Each week we share with you a trading pattern that we use consistently on our desk. Like most successful traders we have measured the win rate for this trade. In short we are giving you an intraday trading pattern that works. In this SMB Trade of the Week we will share an Important Long Term Technical Resistance Level Trade that we made in Baidu, stock symbol BIDU. Perhaps you can make this trading pattern your own.

Let’s set up the trade:

Bidu operator of China’s most popular online search engine, reported their earnings and forecast sales growth that beat analysts’ estimates as rival Google Inc. lost market share amid a censorship dispute with Chinese regulators.

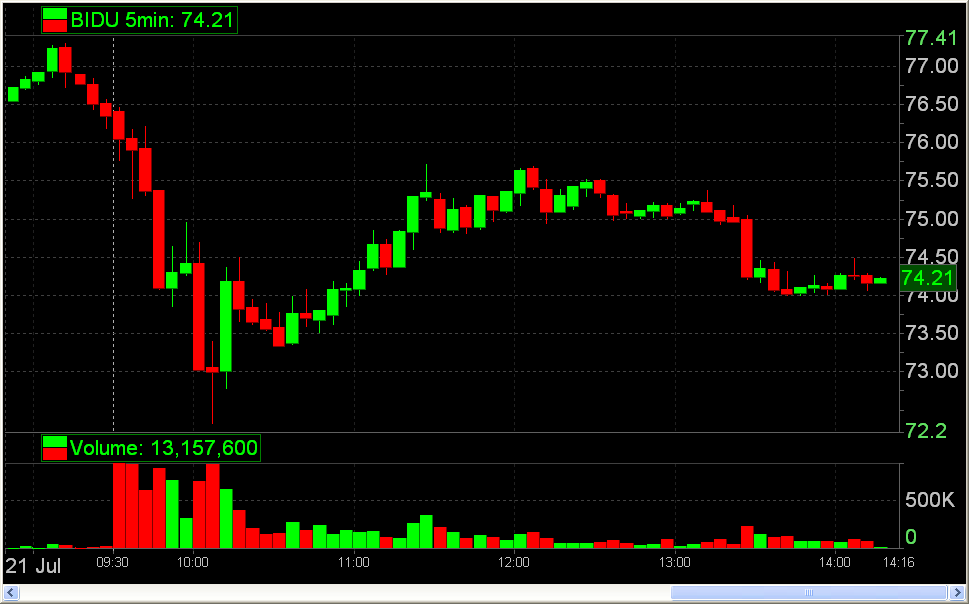

BIDU gapped up to near 76.50 in the Premarket.

On our long term charts 76.50 was a significant resistance level.

The first ticks on the Open were to reject 76.50 as BIDU traded quickly down to 76. Buyers and sellers matched orders near 76 but then the sellers prevailed. Below the longer term resistance level of 76.50 we expected the sellers to prevail near 76.

As long as BIDU was not trading above 76.50 the trade is to short. I added to my position when the sellers overwhelmed the buyers near 76. (longterm chart) And then I scaled out as BIDU dropped while holding a core to the most important next significant technical support level, 72.50.

During a midday lecture with our June training class I stressed, “The key to this trade is not to be a wuss!” If you are covering BIDU at 75.70 and too much at 75 then you cannot be in this short. Hold the stock for the real move. And when a stock is In Play as BIDU was after earnings and opening near an important technical resistance level, then let the stock breathe. let it find an important support level. That could have been 74, 73.50 or 72.50. But that was not 75.70. Don’t be a wuss!

This is an Important Technical Resistance Level Trade in BIDU. Perhaps you can make this trading pattern your own. If you have any questions about this trade please send me an email, tweet, or post a comment on our blog. Please check out SMB University on StockTwits TV this week as we discuss in more detail trading BIDU after earnings.

Mike Bellafiore

author, One Good Trade (Wiley)