Newer traders often ask us “which indicators are best?”

Maybe you have one or more of these indicators on your chart:

- MACD

- Bollinger Bands

- RSI

- Stochastics

- SMA

- EMA

- Parobolic SAR

- and on and on and on

It must be very confusing for the new and developing trader to find technical analysis tools to gain a trading edge. It must be very disappointing for new traders to learn that on their own most technical indicators do not work.

But technical indicators can be constructive. One that is very helpful for the short term trader is VWAP. We do not blindly and exclusively use this tool to make trade decisions. But we do use it to help us make trade decisions combined with other factors, such as a news catalyst and price action.

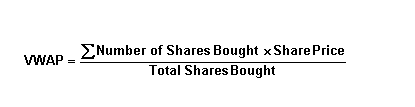

From Investopedia to define VWAP:

As a professional trader VWAP is used as an indicator to help me determine if a stock is independently, significantly stronger or weaker than the market. If a stock is holding considerably above VWAP, and for time, this may be evidence we should get long the stock for a swing trade.

In our newest training program, The Winning Trader, we will teach 10 trading setups, with one demonstrating how to use VWAP so we gain a trading edge.

Here is a recent example of how one of our traders used VWAP to gain an edge with his trading:

*no relevant positions

Related posts

Why you need VWAP for your trading