[EPISODE 37] “The Trade Review: How Pro Traders Keep a Trading Journal”

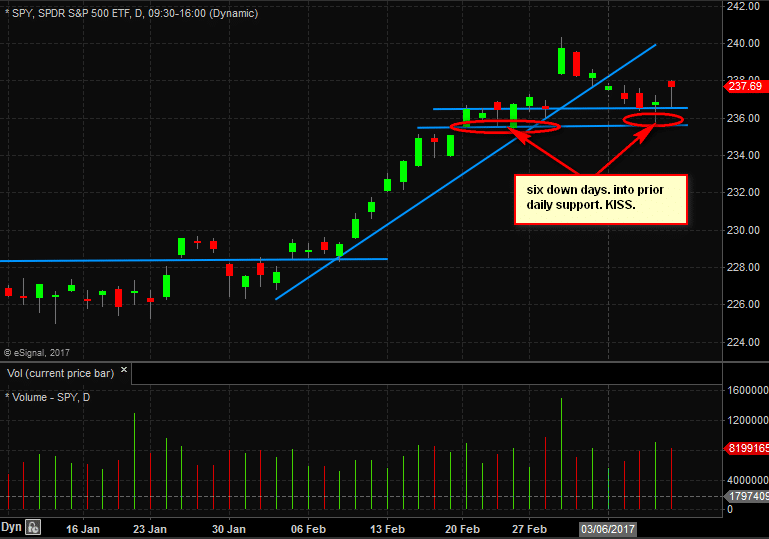

Impossible Market Timing?

Wouldn’t it be great if we had a tool that gave us a heads up when market was making a short term top? What if that same tool could be used to time the bottom in market pull backs as well? If we had something like this surely we would make many millions of dollars if not billions in the … Read More

SMBU’s Options Tribe Webinar: Ed Tulauskas of Random Walk Trading: The Bionic Butterfly

This week, Ed Tulauskas of Random Walk Trading discusses the Bionic Butterfly, a biased butterfly strategy that takes advantage of directional moves. Ed will look at the basic trade framework, explain the best times to utilize this approach, discuss the factors influencing the trade and cite some examples of the use of the strategy.

How do I start as a trader?

Recently I visited Pace University investment club to talk about the life of a proprietary trader. We make an effort to reach out to college trading clubs and college investment clubs and meet their members. Some of our best traders have come from these clubs. Also, college students rarely get to interact with a professional trader so sharing our experience … Read More

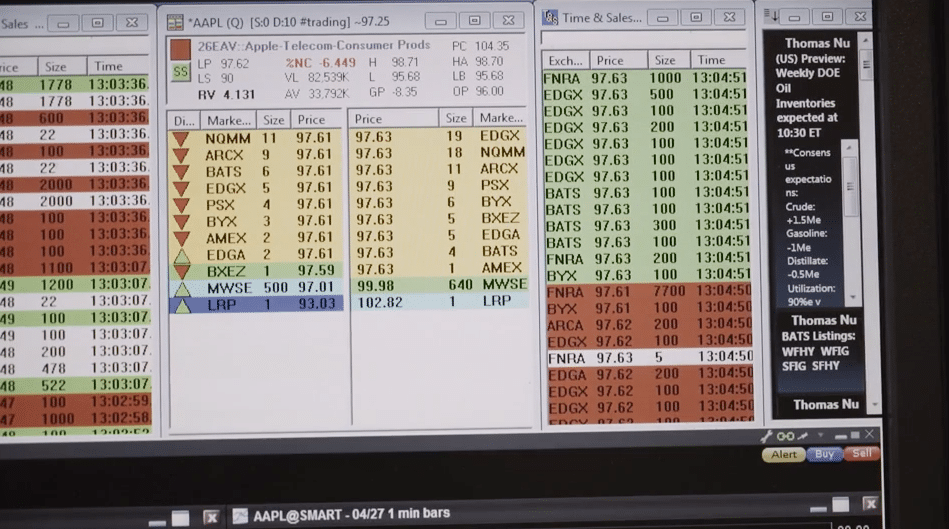

ONE Thing to Improve Your Trading

We have built a new Reading the Tape course to help our trading community trade better. Imagine if this course helped you achieve just one of these: Reading the Tape can help you enter trades at better prices. Reading the Tape is a leading indicator that gets you into trades before the stock moves. Reading the Tape can help you find … Read More

8 lessons from the prop desk (The 2017 TradersExpo NYC)

At the 2017 TradersExpo in NYC, I shared 8 lessons from our prop desk. As a partner at a prop trading firm in NYC, I have the privilege of watching many traders grow from new to consistently profitable trader to high performing trader to even better. I see how they succeed and why. I share their obstacles and together we … Read More

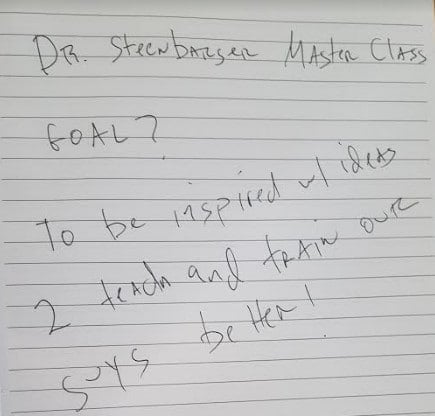

5 inspirations from Dr. Steenbarger’s Master Class

Yesterday I posted 21 key takeaways from Dr. Steenbarger’s recent Master Class at the TradersExpo. During the introduction of the Master Class Dr. Steenbarger challenged us to write down our goal for our time with him. I wrote, “To be inspired with ideas to teach and train our guys better!” He promised not to stop teaching until each of … Read More

Unveiling Trading Wisdom: 21 Key Takeaways from Dr. Steenbarger’s Master Class

This Sunday I had the privilege of taking Dr. Steenbarger’s Master Class, trading coach and author, at The TradersExpo NYC. It was four hours jam-packed with learning. The Master Class was truly exceptional! Many have reached out to my inbox and asked for me to share my notes with you. I will do so here. To become a distinct trader you must … Read More