Let me share actual trading events from our prop desk this week.

It’s Tuesday, the market is selling off hard and Trader A thinks the market should bounce and VXX decline. He fades the market and VXX all day for a net result of -10k. Let’s call this The Sloppy (in his trading).

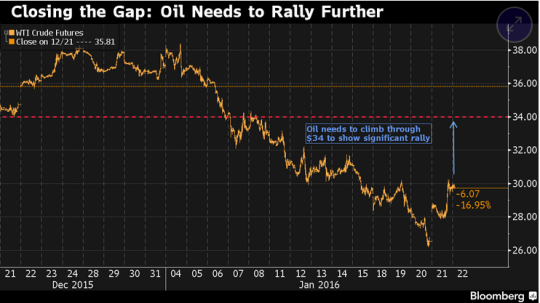

It’s Thursday, the oil has sold off hard of late and Trader A thinks this commodity will rebound. He does nothing. Then comes an important expected oil number. Crude stockpiles had increased. A decidedly bad development for the price of oil as supply was higher. Traders would expect a lower move in oil.

What happened? Oil did not trade lower!

Now Trader A saw from the price action after a news event that his thesis was correct. He bought aggressively. Trader A finished the trading day up 20k. Let’s call this The Good (in his trading).

Same trader. Same seat. Same account. Same platform. Same firm. Same everything. Well expect for one thing….this time Trader A had a thesis and this thesis was confirmed by the price action after a news catalyst hit the market.

Just look at the difference in results from this same trader. See the clear difference between his trading on Tuesday and Thursday. Often there are very real differences between The Sloppy and The Good in your trading.

You build a trading career from The Good. Study The Good. Know The Good.

*no relevant trading positions