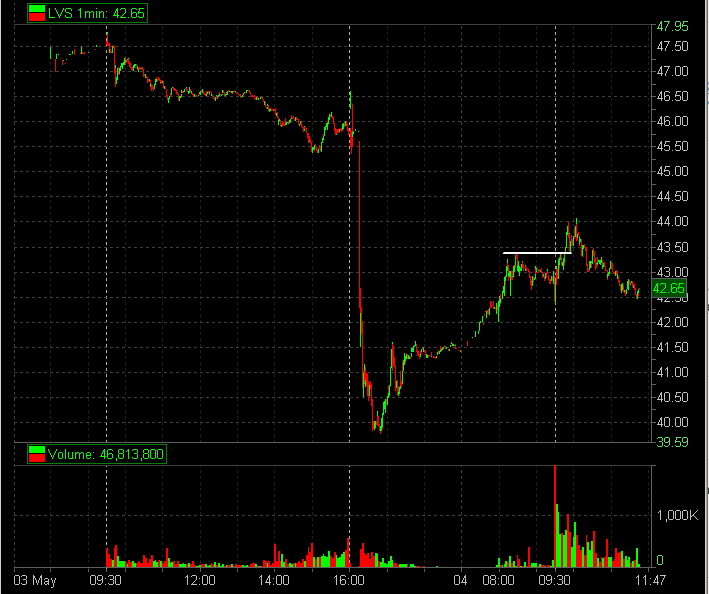

LVS gapped down from 45.40ish to near 40 in the premarket and then recovered some.

From Bloomberg.com

Las Vegas Sands Corp. (LVS), the U.S. casino company expanding in Asia, reported first-quarter sales and profit rose less than analysts’ estimates on lower winnings from table games in Nevada. The shares fell in late trading.

Net income climbed to $289.3 million, or 28 cents a share, from $17.6 million, or a loss of 4 cents a year earlier after preferred dividends, Las Vegas Sands said today in a statement. Profit excluding items was 37 cents, less than the 44-cent average estimate of 22 analysts in a Bloomberg survey.

A low hold at Las Vegas table games hit cash flow, the company said. Sales jumped 58 percent to $2.11 billion, reflecting the opening of the $5.5 billion Marina Bay Sands casino resort inSingapore starting in April 2010. Analysts had projected sales of $2.14 billion, the average of 18 estimates.

43.30ish was resistance intraday in LVS. It had trouble there in the premarket. It failed there once after accumulation at and around 43. The intraday high had been 43.39. And then the psychology of LVS changed for me on the open.

LVS made a new high clearing 43.39. I expected these likely patterns: breakout to new highs or the buy the new high program. It appeared to me that someone tried to fade the new high putting on the sell the new high program but then a bigger buyer just sat there and took everything he could at 43.4o. LVS made a new high, didn’t go down, and then ticked higher. This was a momentum trade opportunity for traders. But this trade is not the focus of this blog.

LVS traded up towards the next logical resting area of 44. Failed there. And then pulled back quickly to 43.40. Here I have to buy the pullback. LVS is trending up intraday. It traded back to a very important price that it exploded upwards from earlier. Also, this is the price where many gained confidence that the next move was higher.

The execution of this trade can make all the difference. When you buy into a pullback you must give the stock some more room. So if you are buying into the 43.40 support area you cannot place your stop at 43.39. The stop is if LVS is clearly holding below 43.40 or perhaps touches a price that so indicates, like 43.25. The exit if LVS trades in your favor is a move through 44.

LVS approached 44 again. I had expected a squeeze to the 44.30 level. Didn’t happen. We got a measly peak above the 44 level to like 5-7c. Then there was a battle at 44. A buyer was trying valiantly to hold this offer. He couldn’t. The bid dropped. This for me is an exit to flat or at most 1/3 of a long position.

You may notice that LVS traded much lower after this trade. That poor move through 44 may have been our foreshadowing. Near 10am and ready for reversal time was also a consideration. At that moment in time our 43.40 level was an excellent risk/reward opportunity that paid us. As traders our job is just to make excellent risk/reward trades based on the information we have. In fact when LVS failed the 44 level Steve and I were gchatting about GMan fading for a short. I could write a whole blog post on how this was an excellent trade as well. Perhaps you can make this pullback trade your own.

Mike Bellafiore

Author, One Good Trade

7 Comments on “Buying a Pullback (LVS)”

Quick question Bella: how much time must elapse on the Open before you are confident in a stock’s direction/trend? I seem to recall you (or perhaps Steve) mentioning that you don’t trust a stock’s direction in the first 30 minutes or so. Thanks for sharing this trade 🙂

it depends. for example prob a little earlier with LVS since it was so active in the pmkt. so we momentum trade the first half hour mostly and then look for the swing trade after the first 45 minutes generally.

I could write a whole blog post on how this was an excellent trade as well.

I could write a whole blog post on how this was an excellent trade as well.

This is a good news…Great job LVS CORP.

It’s very important to know this info.

this is the price where many gained confidence that the next move was higher.