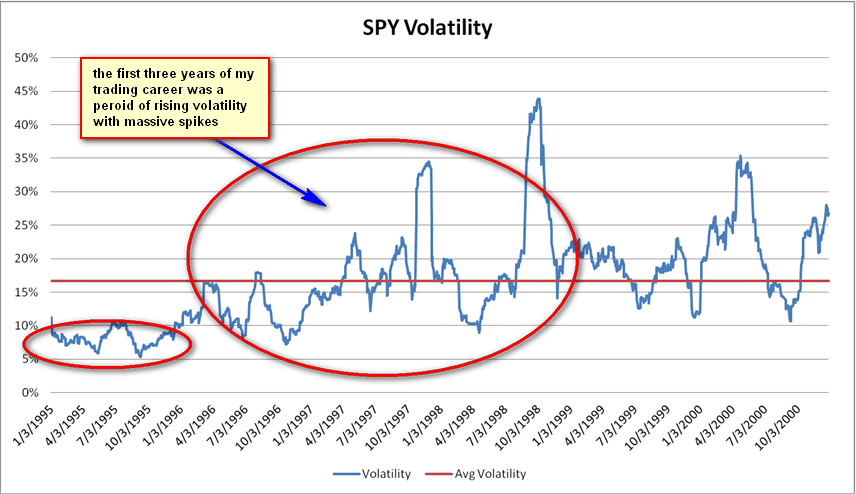

During the first three years of my trading career I participated in a stock market that seemed to move 1%+ almost every day. That market was built for short term traders. But during that same time period regulators pushed through a series of market structure changes that I believe laid the foundation for a long term decline in stock market … Read More

Sometimes Good News is The Best News To Short

Recently, an inexperienced trader asked me about a stock that traded lower after reporting great news. As any experienced trader will tell you, often that is a great opportunity to get short. Yesterday, Facebook reported amazing earnings with a slew of positive metrics. In the after hours it traded to a new all time high above 137. Yet, I got … Read More

Misery–Nothing Worked Today $CREE $STX $EAT

(1/25/17) Things didn’t work out so well today. Technically, EAT trade idea worked perfectly but I forgot to enter my “trading script” pre-market so I missed the short at 46, which worked perfectly trading down $2 to our first support area. It’s actually my second favorite setup for a stock reporting earnings: poor EPS & guidance that pops to well … Read More

Three Opening Trades–Review BABA MMM VZ

Yesterday, I made the below three trades on the Open based on our morning game plan and strategies we teach on the prop desk. It is important to spend time reviewing your trades each day to determine if you followed your trading plan and identify possible improvements on execution. BABA (win)—good #s. With large recent runup no great setup but expect … Read More

Trading lesson learned from a large loss

I am proud of a trader on our desk. He got stopped out in FNSR. In a trade that he should not have made. The trade is too fast for him. (Learn more about trading edge in this video.) He violated his stop loss. He got caught like a deer in headlights as the trade went against him. That is … Read More

Understanding Market Turning Points

Short term traders make thousands of trades each year. But not every trade is of equal importance to our bottom line. We develop a trading plan for every trade regardless of how large or small the opportunity, but with experience we begin to identify the trades that offer the greatest upside and the best risk/reward. I have found in my 20+ years … Read More

When A Stock Is Crushed

When a negative catalyst causes a stock to gap lower 20% or more it attracts a lot of attention. Should we look for a bounce? Should we stay short and look for more downside? Here are some things to consider Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and … Read More

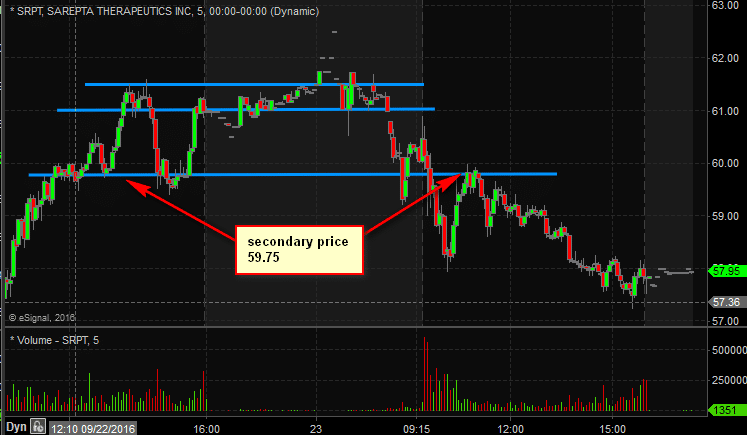

Decoding Short Opportunities: How Goldman Sachs & JPM Morgan Created Profitable Moves in $SRPT

Our #1 trading idea for Friday was SRPT. It sold $300 million of shares in a secondary offering via Goldman Sachs and JP Morgan. Normally, biotech secondaries are excellent long set ups. The prior week I had been long AERI following its secondary offering and it traded 30%+ higher in a few days. But this time was different. I discussed why SRPT was likely a good short … Read More