We covered several interesting topics during our weekly Trading Conversations webinar last Friday. As usual, we covered a wide range of things such as using context, randomness, risk/reward, knowing your market with statistics, and more! Not a bad way to wrap up your trading week with some open trading conversation.

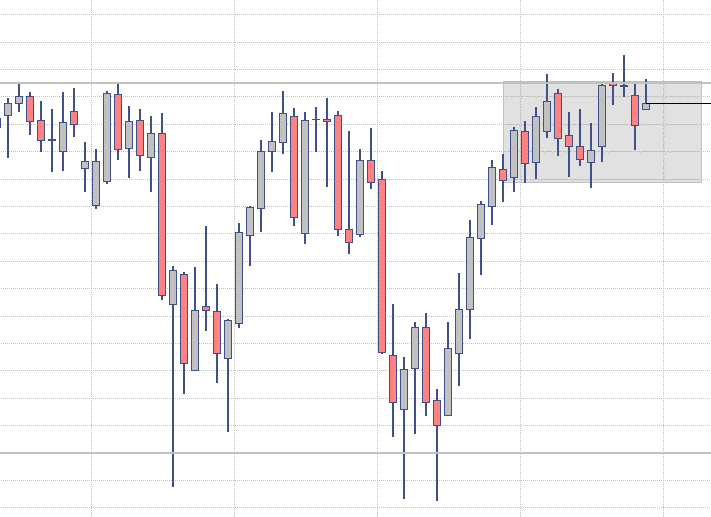

One topic we covered in particular stood out to me, and I wanted to share it with you here today. The thought is that not all trading sessions provide equal opportunity. That may sound obvious to you at first, but do you really live by that belief?

Do you know what types of environments you outperform in? Do you know what types of environments you underperform in? Do you know your trading methodology well enough to know? Even if you know those conditions, do you really allow yourself to “be ok” with the losing trades, or are you stressing out over them seeking perfection? Do you even have a way to look back and review the session and determine what type of conditions were present? Even better, do you have a method to identify high or low opportunity sessions during the session?

I can’t answer all those previous questions for you. Only you can do that with a lot of screen time and effort. The purpose of this article is mostly to get you thinking about ranking opportunity and your beliefs about measuring performance.

Specifically what sparked this thought on Trading Conversations last Friday was a question asked about benchmarking your P/L. I happen to believe that placing outcome-based goals and expectations on your day-to-day trading is a pretty bad idea. Why? Well, because not all sessions provide equal opportunity! Furthermore, you can have several sessions in a row of high or low opportunity for your style of trading. Should you blame yourself if you underperform for a while? I say no. I think it’s helpful for traders to 1) understand what conditions they perform best in, as well as poorly in, 2) work hard to learn to identify those conditions as quickly as possible, 3) truly accept that there will be times where your trading style simply underperforms and be ok with that.

The whole point of repeating this concept is that if you create belief systems that places less importance on the last trade, the last session, or even the current trade or current session; you then free yourself up to focus on your process, focus on market generated information, and focus on simply executing your trade plan to the very best of your ability with the least amount of emotional interference.

Trade smart,

-Merritt

*no relevant positions