In this video I walk you through my thought process in developing a plan to short Red Hat following its earnings report. Each morning we develop trading plans for Stocks In Play. For more info sign up for a free trial which includes all of our trading tools and live position updates. Steven Spencer is the co-founder of SMB Capital … Read More

How To Identify A Long Term Bottom–Twitter

In this video I discuss the process by which Twitter formed a long term bottom in 2016. This lesson has broad applicability for traders/investors attempting to catch larger moves (30%+) in the stock market. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 20 … Read More

A Macro Trade That Is Working

Rarely if ever do I develop a trading thesis that involves macro analysis and a time horizon greater than a few months. But through conversations with pro traders with experience in the energy sector and reading a few excellent analyses on the oil sector I came to view oil as a great risk/reward long trade from the high $30s up … Read More

Old School Market Manipulation

So my friend JC Parets tweeted recently that he is miffed by traders and investors complaining about market manipulation and not formulating a plan to profit from said manipulation. His point is, I think, as market participants our job is to find ways to extract profit from the market and if we recognize patterns/manipulations then we should have a plan … Read More

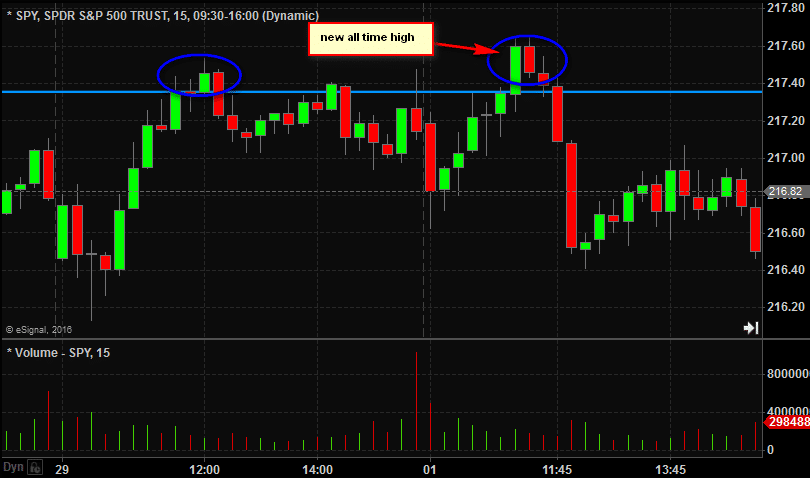

That Was Different—Did You Make Money?

In short term trading we are always on the lookout for something that looks “different”. That is where edge is. That is where good risk/reward is. The past few weeks the SPY has been bopping up and down in a tiny range. After four or five days it was unusual. After two weeks it was historic. Every short term trader was focused … Read More

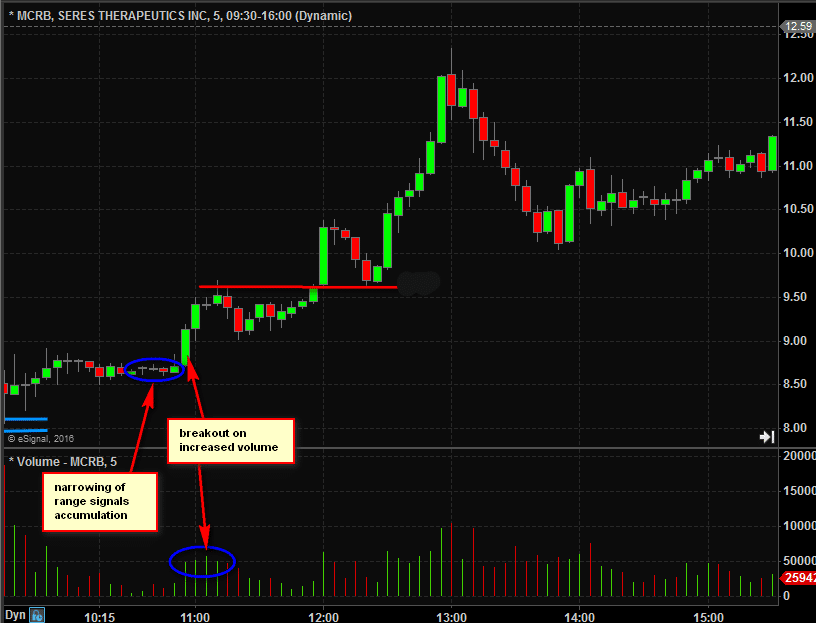

Seizing Opportunities: Making Money in Pre-Market Trading with SRPT

We are in the heart of earnings season and as short term traders this is where the majority of our attention is focused. But on Friday July 29th there was a major fundamental catalyst in MCRB. Its FDA drug trial had failed. The stock was trading lower more than 50%. By 8AM before the market had opened it had already … Read More

