I have been there. Failing and looking for a way to break out as a trader. I first did back in the late 90′s with one setup- The Relative Strength Trade. Our newest High Performing Trader was there and found a way to break out as a trader. He trades almost exclusively one setup. That one setup has propelled his … Read More

Milking an Options Trade

In this video, Seth Freudberg talks about the techniques behind milking a trade. Sometimes it’s obvious that an options trade has potential for greater than it’s normal profit target. This video provides a technique for taking advantage of that trading situation. A conservative two standard deviation move metric is used to make decisions within this technique. *no relevant positions

How to Trade Earnings Season

In this video Mike Bellafiore discusses 6 keys to trading earnings season.

The Opening Drive Trade: Is it for you?

Some trading “gurus” preach that you should learn how to trade the open. Because, as they say, you can trade 15 minutes a day, make 500% a year, buy a Lamborghini like me, and be the envy of all your friends. Other trading “gurus” say things like: avoid the open, I don’t trade until 10am, trading in the first 30 … Read More

Put the trade on……NOW

It is that time of the month. Time for monthly reviews from our traders and time for me to read them. One developing trader wrote something that will trigger an important conversation about spotting your best trades. If you do this better this month you will see improvement with your trading. This developing trader wrote: Decrease the amount I lose … Read More

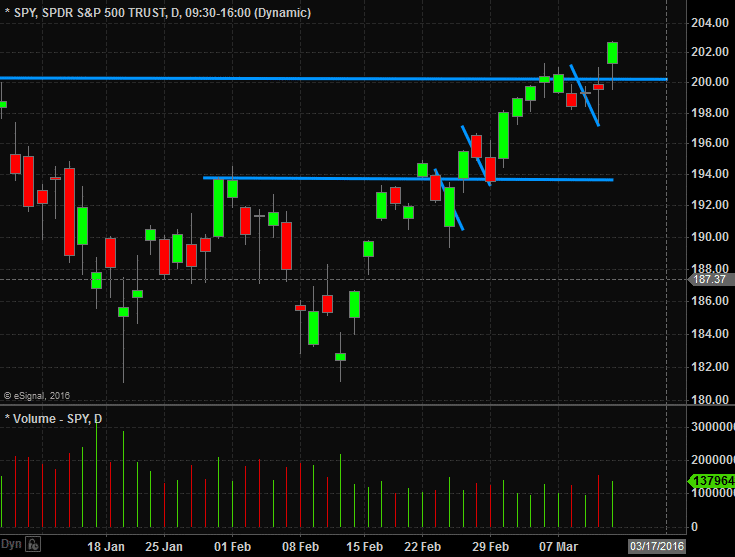

Trade Review: Buying SPY & IWM pull backs

Thursday March 10th was a day many traders had circled on their calendars. Often the greatest short term trading opportunities will occur on days where major economic news is announced. The monthly jobs number, quarterly GDP, FED rate decisions and ECB monetary policy fall into this category. Thursday the ECB was set to announce what steps it was planning to … Read More

Losing Money On A Trade Is Not The Same As Failing

In our SMBU Daily Video, Seth Freudberg discusses why losses are inevitable in this kind of market. Options traders struggle in volatile markets like we are experiencing. It’s important to keep a proper perspective in these circumstances–losing on trades is expected–as long as you stayed disciplined through the trading process then you didn’t fail–you simply lost money on a trade. … Read More

Three Ideas to Help You Catch Your Best Trade Ideas

@mikebellafiore One thing I do before the open is develop a game plan. What stocks do I want to trade first? What prices do I want to enter positions? This helps a trader to not get overwhelmed when the market opens. There is all this data flashing buy on multiple screens in nanoseconds. Sorting out your best stocks and best … Read More