I was chatting in the hallway at our firm in NYC, with a developing trader who was verbally proud of his improvement on that day. He was really proud. I asked him what progress he had made and how. In detail, he offered his improvement. When he was done, I asked him to memorialize the improvement in an email to … Read More

A trading journal that works for you

I trade intraday futures by reading the tape and looking at historically significant price action levels. I start to really get a feel for the process, but I still trade only one future until the process is internalized. To be able to assess myself I keep a detailed journal where I fill in trade information (entry, exit etc.) and trading … Read More

That Was Different—Did You Make Money?

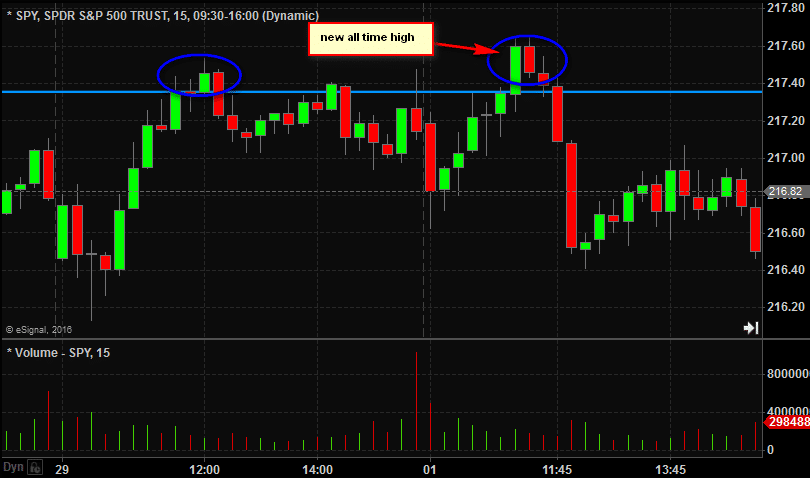

In short term trading we are always on the lookout for something that looks “different”. That is where edge is. That is where good risk/reward is. The past few weeks the SPY has been bopping up and down in a tiny range. After four or five days it was unusual. After two weeks it was historic. Every short term trader was focused … Read More

Seizing Opportunities: Making Money in Pre-Market Trading with SRPT

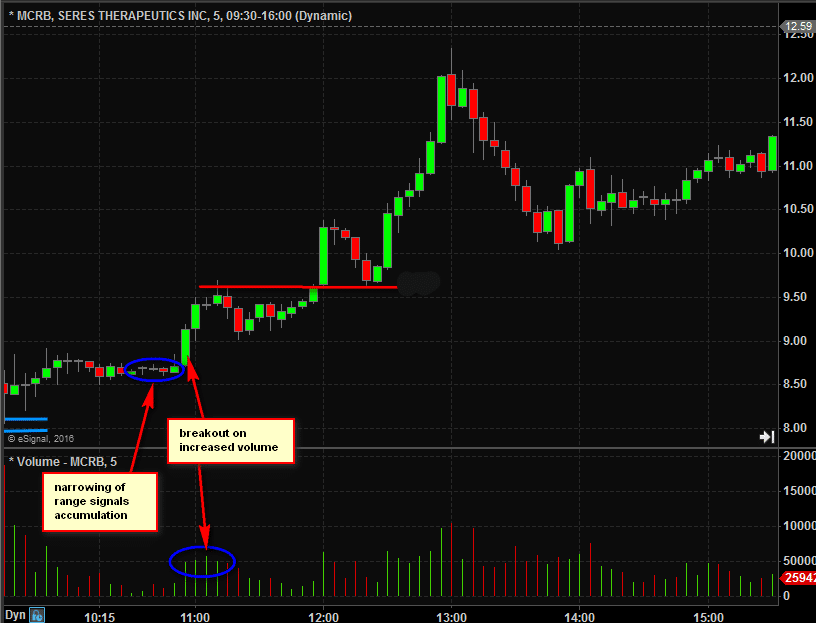

We are in the heart of earnings season and as short term traders this is where the majority of our attention is focused. But on Friday July 29th there was a major fundamental catalyst in MCRB. Its FDA drug trial had failed. The stock was trading lower more than 50%. By 8AM before the market had opened it had already … Read More

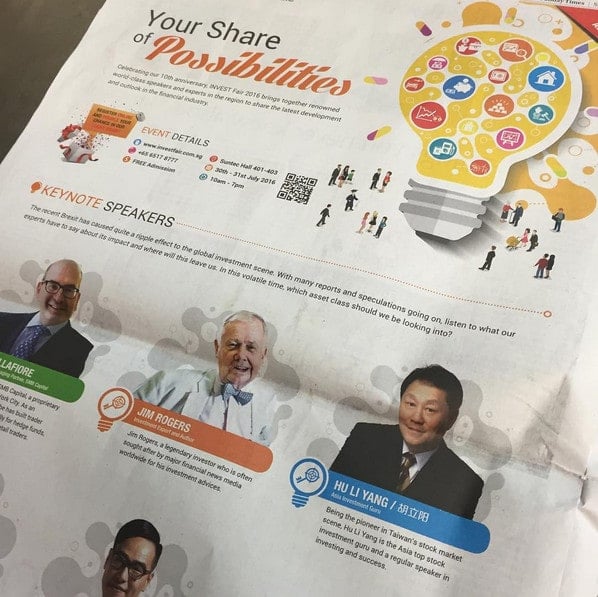

SMB in Singapore for InvestFair 2016

Mike Bellafiore will be a Keynote Speaker in Singapore for Invest-Fair 2016. INVEST Fair is ShareInvestor’s annual flagship event in Singapore for investors and traders. Jointly collaborated with The Business Times, Singapore’s largest business publication, INVEST Fair is an unrivaled event- “the LARGEST Investment/Trading Event in Singapore!” Here is an ad from The Sunday Times (Singapore): If you are a … Read More

