Reading the tape is an essential skill for actively day trading. The tape, also known as the time and sales window, shows the trader important information about order flow. It is a stream of data on price and volume, which are two important criteria for intra-day trading decisions . Tape reading takes time to learn and takes practice to understand what you are seeing on the tape. The best tapes to read are stocks with fresh news, since those stocks do more than there average daily volume. These stocks provide you with fast moves, and you can make a lot more money in them. Identifying keys buyers or sellers at longer term levels is a huge advantage to the intra-day trader. You are able to see the supply or demand at these levels which can make it rewarding.

When to use the tape? Typically, I tend to use the tape during the first 2 hours since the volatility is there and trends begin to develop. After the open, I tend to use intraday technical levels that developed and see if I am able to spot a seller or buyer near those levels.

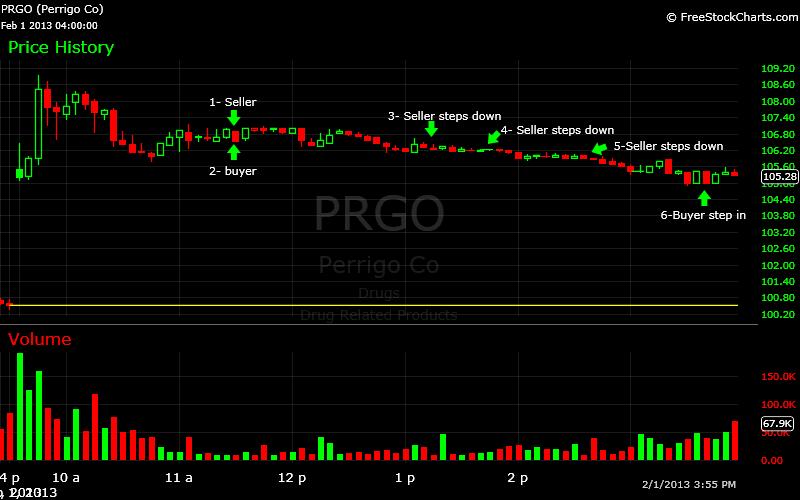

Here is a chart to PRGO. Stock had fresh news and was on a gap. It had a strong opening drive then began to hold lower.

1. There was a seller at 107

2. There was buying near 106.50

3. The seller began to sell the stock below 106.50, he did lift once to get the weaker hands out, but cam right back to the offer.

4. Seller then started to sell 106.25

5. Seller begins to sell the stock near 106. Seller never allowed the stock to have the bid step up to 106. Which was key, even thought the seller lifted there he was still selling the stock carefully.

6. The stock went to the low of the day, where you finally saw buyers step in and would not allow the stock to hold the morning low.

So why did I get short and not long? The offer was doing more volume then the bid. I look for the price doing the most volume and follow it accordingly. If the seller lifted 107 and the bid was able to sustain above 107, then I would have had gotten long.

Simple tape trade where I identified a seller and continued to find areas where he was willing to sell the stock. Follow the seller, when he is met with buying cover your short as I did near 105.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].