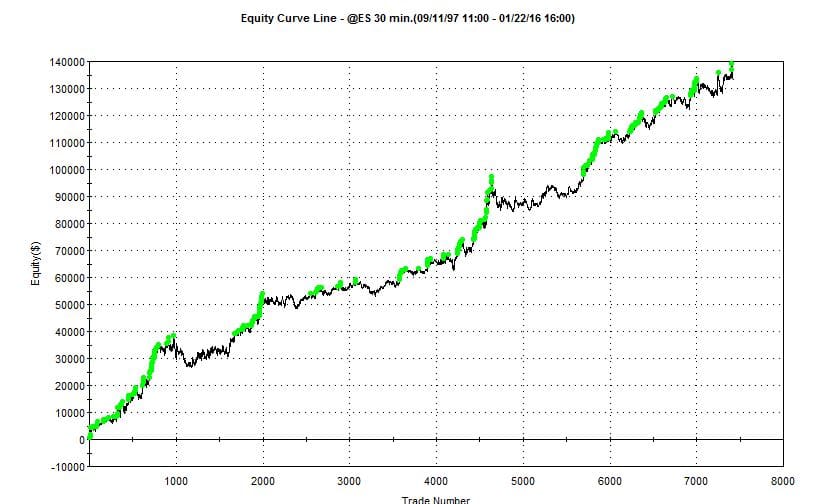

The following is a simulated back test of a simple short term momentum system on SPY. It generally has positive performance but the draw down periods are a little deeper and wider than I would prefer.

Now, I’ve taken the same system but coded it to go flat at the end of each day. Then it waits for a fresh signal the following day. The total performance is smoother and about 80% more profitable because the system simply removes overnight gap risk.

This system uses exponential avergage price to indicate trend direction. However, several other signals including momentum, simple average, VWAP, and linear regression see similar benefits when eliminating overnight gap risk.

In this higher volatility market, there is additional risk in holding overnight positions (for both downside and upside moves). In this market environment, it’s smart to reduce exposure at the end of each day and be prepared to trade a completely different environment the following morning.

To maintain a fresh perspective on the best opportunities, it’s important to regularly generate fresh ideas. Steve Spencer summarizes the best opportunities that the desk is watching each morning in the AM meeting (available to Trader90 subscribers). In these sessions, Steve covers broad market levels and expectations for the day — as well as stocks with fresh news and second-day plays.

Then Steve and some of the other top traders at SMB give updates throughout the day in SMB Real Time — where you can also track their live positions as soon as they are taken.

To stay flexible and profitable during a high volatility market, it takes a fresh daily perspective and a constant flow of great ideas.

SMB accomplishes this by sharing ideas on the desk. The teamwork approach adds value to everyone involved.

If you are trading in a bubble and struggling — then we invite you to consider joining our elite community as a virtual member of the trading desk.

Visit the Trader90 page or contact/chat with us to learn how you can benefit from our tools and community.

-Andrew Falde

@andrewfalde

Please note: Hypothetical computer simulated performance results are believed to be accurately presented. However, they are not guaranteed as to accuracy or completeness and are subject to change without any notice. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since, also, the trades have not actually been executed; the results may have been under or over compensated for the impact, if any, of certain market factors such as liquidity, slippage and commissions. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any portfolio will, or is likely to achieve profits or losses similar to those shown. All investments and trades carry risks.

No relevant positions.