Here is a checklist I use for developing an intra-day trade idea. If the answer to the first two items is YES then I continue down the list to develop a trading thesis. If NO then I don´t trade the stock. Identify if it has a strong catalyst–a strong catalyst often leads to heightened volatility (movement) which is necessary for … Read More

Some Answers on Risk/Reward, Stock Selection, and Time Frame

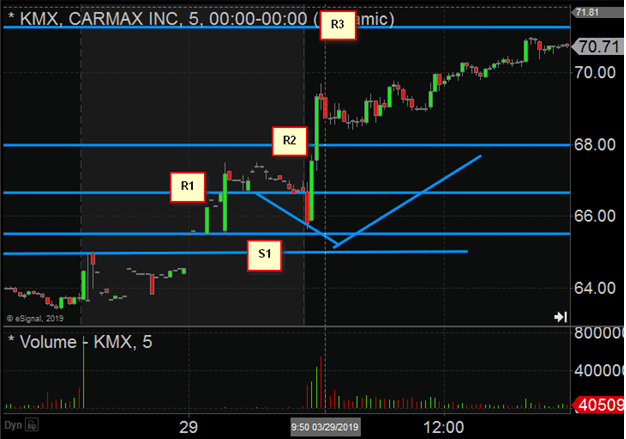

Hey Mr. Spencer. I was a participant in the SMB-U webinar on Tuesday morning and I have some clarifying questions I hope you could answer. 1. You discussed the importance of only trading securities with 1/5 risk reward. I understand the concept, but I’m not sure I understand how those levels are quantified. What I thought was being said was … Read More

Trade Review–WMT HD SPY

The top In Play names this morning: WMT was my focus as the lowering of FY19 guidance was potentially a very strong catalyst. Early indications from pre-market trading were many traders were attempting to dump the stock ahead larger selling that would come after the opening bell. You can see my discussion of WMT in the AM Meeting here. With … Read More

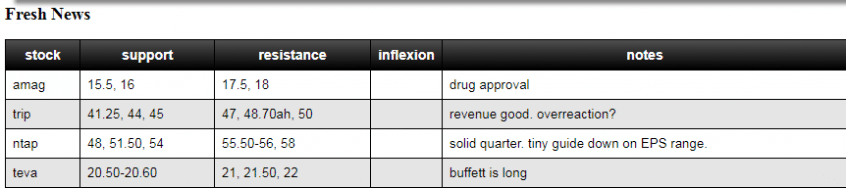

Why I Game Plan Every Day

Every morning when I arrive at SMB’s office in midtown Manhattan I have a pre-market routine. The routine serves two purposes: 1) To get me in the proper frame of mind to attack the markets and 2) Ensure that I’m in the best risk/reward stocks and setups. Here is a brief outline of my pre-market process: Login to trading platform … Read More

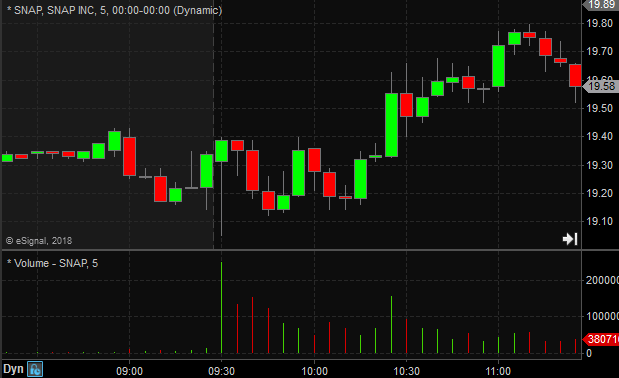

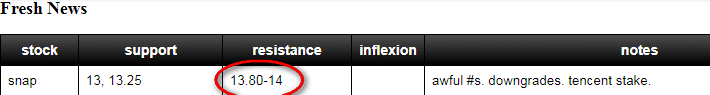

SNAP Cracked

SNAP was our #1 In Play stock last Wednesday. Tuesday, after the market closed they reported earnings below expectations and gave weak guidance. The stock was battered dropping from 15 to 12 in after hours trading. But then at 6AM Wednesday it was reported that a Chinese internet company had purchased a large stake. So what initially appeared as a relatively … Read More

Shorting A Garbage Stock

The market has been on a tear in 2017. On the rare occasion the market has a 1 or 2 percent pull back people are tripping over each other to buy! This environment leads to large runups in what I call “junk stocks”. They are low priced stocks, under $5, that have very small floats. The are easily manipulated because … Read More