This is a guest post from one of our traders, SW, about his trading day from Tuesday: A senior trader CB came to me after the close in regards of my recent performance. I expressed my frustration and disgust in missing an “A trade”. At SMB, we are taught to grade our trading setups A, B, and C, for purposes … Read More

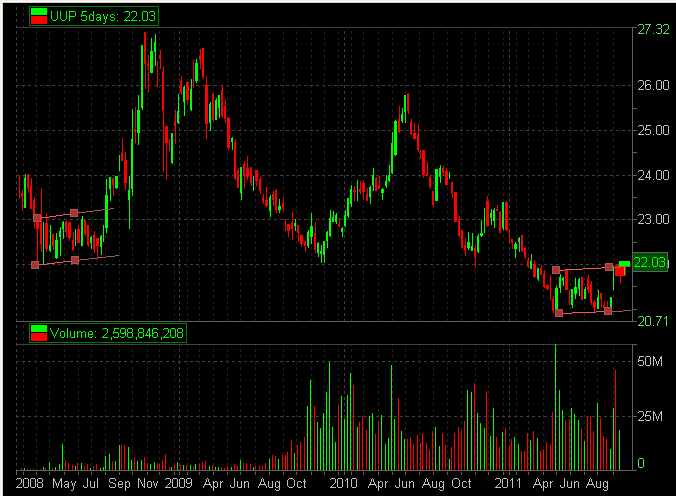

Bears Don’t Exist, Think Like a Bull

This is a guest post from Fred Barnes aka @DCDaytrader: I recently had a conversation with a few somewhat novice traders. For us traders who don’t have the 2007-2008 market experience on our resumes, we’re looking at the recent market activity in awe. Watching the quote screen (of the $ES_F) in August (2011) required the skills of a speed reader. … Read More

Reviewing the SMB Archives

In August and early September, the market seemed to rotate around two distinct type of trading days: 1. The momentum panic day, driven by major news, with lots of volume in the SPY 2. An uptrending grind or ‘melt-up’, characterized by a wide ranges, low volume and steep pullbacks that would shake a lot of traders out but seldom break … Read More

What I learned from my summer internship at SMB

A guest post from one of our summer interns, Chan, practicing his trading skills on the demo while back in school. I interned at SMB this summer and left with a lot of information and skills. I was taught a lot of things, I learned how to read the tape, the psychology of trading, how to control my emotions while … Read More

The nice thing about communicating at a desk (PEP)

A guest post written by trainee SW: Communication is one of the 7 fundamentals taught here at SMB. The nice thing about trading here is that traders are always sharing ideas and learning from one another. Today was not an exception. I was involved in PEP shorts in the morning. However, PEP couldn’t hold below the 62 level from yesterday. … Read More

SMB Radar – Set Up In $MJN

Here is a great example from today on how we use the Strong Today column on the SMB Radar. The Strong / Weak Today list is one of my favorite outputs of the algo on the Radar. I like to constantly look through the lists in search for good set ups. I want to find a stock that is In … Read More

A Case of Bias Conflictus on SOA

This is a guest post from a young trader, CP Bias conflictus is a condition that can interfere with proper reads on stocks in a tape reading environment. This bias, for whatever reason, holds sway over the the obvious information on the tape. Seems a case of the ‘irresistible pull of irrational behavior’ (check out the book ‘Sway’ by Brafman). … Read More