Bella Responds

I love the respect given with the Mr. Bella 🙂

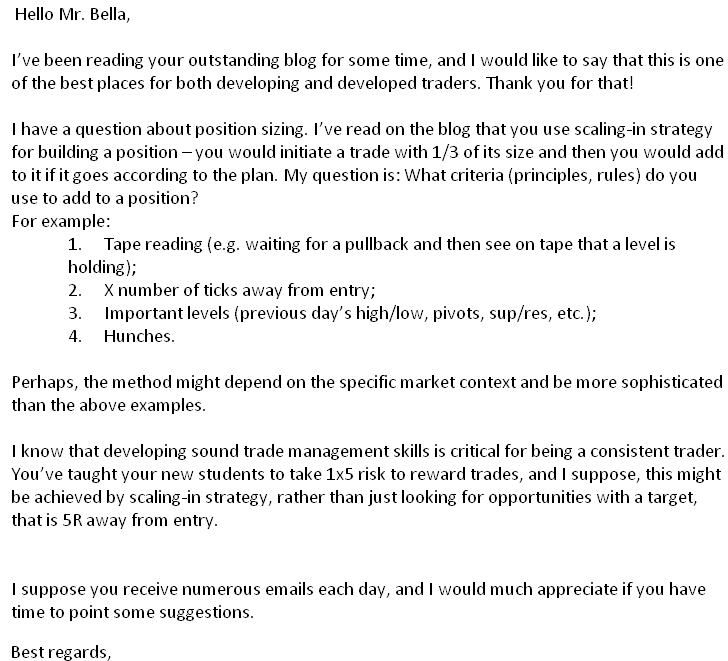

If we start a 1/3 position then we are not as confident in the set up. We are searching for information that gives us more confidence. What factors would do so:

a) the tape

b) intraday charts

c) long term technicals

d) any important news that just hit on the market. the stock or the sector

e) how easy it is to get in and out of the stock

f) a determination that I can control my risk

g) the strength of the overall market

h) the time of the day

i) strong moves away from prices confirming a big order

j) the corresponding futures

k) my trading intution

I will factor in all of the above and look for excellent risk/reward opportunities so I can add some size.

I hope that helps. Great job by you working on your trading game!

Mike Bellafiore

Author, One Good Trade

One Comment on “Traders Ask- Position Sizing (Part II)”

I used to wonder why time plays an important factor in day trading. I thought the advantage of trading is that you can work whenever you want to work. I only found out recently that the most successful traders are those who observe the day market in the morning – before they make any trade whatsoever. I plan to do that now – so that I’ll have more gains than losses.