This post is going to be short but sweet. I will highlight two trades from today. The first is a technical trade that was highlighted on our AM Ideas Sheet. The second is an example of a low risk entry point in a stock that is usually quite difficult to trade intraday.

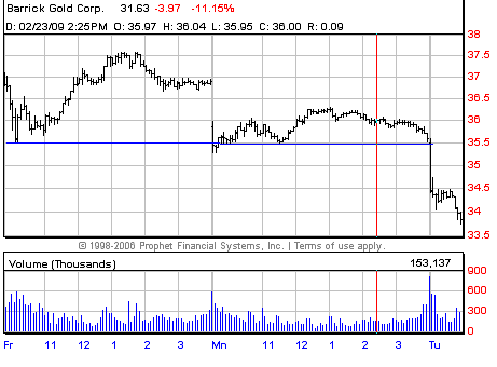

Recently, gold has been very strong. For the past two weeks it has been trending higher. But the traders on our desk noticed relative weekness in some of the mining stocks. This type of divergence often offers incredible risk/reward setups. If the mining stock you are following is making lower highs as gold is making new highs then you start to look for great entry points on the short side in case gold begins to show weakness.

During the past few days ABX has shown support at the 35.50 level. In the premarket we saw some strength in the equity futures and weakness in the gold futures. This was a perfect scenario to short ABX below 35.50. The chart below illustrates the opportunity that this setup offered today.

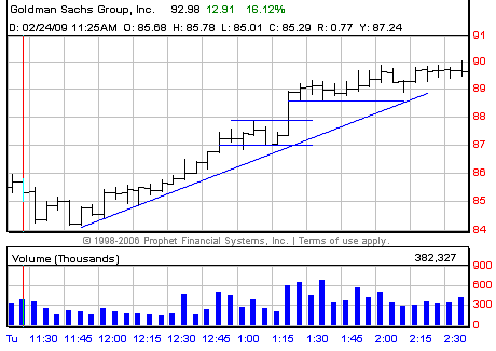

The second trade involves GS. My partner recently blogged about how difficult a stock this can be to trade intraday. The truth is that unless it is trading at a major inflection point or has shown great strength or weakness during the trading day then actively trading GS is a losing proposition. Today, as the financial stocks rallied it showed the most strength in its sector.

From 12pm to 12:45 it was in a nice uptrend. Then it began to move sideways. After failing at 87.56 it had a pullback to 86.84. The next upmove breached the previous intraday high. But this breakout failed and over the next five minutes it pulled back to 87. This was a good risk/reward entry point. GS had not violated the uptrend that began at 12pm and there was some support at the 87 level. Over the next few minutes GS traded through its high on very heavy volume.