In this video Steven Spencer discusses trading during volatile periods.

Volatility Has Returned, But for How Long?

Here’s something that you can learn from and potentially add to your trading to increase your chances of being profitable every month. SMB added an options trading desk a few years ago. Over that time we have seen a very valuable pattern develop. When directional equities and futures traders are struggling with low volatility, the options desk is usually doing … Read More

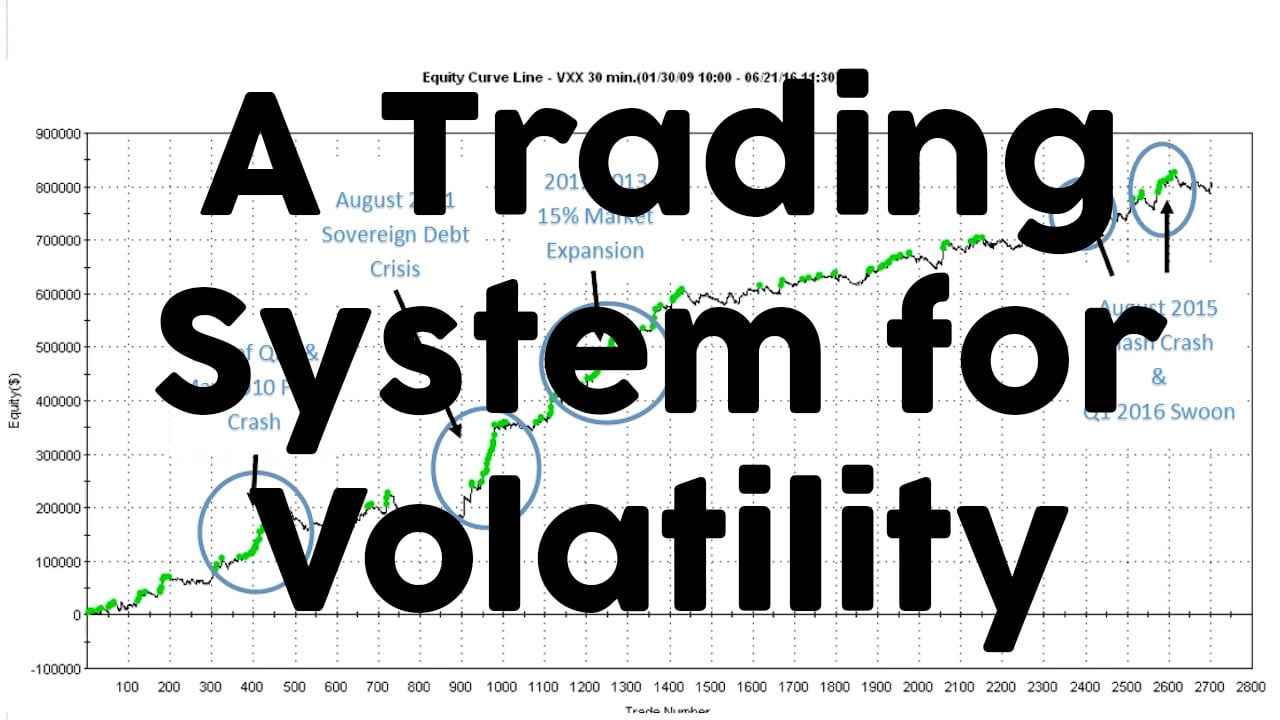

A Trading System for Volatility

Andrew reviews a VXX strategy to see how it would have handled several high volatility events over the past several years.

Tweaking Our Strategy During Market Volatility

In our SMBU Daily Video, Seth Freudberg explains how SMB’s Options Trading Desk tweaked its portfolio of monthly trades to adjust to this market environment. Traders need to realize that the market has changed–2016 is much more volatile In these environments, tweaking your portfolio of trades is recommended for retail traders * no relevant positions

A Perfectly Ineffective Hedge

In our SMBU Daily Video, Seth Freudberg explains a perfectly ineffective hedge. Many options traders buy puts in a panic thinking they will control downside risk in their trades We did a study on weekly options and found that they were incredibly ineffective at controlling downside risk over the last year In fact, traders would have made much more money SELLING … Read More

Heightened Volatility is a Double-Edged Sword

Volatility (both real and implied) has been stepping higher. While not at extreme levels, the S&P 500 Volatility Index ($VIX) is at a precarious point. Volatility is one of the more reliable market segments for a mean reversion bias. Most of the time, the VIX lives somewhere between 10 and 30. However, when it gets above 30, the index can … Read More

Trading The Current Market Volatility

When market volatility picks up short term traders shift their trading style. This short video gives some pointers on how we can more effectively navigate this type of trading environment. Get our daily video sent to your inbox each day. no relevant positions

One Good Trade Review

*****This is a guest blog contribution from Jeff Williams, a hedge fund manager, PMP, and PMO Director***** — Editor’s Note One Good Trade is a great book! I bought the Audible.com version, as I do a lot of driving. Good narration. This book is not a step-by-step guide on how to trade and it doesn’t advertise itself to be, so ignore … Read More