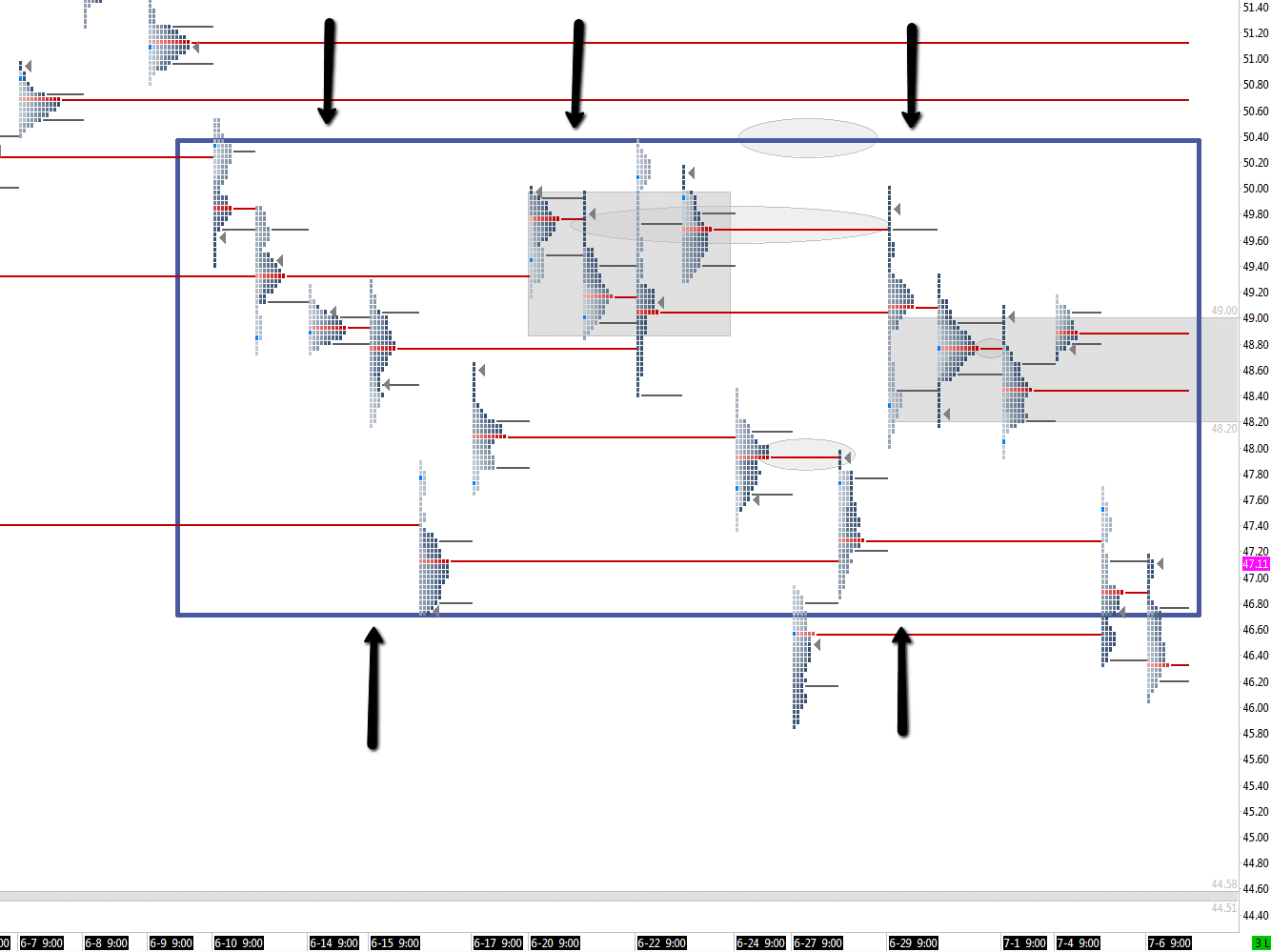

Analysis of Crude Oil & Followup

Each Friday after lunch, Andrew and I do a Q&A webinar for the SMB Community. We call it Trading Conversations. One question we covered in last week’s webinar was about the current state of Crude Oil. I use Market Profile, so I laid out exactly what I was seeing in “Texas Tea” from a Market Profile perspective. Largest view: 16 … Read More

Entry Types For Momentum vs Rangebound Plays

Last Friday we had a great talk, with Brexit fresh off the press, during our weekly Trading Conversations webinar last Friday. As usual, we covered a wide range of things such as using context, how to adjust your trading to handle volatility, and more! Not a bad way to wrap up your trading week with some open trading conversation. One … Read More

Why did LVS trade through 44 if that was support?

LVS hit our radar for a Spencer (my trading partner) 2nd Day play. There was not much a news catalyst in LVS, but yesterday it traded a higher RVOL, finished near the bottom of its range, and traded significantly weaker than the market. We walk onto our trading floor today wondering if there will be follow through or a bounce … Read More