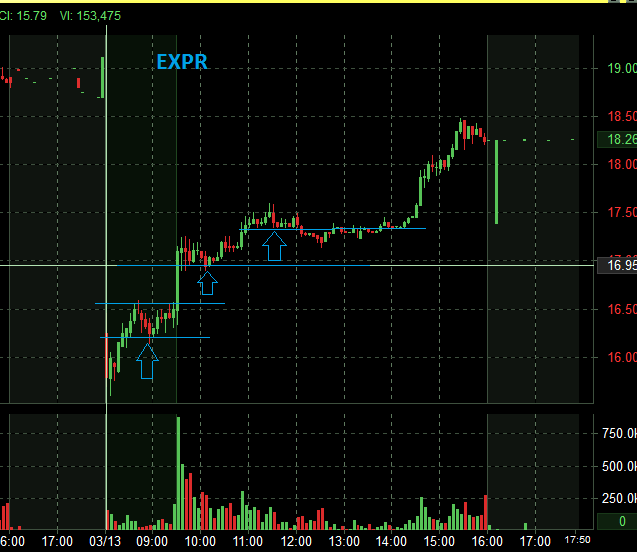

There wasn’t much In Play this morning. EXPR was gapping lower in reaction to an earnings release. When a stock has a large gap from an earnings release the first thing we do is look for clues during the pre-market session for whether it will be a gap fill candidate or a continuation play.

EXPR was trading actively in the pre-market around 16, which is an important longer term level. In the chart below you can see that after falling below 16 EXPR was bought and established a pre-market uptrend stalling at 16.60 before pulling back and supporting at 16.20 establishing its first higher low of the day. As the market opened it drove above pre-market high and there was clearly a buyer. This was an easy trade. There was a buyer at .63 and offers at .64 so I paid the offer. The offer lifted and it quickly traded up to the 16.80s. Open rules were in effect, no trends, so I actively traded the position eventually getting flat when it failed to get above 17.25.

When it dropped quickly to 17 my bid got hit at 16.97. When I get flat into a quick up move on the Open I like to bid in an area where I think others will be hitting out of their positions. I set my stop for 16.89, shared the trade idea on StockTwits, and then moved on to BIDU.

Notice the first consolidation area occurred in pre-market after an up move. This is the ideal setup for a potential gap fill. A break to the upside of consolidation give you a perfect area of defined risk for a long position. The fact that the break occurred right on the Open with a clear buyer on the Tape at 16.63 probably makes this play a 9, A+, 4 stars or however you want to categorize a trade with a risk/reward of better than 1/10.

I moved my stop up after the 11:00AM consolidation to below 17.35 which was the bottom of the consolidation range. This was to protect against a reversal. Not on the desk after being stopped out so no opportunity to buy back between 1-2PM when it began to consolidate again. And not on desk for the 2PM breakout 🙁

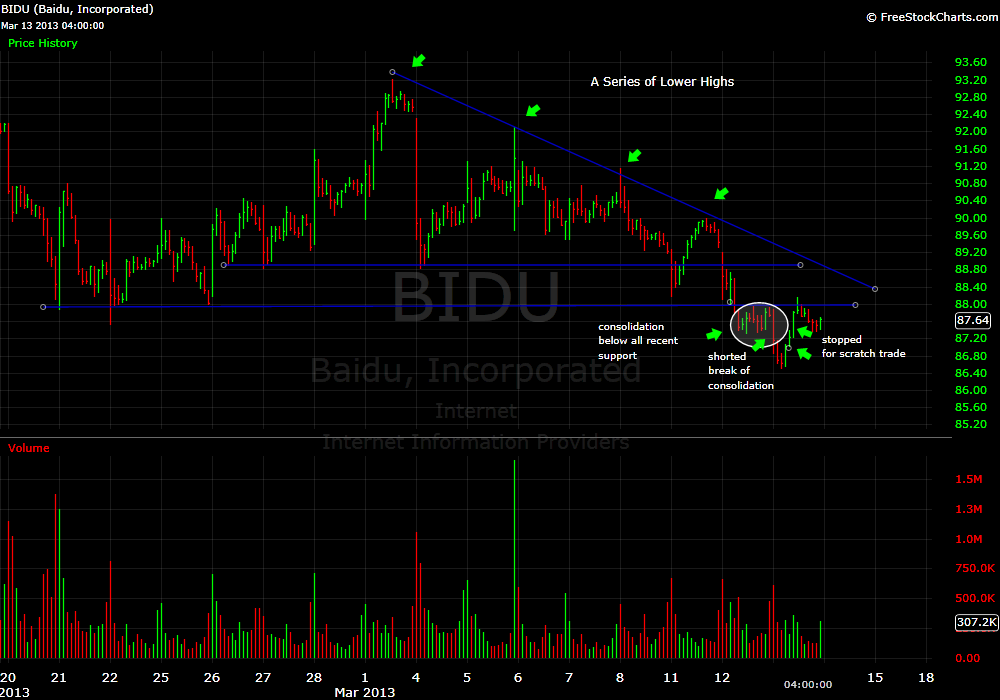

Next trade is BIDU. It was a good trade which ended in a scratch. Down a few dollars. If your trades that don’t work end up as scratches or small losses you will have a much easier time being positive every day. That is why we teach our trainees to find setups that offer 1:5 r/r or better. BIDU was a very good technical setup. The only reason I was not fully loaded in the trade is BIDU has been a below average day trading stock for the past two years. This means that on good technical setups it has not trended cleanly, has had some sharp reversals, and some vicious spikes.

Take a look at the 30 minute chart. It had been trending lower with a series of lower highs. Yesterday it was consolidating below recent support and this morning when it broke below that consolidation I offered some stock at 87.20 to start a position. When it got below 87 I added a little bit. There was large bid at 86.85 that was hit and I added a little more. My expectation was that the trade wouldn’t work but as time passed BIDU continued to very slowly trend lower. I grew more confident and figured there was a 70% chance the trade would work. My concern was that AAPL would have some sort of multi-point bounce which would cause some jokers to bid up BIDU to 87.50 stopping me out.

Shockingly that didn’t happen and at one point I was about 50 cents in the money on the position. I lowered my stops and staggered them. They were all triggered after I had left the desk and I gave back all of my open P&L in the position. I really liked this trade. If this setup had occurred in a better stock I think its an A type trade.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

If you would like more great trade ideas sign up for a trial for our AM Meeting and Real Time chat.

No relevant positions