When it comes to paper trading, there seems to be two strongly opinionated sides to its purpose in helping traders learn how to trade.

There are the opponents and this group usually includes brokers (I wonder why). Their argument goes something like this: Paper trading is something you want to do for maybe a week or so in order to get used to your trading platform. After that, you want to start trading for real because in order to learn how to trade, you need to have skin in the game. Otherwise you are wasting your time. Just think every time you make a good paper trade, that could have been real money!

This argument has some plausibility. As far as having skin in the game to feel the market and how its movements affect your levels of greed and fear is an important educational aspect of becoming a successful trader. The problem with this argument is the motive. Usually the ones that make this argument want you to trade because they benefit from it. If you are trading real money just for the emotional education alone, you will not get very far. You will only become a victim of your greed and fear sooner than not.

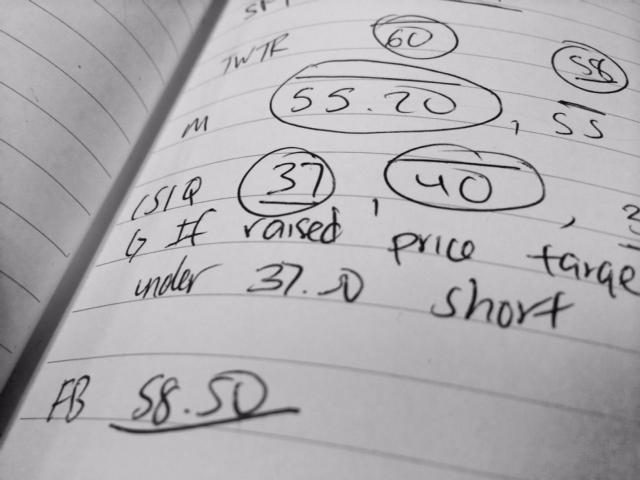

The argument for paper trading, usually from people like other traders or some educators, who gain very little from your trading volume, usually sounds like this: Paper trading is good for testing a new strategy, fine tuning or testing ideas of some kind. Every aspect of the paper trading process should be treated as if you were trading real money. There should be a clearly defined methodology and a way to measure variables besides your P&L to judge your results. Professionals will back test and forward test strategies in order to be better prepared for what to do when there are losses to deal with.

Paper trading gives you the opportunity to prepare yourself without having to lose thousands of dollars trying things that may not work at all. You first need a well defined methodology or system to test, otherwise paper trading will only help you to reinforce ineffective trading behavior. Once you have decided what kind of trader you want to be, and once you have your set of clearly defined rules, and a way to measure your performance in detail, then you are ready to paper trade.

It is important to understand that paper trading for a week is meaningless. Collecting performance statistics over time will give you a much better perspective on the strategy that you are employing. How much time is enough? That depends on you, but I think 1 – 3 months is a good starting point.

The problem with most new traders is they are in a hurry to see results. For some reason, they think this business should produce great results from the onset (must be all that great marketing we are exposed to). Meanwhile just like any other legitimate business, the results we seek require a great deal of time and effort. Research is a major part of that effort. Even if you opened a casino where you have the gaming conditions in your favor, you still have to put up a huge amount of money up front for operational and advertising costs in order to get to your customers in front of the slot machines. You still have to give it time for your casino to become profitable. When comparing to the trading business, which is one where conditions are usually not in your favor, how can you justify your impatience for instant results?

Papertrading can be a valuable tool that can save you money as you are learning and better prepare you for when you are going to trade for real. You don’t want to make a career of paper trading of course because at some point you have to make the transition. I just think you are much better prepared to make that transition after you have done your homework because you will be that much more confident in your methodology when real money is on the line.