The other day I tweeted that I was long NFLX and short SPY and that it felt kind of “weird”. I wrote “weird” because the easy money trading NFLX had been on the short side for over a month and at the time the SPY was in a multi-week uptrend. As an intraday trader I often will take trades that are counter to daily and weekly trends.

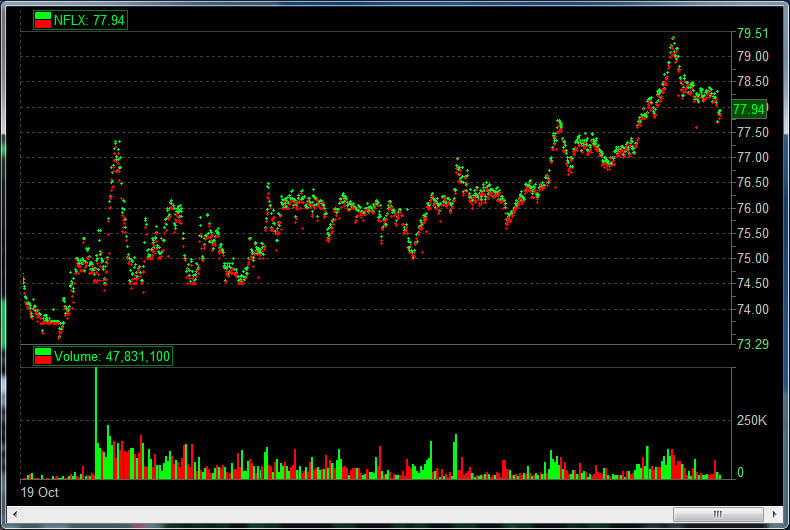

In the case of NFLX I got long when I spotted a buyer on the tape at 74.50 (see chart below). I consider three factors when making trading decisions: The Tape (order flow), Technicals (the price action that ensues from buyers/sellers pushing a stock up and down), and Catalysts (fresh news that leads to short term institutional interest).

These three factors receive different weightings for each trade that I make. For this particular trade the Tape was the primary reason I was long. The Technicals were still pretty awful at the time for a long trade. And the Catalyst was to the downside as well as NFLX had given worse earnings guidance than had been expected.

Reading The Tape is a skill that requires hundreds of hours of direct observation of Level II quotes and time/sales data. One of the “tricks” I recommend to newer traders is to use a “tick” chart to help confirm things they think they are observing on the tape. It is easier to spot the fingerprints of a buy or sell program on a tick chart because of the compressed time frame it highlights.

There are no books or articles that can teach you how to read The Tape it must be done by direct observation. Gman did a phenomenal job a couple of years ago compiling a series of videos, quizzes, and exercises to help jump start a trader wishing to learn on how to effectively use the tape in their trading decisions. More info on the program can be found here.

2 Comments on “Why I Was Long NFLX”

Hi Steve, how much room were you going to give this trade? 20c?

that sounds about right for the initial buy (stop at .29) but i actually don’t remember where i had them set. also my thinking starts to change after the buyer defends second and third time. if the buyer dropped on the 4th attempt prudent to just hit out right away and see how far it drops.