We covered several interesting topics during our weekly Trading Conversations webinar last Friday. As usual, we covered a wide range of things such as using context, randomness, risk/reward, knowing your market with statistics, and more! Not a bad way to wrap up your trading week with some open trading conversation. One topic we covered in particular stood out to me, … Read More

How Do I Use Previous Support and Resistance Levels?

Hi Bella, I have been learning a ton from One Good Trade, The Playbook, and all the online educational content you have. Thank you! When you are analyzing a stock “in Play” and looking at previous support/resistance levels, how much weight do you give them going forward with that days trading? After all, we would be trading this stock in … Read More

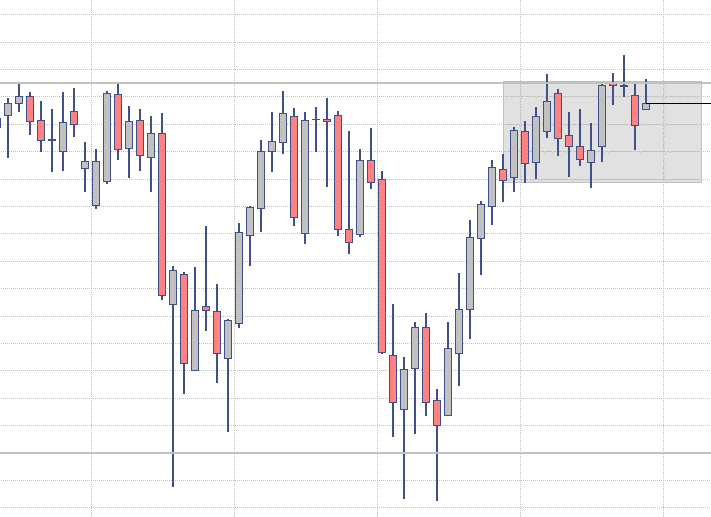

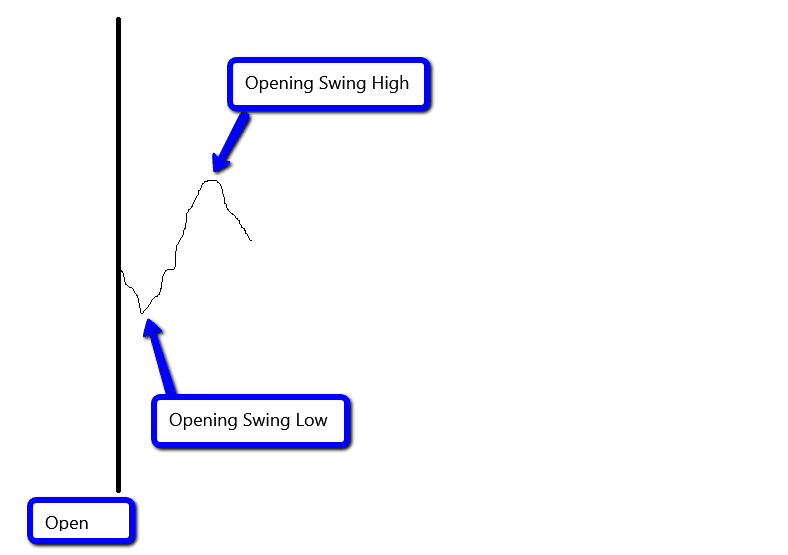

Using the Opening Swing to Improve Your Trading

Last Friday, during our weekly Trading Conversations webinar, we had a lot of great questions from our community – like we do most weeks! One question was about analyzing stocks right around the open, from the first minute to the first hour or so of trade. Keeping with the live and interactive spirit of Trading Conversations, I asked users to … Read More

Must I time my trades properly?

Mike, I just joined SMBU and I’m half-way though all the lectures and I like it a lot. Bluntly, I’m a piker. I’ve failed numerous attempts at trading and blown through a lot of money…. I’m trying to apply your best set up/idea concept to his strategy> the best example can be the BABA trade on 5/25/16. SEC investigation into … Read More

The trade that propelled one trader to start winning

I have been there. Failing and looking for a way to break out as a trader. I first did back in the late 90′s with one setup- The Relative Strength Trade. Our newest High Performing Trader was there and found a way to break out as a trader. He trades almost exclusively one setup. That one setup has propelled his … Read More

A test of conscience at a trading firm

Hi Mike, I was part of the first edition of SMB DNA and I am a consistently profitable trader now. I just read your article about the low float reversal trade. It is also a favorite trade of mine. The difficulty I sometimes have with these plays is to get borrows to short the stock. (I have one IB account … Read More

A favorite trade of active successful traders

The Low Float Reversal Trade is a favorite of the active trading community. It is a favorite of the best retail active traders. It is a favorite of many large proprietary firm traders. Here’s why: Low Float stocks are not as competitive as other stocks, and thus easier to trade. When they reverse, the downmove is substantial and fast, with … Read More

A note from the prop desk

This African Proverb above presently sits on our whiteboard, just outside the trading bullpen, on our trading desk. It encapsulates the advantage of trading at a proprietary trading firm, and helps us raise questions about what we want to be as a trader. Let me offer five examples from the desk this week to illustrate this point. 1. Trader A, … Read More