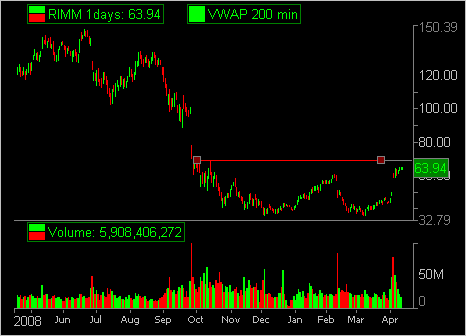

I love trading RIMM. Not because it was my most profitable stock in 2008. Well maybe partly. I love trading RIMM because it is one of those few stocks that all the major players on Wall Street trade. Hedge funds flock to RIMM when the market is moving. As do mutual fund managers, professional traders, and retail brokers. With so many followers it tends to have explosive moves from classic setups.

One such setup has begun to form in RIMM. After a large gap up following its earnings report RIMM has consolidated in a 2 point range (62.70-64.80). A move outside of this range on heavy volume should produce a multi point move. I believe RIMM is more likely to break to the upside than the downside for a variety of reasons. One, the market has been in an uptrend for the past month. If we have another leg up RIMM will be one of the first stocks bought by hedge funds, retail traders, and professional traders. Two, the hedge funds who love pushing RIMM around are all looking at the same long term chart that still shows a ton of upside. Three, the second day after releasing its earnings report RIMM was dumped by some large sellers that caused it to trade down to around 58. I believe this selling eliminated some of the weaker hands in the stock.

I am mentally prepared for RIMM to break in either direction but my expectation is a break to the upside. How will I play this break? I will be long a small position when it trades above 64.80. I will watch the trading volume closely to assist me in determining whether this will be a true upside break. If the volume is good I will look for a held bid above 64.80 to add a second lot. Then next I will watch to see how RIMM handles the 65 level. A lot of information can be gained by watching how RIMM trades through a whole number. If RIMM blows through 65 and quickly moves up to 65.30-65.50 then this would be further evidence of a true breakout.

My same day target would be 68. I will hold at least 50% of my largest position until RIMM reaches my target. If I see further evidence in the next few trading days of this trade developing I will post an update on our Twitter page.

4 Comments on “Attention All RIMM Traders!”

A Crabel NR7 day yesterday..use today’s 30 min opening range with a break of that range for entry and a slightly more aggressive play if still inside yesterdays range

A Crabel NR7 day yesterday..use today’s 30 min opening range with a break of that range for entry and a slightly more aggressive play if still inside yesterdays range

Must say major props on the RIMM call after this blog! I noticed the next day it traded down to your low of the range you pointed out, 62.70…then rallied hard into the close! Sure you guys made major bank on it. Been reading your blog since day one and really enjoy it!

Must say major props on the RIMM call after this blog! I noticed the next day it traded down to your low of the range you pointed out, 62.70…then rallied hard into the close! Sure you guys made major bank on it. Been reading your blog since day one and really enjoy it!