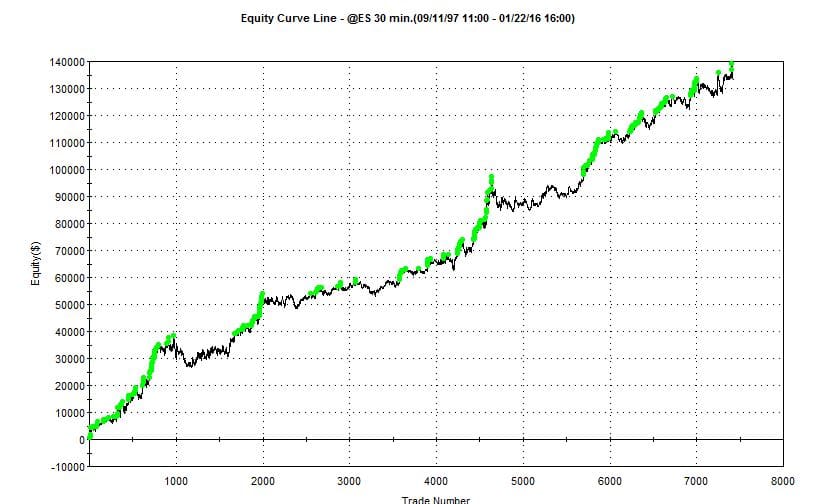

The following is a simulated back test of a simple short term momentum system on SPY. It generally has positive performance but the draw down periods are a little deeper and wider than I would prefer. Now, I’ve taken the same system but coded it to go flat at the end of each day. Then it waits for a fresh … Read More

The sloppy, the good, the same trader

Let me share actual trading events from our prop desk this week. It’s Tuesday, the market is selling off hard and Trader A thinks the market should bounce and VXX decline. He fades the market and VXX all day for a net result of -10k. Let’s call this The Sloppy (in his trading). It’s Thursday, the oil has sold off … Read More

The Market Pays You For Volatility

In our SMBU Daily Video, Seth Freudberg discusses how market volatility can pay you. Everyone knows that the market has been selling off hard since the turn of the year. Many traders of market neutral options strategies are struggling in this environment However, initiating trades in this environment historically provides the trader with an edge. This video discusses one of … Read More

Heightened Volatility is a Double-Edged Sword

Volatility (both real and implied) has been stepping higher. While not at extreme levels, the S&P 500 Volatility Index ($VIX) is at a precarious point. Volatility is one of the more reliable market segments for a mean reversion bias. Most of the time, the VIX lives somewhere between 10 and 30. However, when it gets above 30, the index can … Read More

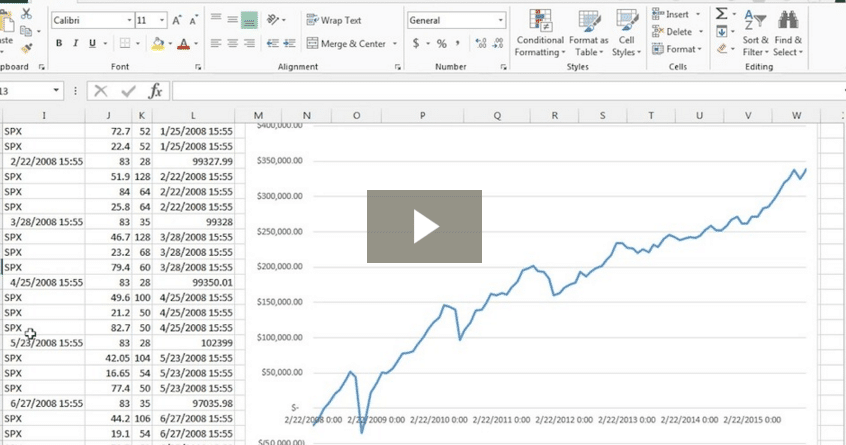

Building a Once Per Month Trade Plan

In our SMBU Daily Video, Andrew shows you how a simple, once per month, trade plan on the SPX could have generated a 43% annual return over the past 8 years (when the market averaged less than 5%) Andrew discusses the importance of finding the key (and simple) elements that provide edge. He shows you how to systematically eliminate the complexity that may … Read More

Which Options Strategies Is SMB Invested Into?

A few years ago, we partnered with a hedge fund, The Kershner Trading Group, to expand our resources and capital for trading. At about the same time, the partners were noticing that John Locke’s options strategies had been showing great results for several years. The natural next step for SMB was to connect these great strategies (and great traders) with the capital … Read More

The caring makes all the difference in trading

Trader A is an experienced trader learning futures on a new platform above, as he shared with me with this screenshot. Trader A is up over 2k in 2 hours of futures trading. What he cares about makes all the difference. Here is what Trader A said about his start: The elite trader is proud of learning a new platform. … Read More

TICK TICK TICK tools at this trader dinner

Last night our trading desk grabbed some Mexican and beers with our top traders for dinner. Generally we trade stocks with a news catalyst (we say Stocks In Play), but recently we have been focusing on market trades. SPY, UVXY, DWTI, OIH, SCO are products of interest. Many would assume these traders would sit around predicting the bottom in oil, … Read More