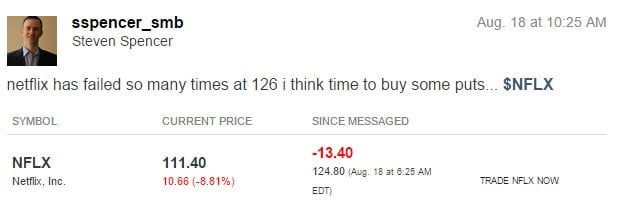

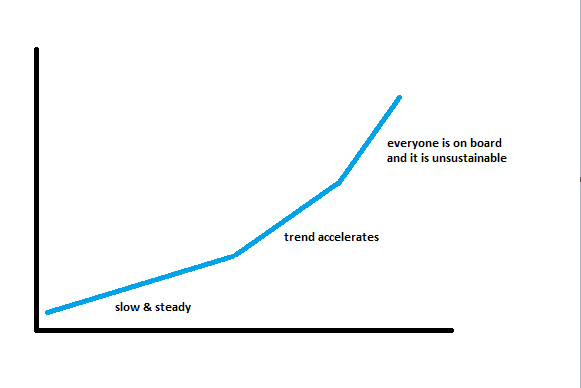

Netflix has been the #1 momo stock for the past few years. Recently, its ascent began to accelerate at an unsustainable pace. When a stock begins to behave like this it is time to look for low risk high reward entries on the short side. Here are a few things you can look for as clues when to open the … Read More

Twittergeddon!

The after hours price action in TWTR was epic. The market had been anticipating a large move following its earnings release based on how pricey its options contracts were prior to the announcement. And TWTR certainly didn’t disappoint. After closing the regular session at 36.50 it traded above 40 when its earnings were released. It beat on both top and bottom line … Read More

Study Price Action & Stop Being A Silly Troll

Back in April I tweeted a picture of a SPY chart that I thought was rather instructive. Here is the chart: A few things we can take away. The first is that the SPY 204.30 had been tested in February and then again in March. The bounce in March was very fast moving from the low to SPY 211 in … Read More

Netflix Reported Earnings–This is What Happened Next

I have been trading “momo” stocks for almost two decades. What makes stocks like NFLX, TSLA and FB so enjoyable to trade at times is the almost monolithic behavior of their large investors. This behavior greatly increases the risk/reward for short term trading setups. That is why I always spend time covering these stocks in detail in our AM Meeting … Read More

The Basic Truths of Trading

**This is the second in a series of posts from Bruce Bower related to “Peak Performance” the topic of his new book that SMB U will be releasing April 20th** **SMB will be hosting a free webinar on April 13th in which Bruce will discuss in depth the concept of “Peak Performance” and how it can be applied by all successful traders and … Read More

Trading After A Market Correction

In the Spring of 2014 both the biotech sector and momentum stocks were hammered during an eight week period. I have developed a set of criteria to identify when this sort of market correction has likely run its course. If you are able to develop a system to identify when a major market turn is close then you are more likely to capitalize on … Read More

Bad News–It’s Time To Buy

As a short term trader I scan the market each day for stocks that will be “In Play”. These are stocks that have fresh catalysts which can lead either to a lot of people trying to enter or exit positions at the same time. If I can identify the best opportunities and the likelihood of a strong trend then at … Read More

Some Thoughts on 2014: Upside Volatility

The price action in 2012 presented a very compelling case for a strong market and low volatility in 2013 (see post on #NewNormal). It wasn’t the price action in isolation though. 2012 was in such stark contrast to the latter part of 2011 it really set off alarm bells in my head. We went from a period of massive volatility … Read More