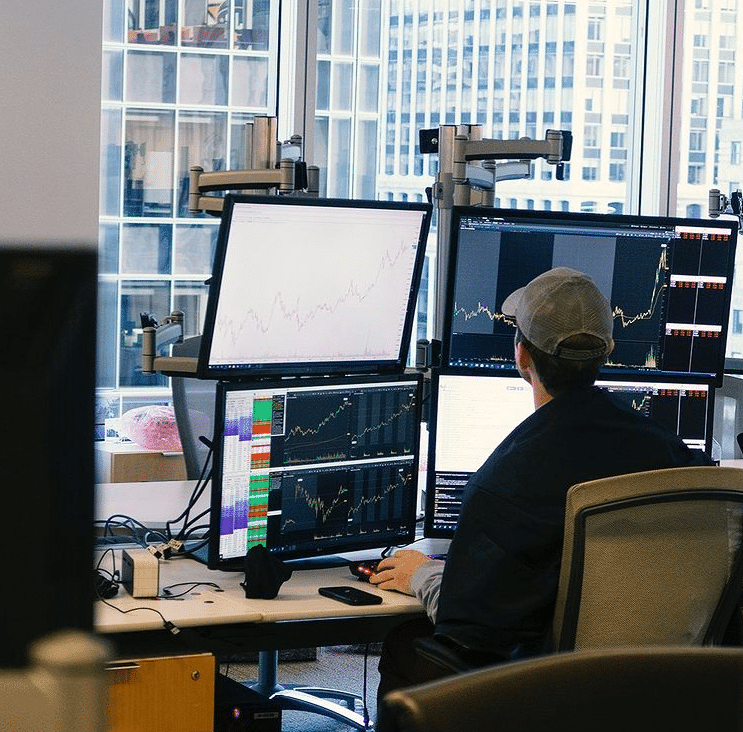

These are crazy times to trade and $CAR was crazy for even this market. This is what traders on our desk are saying about this market and this most recent $CAR trading opportunity.

One elite trader at our firm in an AAR (After Action Report) to other select elite traders described these trading times this way:

What a crazy time to trade. These things are unbelievable really.

Another elite trader at our firm described the $CAR opportunity this way:

Definitely by far the craziest real stock squeeze I’ve seen with the amount of float plus history of trading.

What lessons can we learn from the crazy trading during this crazy market in $CAR?

1. $CAR was not easy.

There were several experienced traders who lost 1 million plus trading this most recent $CAR opportunity from reading $TWTR and my inbox. And there were traders who lost long and short from what I read and heard. Some tried to play a bounce that never came. Some shorted what they thought were unstainable prices or what they thought was the turn in the stock only to cover higher. (We did not see this at our firm. All our traders stayed within their risk limits.)

2. New traders should not have been trading $CAR.

3. Do an AAR!

Several elite traders shared their AAR on an email chain, that I was fortunate to be on, after their trading experience. Each brought a unique experience and additional learning for the others.

4. Consider carefully the liquidity and volatility when calculating your real risk.

It is fine to be wrong about a trade in an opportunity like $CAR. It is fine to play the bounce, for it not to bounce, and for you to lose. It is fine to see the turn in the stock and go for the short and lose. Where traders get in trouble is by improperly calculating their potential loss. This comes from not properly respecting what the stock can do. What the stock can do in this market. What the stock can do in this market with the liquidity it presently is offering. The real losses come from this miscalculation and not from choosing the wrong direction.

5. If you are wrong, bail quickly.

Traders who traded big, lost, but stayed within their loss limits, bailed quickly when they were wrong on direction. Traders who were slow to take their losses, before exiting their position trading against them, took excessive losses.

6. Don’t blow up!

In this market, at these times, there is always another $CAR right around the corner. See $AMC, $GME, $BBBY the very next trading session. Live to trade another trading session. Don’t let one crazy stock, on one crazy day, during these crazy trading times blow up your trading account.

Mike Bellafiore is the Co-Founder of SMB Capital, a proprietary trading desk, and SMB Training, which provides trading education in stocks, options, and futures. Bella is the author of One Good Trade and The PlayBook. He welcomes your trading questions at [email protected].