The after hours price action in TWTR was epic. The market had been anticipating a large move following its earnings release based on how pricey its options contracts were prior to the announcement. And TWTR certainly didn’t disappoint. After closing the regular session at 36.50 it traded above 40 when its earnings were released. It beat on both top and bottom line and gave in line guidance for next quarter. As the stock has been hammered past six months it made sense it would trade higher if it reported reasonable numbers. As you can see from the chart below after the initial move to 40 it sold back down to 36.50 before grinding higher as the conference call began.

The new CEO Jack Dorsey gave some introductory comments and was very frank about areas where he thought Twitter had come up short and clearly defined the companies strategy going forward. The stock actually ticked higher during these initial comments from about 37.70 to 38.50. He then handed the call over to Anthony Noto, the CFO and form Goldman Sachs internet analyst, and things got ugly fairly quickly.

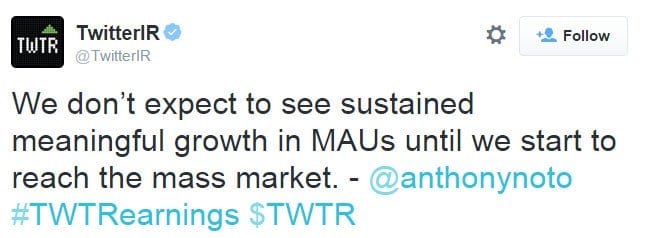

Noto at first presented some financial numbers that weren’t moving the stock much one way or the other, but then he made a statement with respect to initiatives Twitter had undertaken to grow its user base, and pointed out he didn’t expect these things to grow Twitter’s user base for an extended period of time. As he made the statement I had a sinking feeling in my stomach added to my short position just above 38. Within a few minutes it was trading below 36 and then 35.

The ironic thing about Noto being the catalyst for the 180 degree move in TWTR stock was that he was ostensibly brought in to the company to “handle” Wall Street as he was a former Goldman Sachs analyst. Listening to him speak was painful. Every time he opened his mouth it sounded like he needed a glass of water or perhaps a throat lozenge for his grainy voice. As I write this post I’m listening to the conference call again and it is quite painful. Jack Dorsey spoke for about five minutes and although the information he shared wasn’t particularly positive it was delivered in an effective manner. Noto was awful. He read from his notes in such a way that made you wonder how/why he was ever hired and why the heck he was allowed to speak directly to investors.

I am sure some people will argue that Twitter isn’t growing their user base quickly enough and is dwarfed in comparison to its very successful social networking cousin Facebook. But I wonder how vocal those people would be if the stock never sold off from the 38 area in after hours?. The biggest potential negative I heard on the call was the idea that user growth is currently slow and therefore they may run out of ad inventory in the future. So basically they are seeing a large uptick in number of advertisers and ad demand but think there is a possibility that revenue growth could be impacted if they aren’t able to re-accelerate user usage or growth.

We will look at TWTR in our AM Meeting and outline the most likely trading patterns based on key after hours and pre-market price levels as well as all of the research that is released.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 19 years. His email address is: [email protected].

Steven Spencer is currently long TWTR 37 calls and short TWTR stock, 40 calls, 36 calls, 34 puts and 32 puts