You have always wanted to trade for a living. You don’t want a boss. You want unlimited upside with your income. You don’t want your pay determined by office politics. You want to be paid based on what you are worth and what you produce. You love figuring out the daily puzzle that is the market. You love trading.

The start of your stock trading career

You put in the time. You study. You train. You develop some trades with edge.

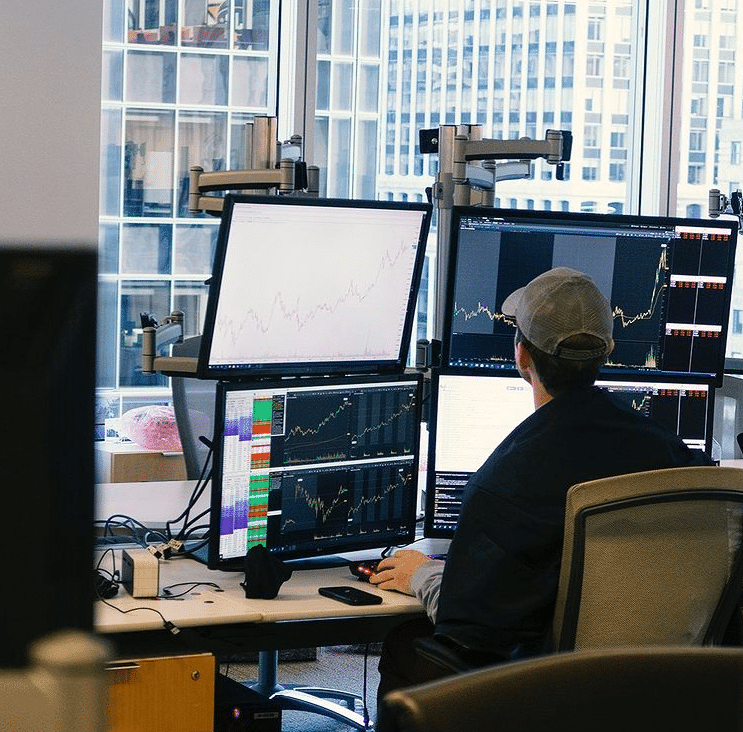

You are now ready to trade for a living. Perhaps you have landed a spot on proprietary trading desk, like SMB Capital. Perhaps, you are beginning as an independent retail trader. Either way, you have a trading account. You are ready to do this.

Or so you think.

And then you start.

The common mistake you must avoid

And too often I see new traders make the same common mistake. I see this over and over and over again. I saw it when we started SMB. I see it now. Heck I just saw it the other day.

Let’s stop doing this. Let’s discuss the problem and how to solve it. Let’s put you on the best path to be successful as a trader.

And taking a step back, I saw a new trader just start with us do this. And quite honestly it pissed me off. I think highly of this new trader. He has ability. He is so much better than he has shown. His poor start is not acceptable. He is much better than this. I have to say, I am disappointed in him.

Stop trading too many stocks when you start! Stop! Start the right way or else you are going to dig yourself a deep, unnecessary trading hole. You are going to feel frustration that you do not need to feel. You will be inflicting pain on yourself that you shouldn’t. I know when I trade too many stocks I feel it.

Here is what that one new trader wrote in his Daily Report Card (DRC) about his poor trading…

Firstly, I rarely perform well when pressing or when trying to do too much. I have definitely felt the need to perform well right off the bat and this has led me to veer away from my style of trading in the follow ways:

– Focusing on too many tickers in the first 30 min, causing me to get distracting from what I have game planned. (end)

Okay so I am admittedly pissed and disappointed in this trader, which actually is a good signal to me. I believe in this trader. I wouldn’t have gotten pissed if I didn’t have high hopes for this trader. So now we need to find a constructive way to help this trader. I needed to communicate this was not acceptable and provide guidance. I responded to this new trader in a curt email:

you are not permitted to trade more than three stocks in a day going forward, until you show you can trade 3 profitably

The phone call with this new stock trader

I followed up with a phone call to this new trader. I was honest with the new trader. I communicated his start was not acceptable and surprising. That I believed in him and his ability to succeed and that he didn’t need to press at the start. That pressing and overtrading is the way to get fired and lose his seat. I was clear we expected this trader just to be himself, at this moment in time in his trading career. To just be consistent and build from there. And do what he does well. That would be more than enough. Slow and steady and consistent progress is the way.

Not surprisingly this trader was positive the very next day.

When you trade too many stocks as a new trader all you learn is how bad you are as a trader when you trade too many stocks. Your trading results will not be an accurate representation of what you are capable of as a trader. And that is just…not necessary.

This example from the desk provides an excellent opportunity to find solutions for this trading problem. I know this trader is not the only person to have ever struggled with this issue. I know many of you do as well. Let’s offer some solutions so we can do better…together.

6 Solutions to solve this trading problem

- Save enough money to survive the very real learning curve. Notice how this trader is pressing at the start. This tends to be from a need to make money. Have enough money saved so you do not have to make money for 1-2 years. Recently, a former intern visited for lunch. He took a job at an investment bank. His present job is not what he really wants to do. He wants to trade. And he has had a lot of success with his trading done part-time. His account has grown to approximately 3 million dollars. But but but…he has a number he wants to hit before he quits his safe, investment bank job and trades for a living. And he will not start until he hits this number.

- Be YOU at the start. Don’t try and be Shark (one of our best traders at the firm). YOU are NOT Shark. Be YOU- a new trader building your niche and your trading edges in the market. Focus on being consistent. Being consistent at the start is YOU being a star, as a new trader. This is enough. This is awesome.

- Start trading with only 2-4 stocks. Prove that you can trade profitably with 2-4 stocks first. Then only after being profitable increase the number of stocks you trade. Then trade 5-6 stocks. Then only after being profitable increase the number of stocks you trade. Then trade 6-8 and rinse and repeat. And if you are not making money trading 2-4 stocks, then drop to trading 1-2 stocks.

- Take scheduled breaks during the trading day. Schedule breaks for 11AM, lunch, and before the close to reset. Check during each break if you are trading too many stocks. These scheduled breaks give you an opportunity to catch yourself trading too many names.

- Find an accountability partner. Share the maximum number of stocks you can trade with a partner. Ask that partner to hold you accountable to staying within these guardrails.

- Think like two sustaining successful experienced traders from our firm. An experienced trader on our NYC desk shared a conversation he had with another experienced trader on the desk. They had noticed another experienced trader in our space at a prop firm trade too big, lose too much, lose too much too fast, and get fired. They both shared the same thoughts. That this was not smart and irresponsible by this experienced trader. These two experienced traders preferred to make profits consistently. Too much volatility in their PnL was not for them. This is how you sit in that trading seat for the next ten years. And being able to do so is how you make real money.

From all of us at SMB, train and trade well.

Mike Bellafiore is the Co-Founder of SMB Capital, a proprietary trading desk, and SMB Training, which provides trading education in stocks, options, and futures. Bella, @MikeBellafiore, is the author of One Good Trade and The PlayBook. He welcomes your trading questions at [email protected].