SNAP was our #1 In Play stock last Wednesday. Tuesday, after the market closed they reported earnings below expectations and gave weak guidance. The stock was battered dropping from 15 to 12 in after hours trading. But then at 6AM Wednesday it was reported that a Chinese internet company had purchased a large stake. So what initially appeared as a relatively straight forward short setup had thrown traders a curveball. SNAP popped from 12 to 16 between 6-6:30AM. By the time I started watching it in the pre-market it had settled down below 14. My initial thought was regardless of whether SNAP had a large Chinese shareholder many investors would still head for the exits.

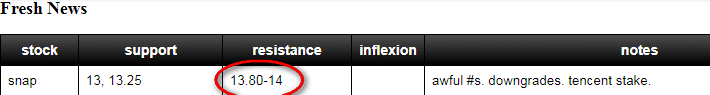

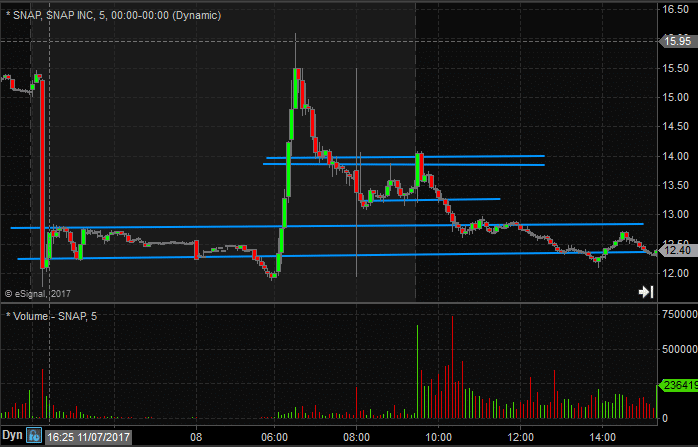

Based on the after hours and pre-market trading I developed my game plan. I would short a pop on the Open between 13.80-14 ![]() and look to cover most of the position at pre-market support. If SNAP traded below pre-market support then it would make sense to build a larger short position. Because of the poor earnings report volume in SNAP was likely going to be multiple of its normal average trading volume making it relatively easy to trade large blocks at a time (one trader on the desk was moving in/out of 50k shares per trade with little slippage).

and look to cover most of the position at pre-market support. If SNAP traded below pre-market support then it would make sense to build a larger short position. Because of the poor earnings report volume in SNAP was likely going to be multiple of its normal average trading volume making it relatively easy to trade large blocks at a time (one trader on the desk was moving in/out of 50k shares per trade with little slippage).

at 9:30 SNAP opened around 13.50 it quickly dropped to pre-market support at 13.25 before reversing quickly and hitting my “short zone”. As if it was reading directly from my morning game plan script it failed at 14 and in the next few minutes traded down to 13.50.

Once it trade below the Opening low and pre-market support of 13.25 it offered another opportunity to press shorts. Most of the experienced traders on the desk were short at this point with sellers in control. From a price action perspective SNAP did just about everything I could have hoped for to confirm a short position. 1)Dip buyers quickly pushed the price up in the first few minutes after the Open; 2)It failed at a well defined pre-market resistance area; 3)It traded below pre-market support and the Opening low; 4)It consolidated below the after hours resistance. As short term traders we develop a thesis but without price confirmation we must not press a position and be prepared to exit quickly.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 21 years. His email address is: [email protected].

No relevant positions