Not all trading days are created equal. As much as we would like to walk into an exciting market each day, we need to look beyond our impulses and really pay attention to the subtle hints that the market offers each day in terms of what kind of day it can turn out to be.

It’s important to have an idea of what kind of day is possible in terms of movement because this information is can be used to guide your trading expectations. As my traders know, I am very big on forming expectations before entering a trade.

1. Always Check the Upcoming Economic News Items

One of the first things I look at each day before placing any trade in the forex market is the upcoming economic news items. Remember, not all of them are important. You need to be able to judge the level of importance by how it is viewed by the trading crowd. For example, is the upcoming news an ISM Manufacturing PMI or is it Natural Gas Storage? The ISM number can be a potential catalyst depending on how it relates to the current market sentiment, while no one in the currency market cares much about Natural Gas Storage. Know what kind of potential each news item presents, and also be prepared if it turns out to be a non-event.

What if you are looking to trade on a US bank holiday? How much potential do you think exists in this market? No idea? See: come back tomorrow.

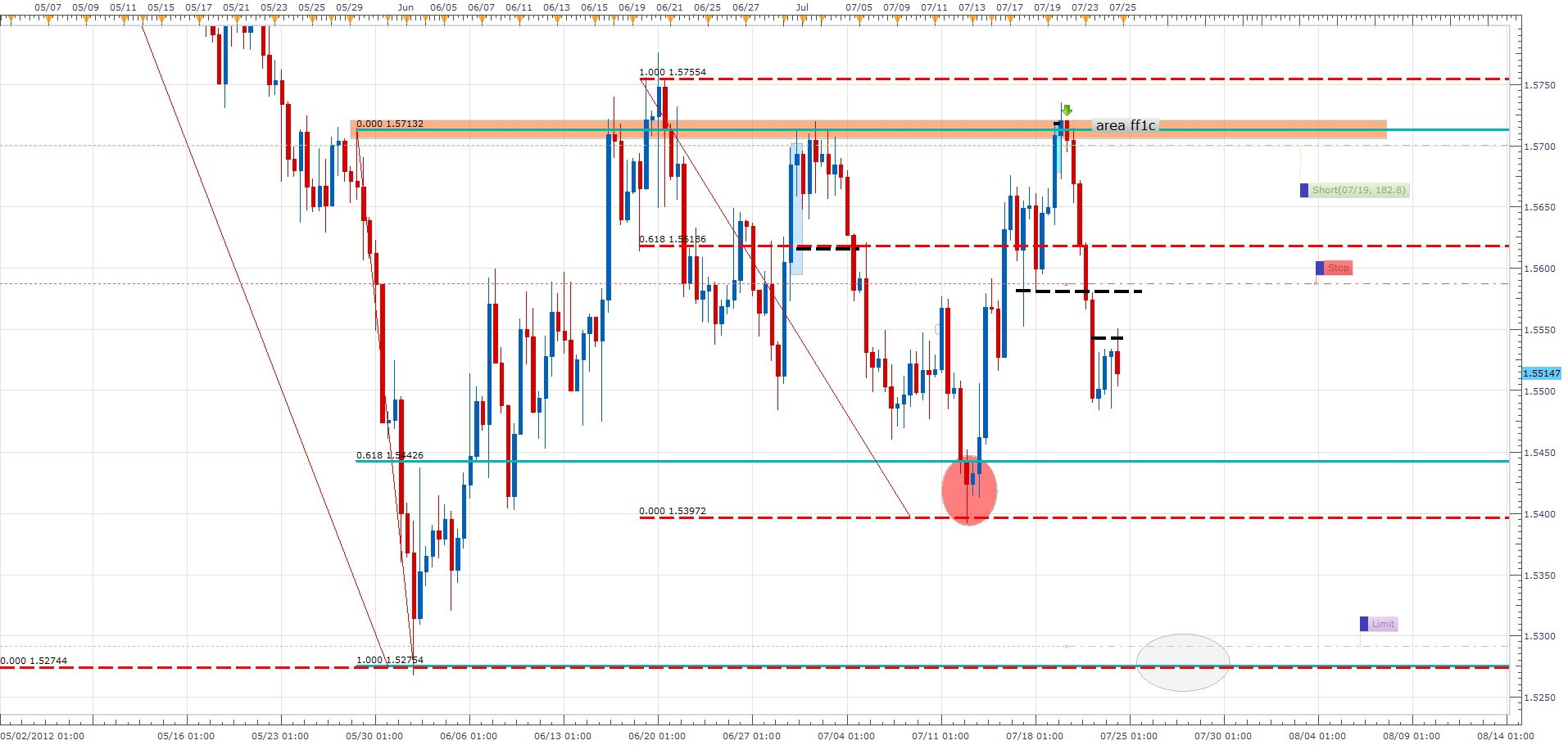

2. Price Action

Can you identify a trending market? Sure you can, after the fact. Can you identify a trending market before it begins trending? Do you know what signs to look for? You should be comparing highs, lows and how much time it takes to make progress. For example, what if you watch your favorite forex pair push a new low, reverse back up, and then over the next 30 minutes attempt to make a new low but can’t? That is a potential trend reversal. Now what if it establishes a higher high from this structure, only to pull back and fail to make an additional high? What kind of market is that? You should be saying, “A choppy market”.

3. Time of Day

Trading activity is not evenly distributed through each forex trading day. Certain times of the day are going to be more active than other times. Are you trading the London Session? New York Session? Or Tokyo? London and New York is where most of the volatility of the day occurs mostly because this is the span of time where most of the economic news comes out. To see a video example I produced about this topic, click here.

Before you place a trade, it’s important that you have considered my factors: starting with the bigger picture levels, reviewing potential catalysts, and then refining this further by examining current price action and how it relates to the bigger picture information you just analyzed. Being able to anticipate what kind of day you are facing in terms of price range is just as important as deciding whether you should be bullish or bearish. It’s just as important to be able to identify a lack of direction or a flat market, because this information can be very helpful in terms of forming targets and expectations for managing your trades.

—

Marc Principato, CMT

*No Relevant Positions