I make trading decisions based on 3 factors: Tape (order flow), Technicals (trend, support, resistance) and Catalysts (News). The least understood of the three is the Tape. It is a skill that takes thousands of screen hours to develop. But once developed it is a skill that enhances the risk/reward of your trades and often enables you trade with larger size with a minimal increase of risk.

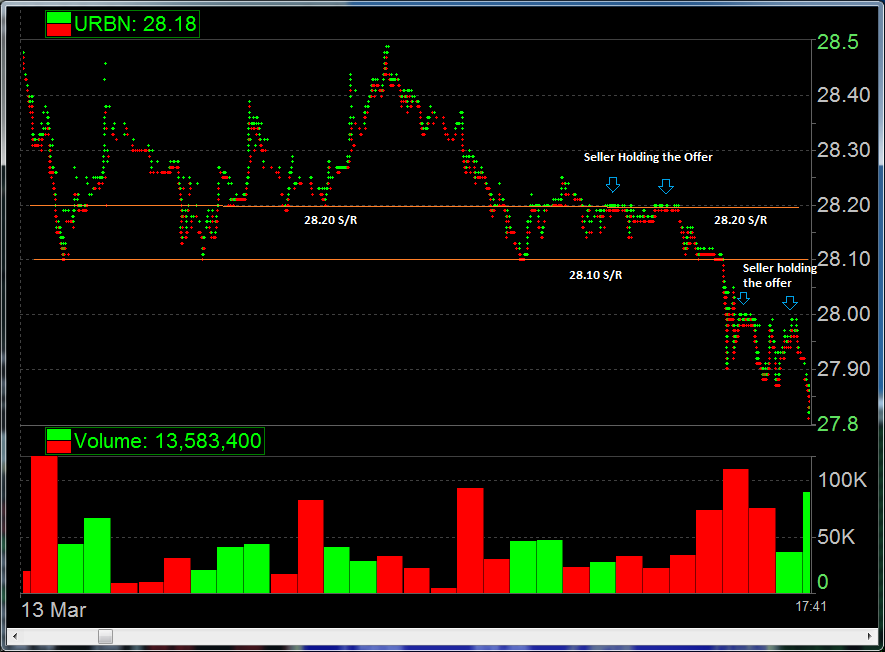

Yesterday I was trading URBN that had released earnings. The initial reaction to the news was negative as you can see from the two day chart. I was interested in looking at a short trade around 28.50 with confirmation below 28 for a move down to 27.50. (28.20 level highlighted as well for reason listed in next paragraph).

The market opened and URBN was bouncing around for the first ten minutes. The range started to tighten between 28.10 and 28.20. A seller at 28.20 could clearly be seen on the offer absorbing dozens of buy orders. I established a short and added to my position when the 28.10 bid dropped breaking the tight range. I continued to trade it on the short side for the next 30 minutes with my ultimate stop above 28.20.

I was looking at URBN because it had fresh news and was reacting strongly to that news in the pre-market. But the decision to open a short position was based on The Tape.

Steven Spencer is the co-founder of SMB Capital and SMB Training and has traded professionally for 16 years. His email is [email protected].

No relevant positions

*live trades discussed in this post took place in T3 Trading Group, LLC a CBSX broker dealer

2 Comments on “A Tape Trade–URBN”

Steve,

Great information on your thought process in the trade.Question on this trade:Are you selling initially on the offer @ .20 or close to it? How many prints are you waiting for @ .20 to verify the seller and begin your accumulation?On these initial shares is your stop above the .28 pivot spike or just above the seller @ .20?As .10 bid drops, you’re adding shares. How are you selling? @ .10 or just below?

Thanks,

-B

Bruss,

Always such good questions. My guess is you have been well trained. On the Open things are moving so quickly with momentum so when something breaks a range you need to get in by sweeping and not bidding/offering. While still in the range you can bid offer in front of prices that are printing. For the stop I think if he lifts since he has clearly shown that he is now trying to hold the offer.

Steve