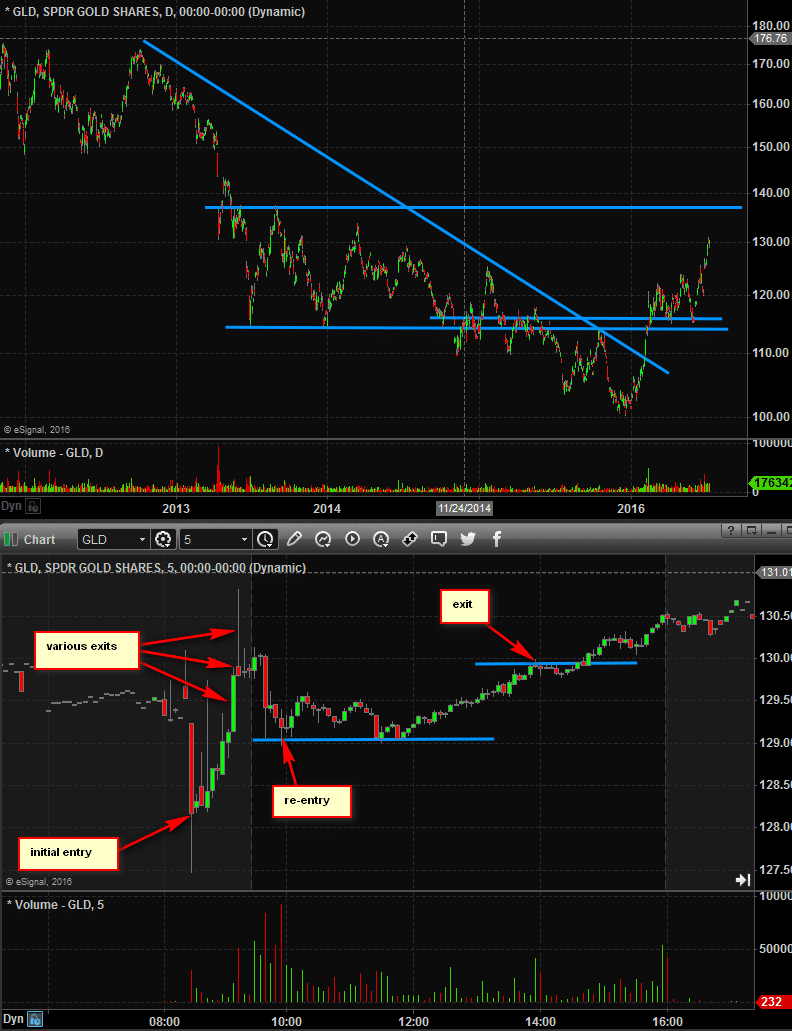

Why Buy Gold On A “Risk On” Day?

I received the following email last night while watching Netflix: Dear Steve, my name is Guglielmo and I’m glad to be part of the Trader90 community. I trade from Singapore. Yesterday in the AM meeting you were discussing GLD as a long being a very strong stock. At the same time, we saw the strong NFP numbers, suggesting … Read More

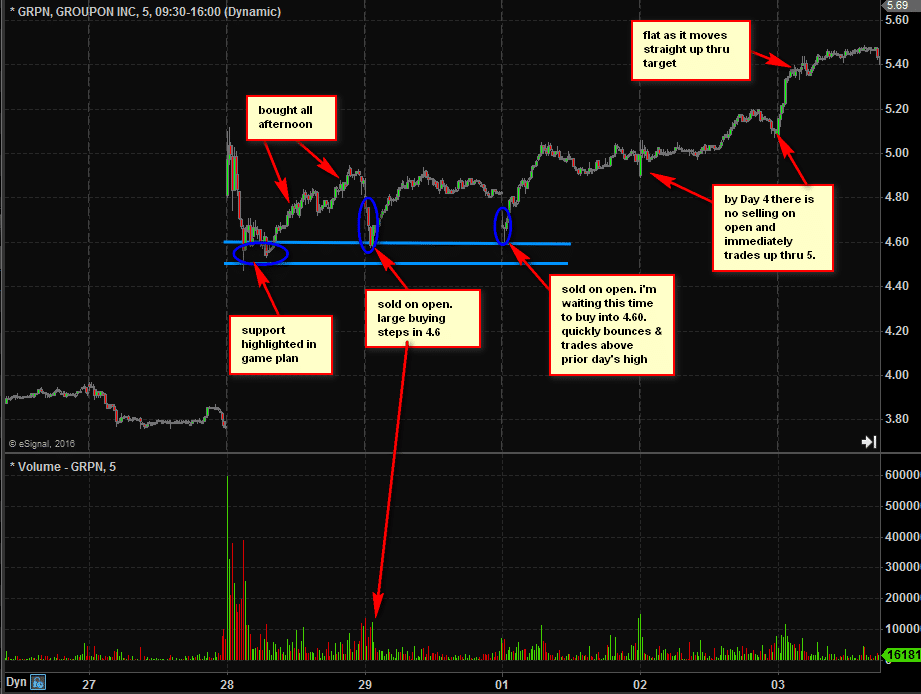

Wandering Off The Path

(May 25th 2016) I had a very disappointing day. I Lost money in trades that weren’t part of my pre-market game plan. And I Didn’t make money in the trades I outlined in our AM Meeting. When the day is over and I review my work I’m primarily measuring my results against how I executed on the opportunities that were identified prior … Read More