I share some thoughts on trading adjustments we make in a market with expanding volatility. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 18 years. His email address is: [email protected]. no relevant positions

Higher Volatility = Higher Trading Expectations

Hey Bella, First of all I want to express how excited I am for this (SMB DNA). I have been trying to trade part time for years and have been on the edge of being good for over a year. I have had some personal issues with my dad’s health that has kept me doing the “safe” thing with my … Read More

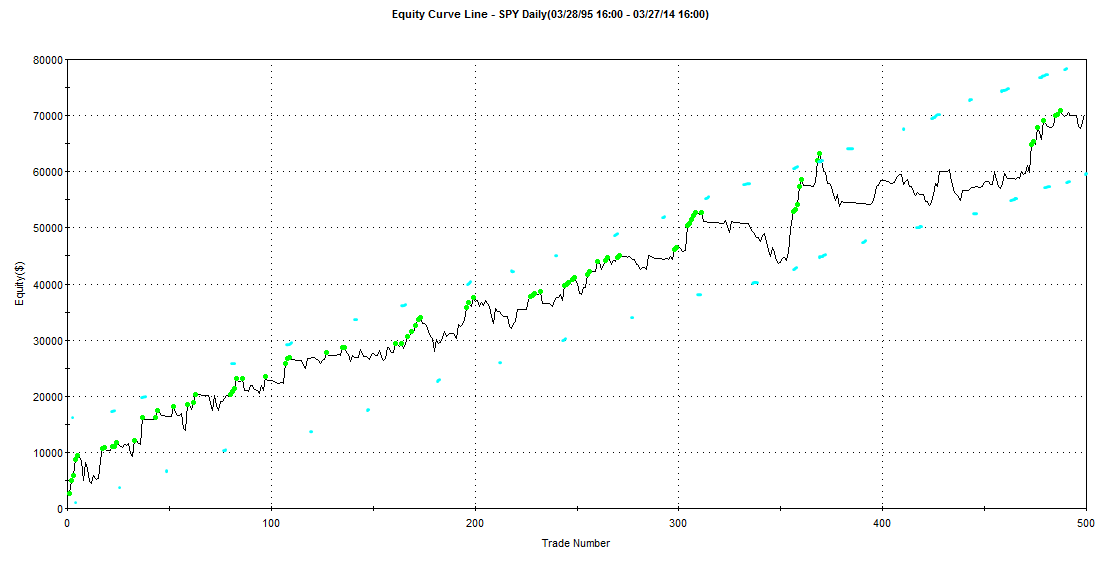

Volatility-Based Sizing

In running back tests, it’s important to understand the impact of volatility and position size. A consistent position size in number of shares or dollar amount can greatly skew historic results. If optimizing, this may lead to curve-fitting the system to periods of high volatility. Here are some examples of the impact of fixed-position sizing vs volatility-based sizing: The first … Read More

Step Four of Systems Success: Volatility

Is volatility good or bad? Let’s look at it from the perspective of run ups—potential gains, and drawdowns—potential losses. And let’s not forget real gains and real losses. Never take your eye off the ball on what we are trying to do, which is to build a trading system that is statistically reliable so that over hundreds, or even thousands of … Read More

Free Options Webinar: Greg Loehr—Taking advantage of AAPL’s low implied options volatility

SMBU’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each Tuesday, SMBU hosts an options webinar—the Options Tribe—during which veteran options traders and experts in the world of options trading share live presentations. Next week, Greg Loehr returns to the tribe to discuss ideas as to … Read More

Some Thoughts on 2014: Upside Volatility

The price action in 2012 presented a very compelling case for a strong market and low volatility in 2013 (see post on #NewNormal). It wasn’t the price action in isolation though. 2012 was in such stark contrast to the latter part of 2011 it really set off alarm bells in my head. We went from a period of massive volatility … Read More

Sizing and Entries in This Volatile Market

Surviving as a professional day trader means adapting to the ever changing conditions you’re presented with. In this volatile market how you size your positions at entry is so important. If you think you can still set stops tight like you did when the VXX was in the teens you will miss a lot of nice moves because you got … Read More

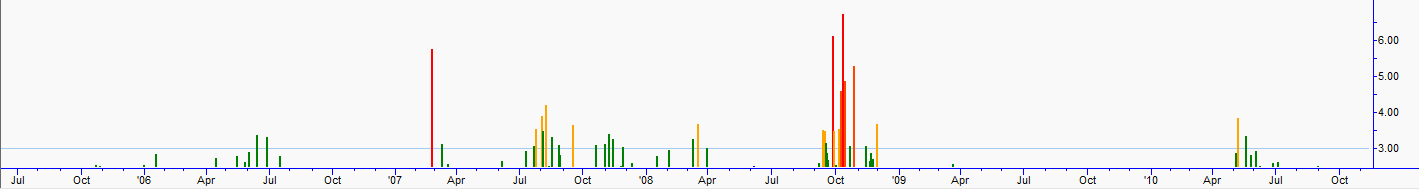

Volatility Clustering: Unveiling the Non-Random Nature of Markets

Volatility can be more predictable than the behavior of actual prices.