What if I told you some of the best prop traders experienced periods of awful trading? I might go so far as to say their results were awful during specific periods. They lost money. They made unforced errors. They lost confidence. You might have periods in your trading where you conclude you are terrible. You wallow in despair that you … Read More

Boost Your Trading Performance: 4 Simple Solutions to Avoid Missing A+ Trades

Do you ever feel like if I you could just take my best trades, we say A+ trades, my results would be a lot better? I am talking a lot better. You are probably right. Let me share a recent anecdote about this from the desk and offer 4 simple solutions. A few traders on the desk had been missing … Read More

Thank you Covid!

I got Covid for the first time this week. Many on the desk didn’t miss their opportunity to tease me about being the last person on earth to get it. My son got it as well. That meant a trip to our house on the Jersey Shore to isolate from mom, his sister, and others. So it was just the … Read More

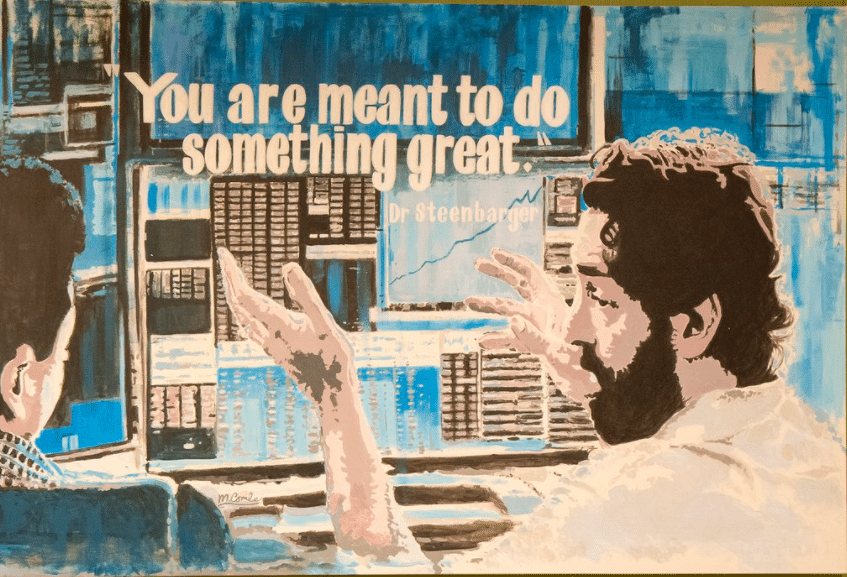

The #1 Trading Goal for Top Prop Traders: Achieving Consistency

One of our top traders, perhaps our best, sent us his yearly goals. I highly await this trader’s goals each year as he often recognizes the most important goal for the upcoming year. We will reveal the #1 goal for a top trader at SMB in 2023 in this post. Choosing the wrong goal for 2023 can cause underperformance. … Read More

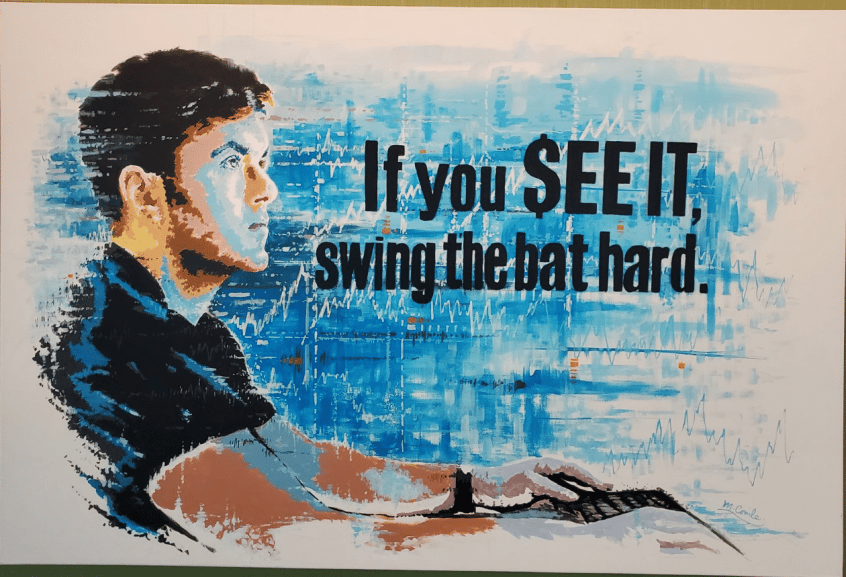

Taking a Rip in Tesla

We shared that we have been hawking a potential Bounce Trade in Tesla. I spelled out Four Keys for a Tesla Bounce Trade. Some on the desk pounced on a Bounce Trade in Tesla after SEEING it. They took rips as the trade failed. Let’s discuss an important reality to being a professional trader. Taking losses is part of the … Read More

Mastering Tesla Bounce Trades: Four Key Strategies

Many trading eyes are waiting for a $TSLA bounce. Let me share four keys (not all of them) to trade this opportunity well as an active trader. Sensing too many traders were positioning for a bounce *too early*, I shared this tweet with the trading community: My goal was to remind traders they needed to be specific about the Bounce … Read More

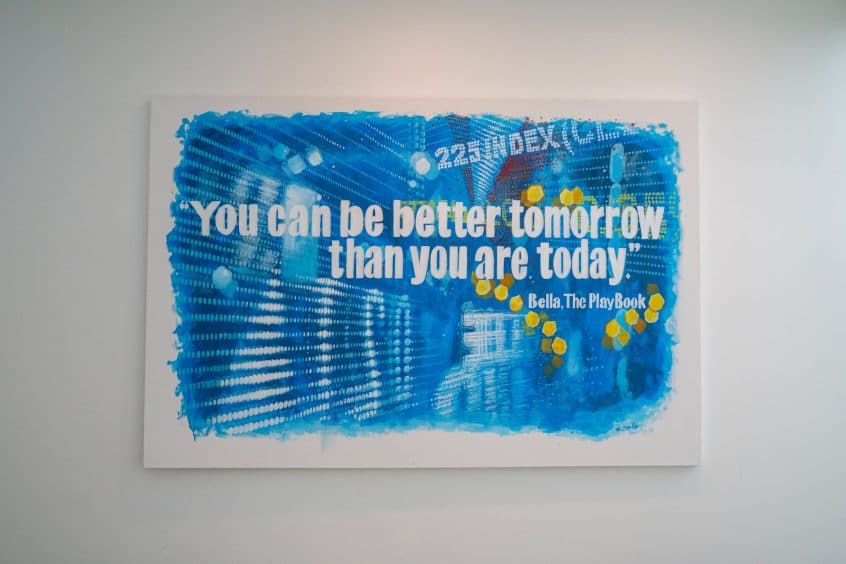

Team Good2Gr8! at SMB

At SMB we identified an important goal for 2023. That goal is to help *good* traders become *great*. We call it Team Good2Gr8!. The goal is raise the floor on our good traders to improve these traders and the firm. One exciting new best practice has come from Team Good2Gr8! that could help your trading. @TheOneLanceB, Legend, is assisting in … Read More

9 Trading Lessons Essential for Today’s Market

1. Develop your system to short circuit trades that do not feel right. What you certainly DO NOT want to do is short circuit a trade based on your feel before developing your system to do so. That could lead you to prematurely exiting a good r/r trade. 2. Do your Daily Report Card without fail. Watch: How the Daily … Read More