Trading is not simple. Developing traders must learn the subsets of trading set ups, and craft trading systems that account for the nuances and variables of each trade. Each trade is different.

A spot on example of the depth needed for your playbook is a look at a Trade2Hold in V yesterday. First as intraday traders we must adapt towards these longer holding periods because of today’s market structure. Second we must develop a list of Trades2Hold that makes sense to us. Third we must have well-defined exits for our Trades2Hold. Fourth we must enter our positions based on new intraday patterns. Finally we must use different Trades2Hold from our playbook depending on the market. For example the Tuesday before the Senator Scott Brown election we gravitated towards buying into pullbacks for strong stocks. With the recent weakness in the market we change gears.

This is a lot of change. But change mandated by Mother Market.

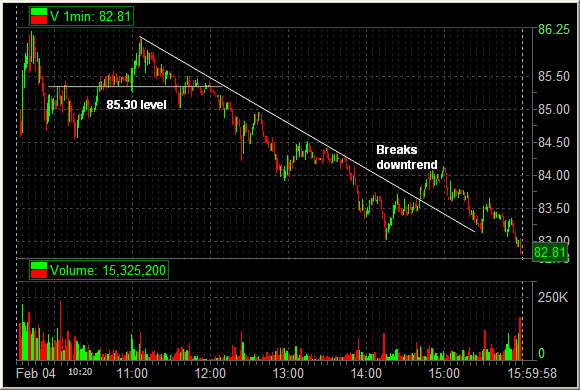

Yesterday I caught a Trade2Hold in V. 85.30 was an important intraday support level. Sellers tested this level and the buyer would not drop. V found 86 where it met long term resistance, previous intraday resistance, and resistance in the After Hours. In a weak market what were the chances that V would clear 86? ALJ who runs SMB Training Trading Tools exited his intraday long from 85.30 there, at 86.

V failed at 86 for the second time and then violated the important intraday support level of 85.30. I shorted into the next upmove. Before the explosion in HFT (high frequency trading). whacking the bids below 85.30 would have been my entry. That does not work in this market. The trader often must wait for the next upmove after the 85.30 bid is violated to start their short position.

Now that I have established my Trade2Hold I must decide how to exit. The market was very weak so my mindset was to be slow to cover. Something substantial needed to occur before I covered. And finally something did. V broke the intraday downtrend on my 5-minute chart at 83.75. I covered, booked my profits and readied for the close.

This trade worked because I adapted to a Trade2Hold because of this market, a particular Trade2Hold that works best for a weak market, an entry that accounted for HFT’s, and an exit appropriate for yesterday and me.

Best of luck with your trading! Don’t forget to follow us on Twitter!