I am really excited to be taking the Master Class taught by Dr. Brett Steenbarger, trading coach, this Sunday at The TradersExpo NYC. Our culture at SMB is simple: improve every day. That starts with me and continues through all, including the newest of newbs. I was privileged to see an outline of the Master Class and provide feedback, which … Read More

SMBU’s Options Tribe Webinar: Paul Forchione of Optionvue Systems, International: “Butterflies and Calendarized Butterflies”

This week, options educator and strategist Paul Forchione returns to the Options Tribe to show how he uses OptionVue software to structure and analyze these positive theta spread positions in various futures markets. He will show how these positions behave in relation to market movement and changes in implied volatility by generating performance curves and discussing the Greeks.

Sometimes it’s your job to lose money

In this video, Seth Freudberg discusses why it is disadvantageous for a trader to get into a mindset that he must win every trade at all costs. He must instead accept that the best trades have anticipated losing months in each year, no matter how well designed that strategy is.

One of the Most Important Trading Skills You Need to Develop

This coming Wednesday, after the market close, Bella is going to teach a trading class about one of the most important trading skills that many traders don’t understand. Tape reading is a crucial skill for all types of traders. Not just intraday or short term traders. Tape reading skills add value to trades that are held for swing, intraday and … Read More

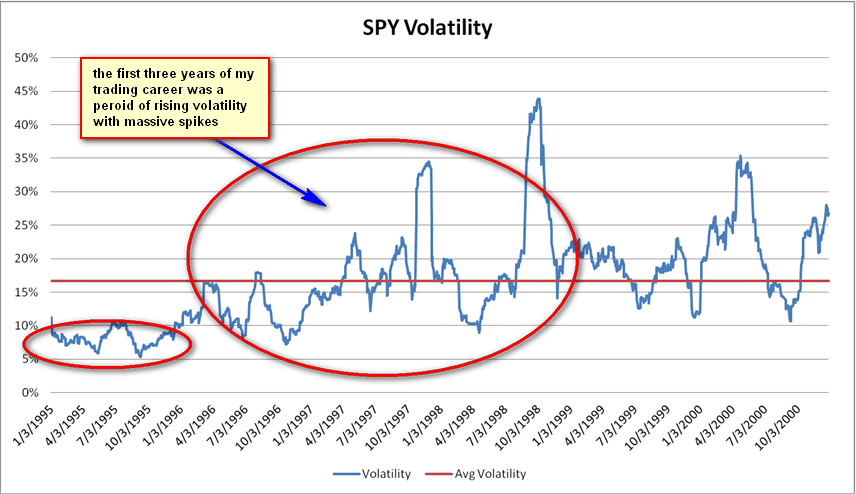

The End of Volatility

During the first three years of my trading career I participated in a stock market that seemed to move 1%+ almost every day. That market was built for short term traders. But during that same time period regulators pushed through a series of market structure changes that I believe laid the foundation for a long term decline in stock market … Read More

Impatience is a major enemy of beginner options traders

In this video, Seth Freudberg details the problems of raising capital level too quickly and suggests an alternative way to structure your growth process as an options trader. After experiencing some success over a small time period, they decide that they can trade much larger without understanding the tragic ramifications of increasing your capital level too quickly.

See the Hypos

Today we’re looking at creating premarket if/then statements. There’s a powerful list of benefits associated with adding this to your routine. I hope that is helpful to your own trading. Merritt Black *No relevant positions Important Disclosures

The danger of the overconfident trader

Yesterday I wrote about a trader struggling with added size and risk. In seeking a solution for this trader one possible area of focus was overconfidence. How does it happen? Why is it dangerous? What can we do to combat overconfidence? You trade well. You are seeing screens well and the market is trading in a way that allows your … Read More