normally i don’t blog during trading day but unusual circumstances…we failed right at the level i tweeted pre-market around 193. great spot to short and many traders did. sellers now in control and that only changes if we break the downtrend moving back above 190. a hold above 190.50 would give us a chance to close in the 191.50-193 level … Read More

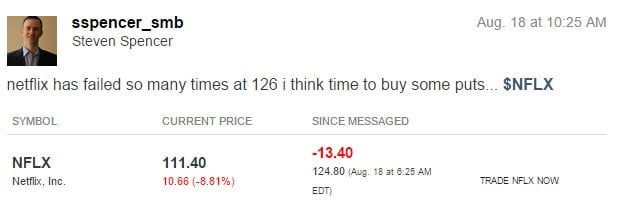

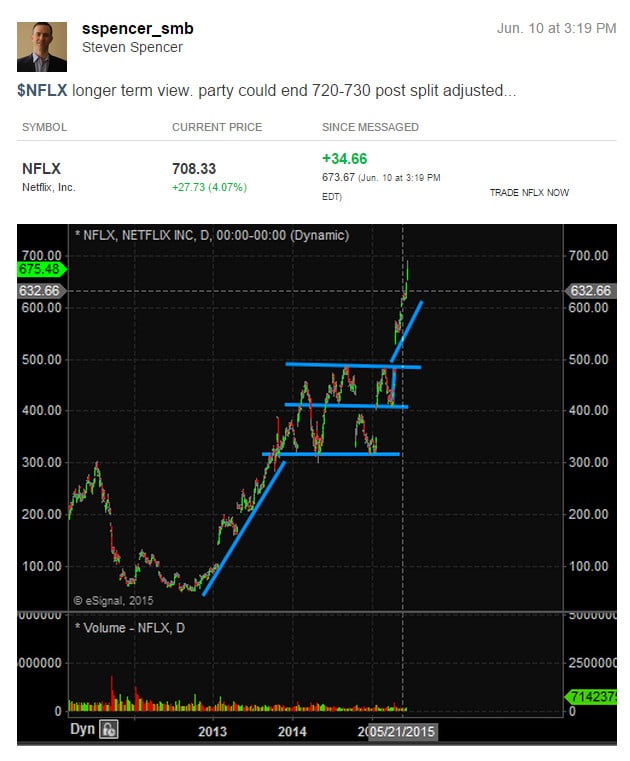

The Anatomy of A Selloff—Netflix

Netflix has been the #1 momo stock for the past few years. Recently, its ascent began to accelerate at an unsustainable pace. When a stock begins to behave like this it is time to look for low risk high reward entries on the short side. Here are a few things you can look for as clues when to open the … Read More

The Analyst Downgrade Bottom–Micron

When a stock has been in a longer term down trend there are many ways that it can put in a tradeable bottom (assuming it isn’t a commodity stock in which case it may just file for bankruptcy at some point). The fundamental cause of its down trend goes away. This is what happened in Apple in 2013 after its 40% … Read More

“This Stock Is Going To Zero”

Yesterday we started looking at SUNE as a good bounce candidate. Since issuing a profit warning the stock had sold off over 50% in a matter of days. We had been receiving pretty good news flow that large buyers began accumulating the stock around $16 and as it approached its 52 week low our expectation was that it would bounce … Read More

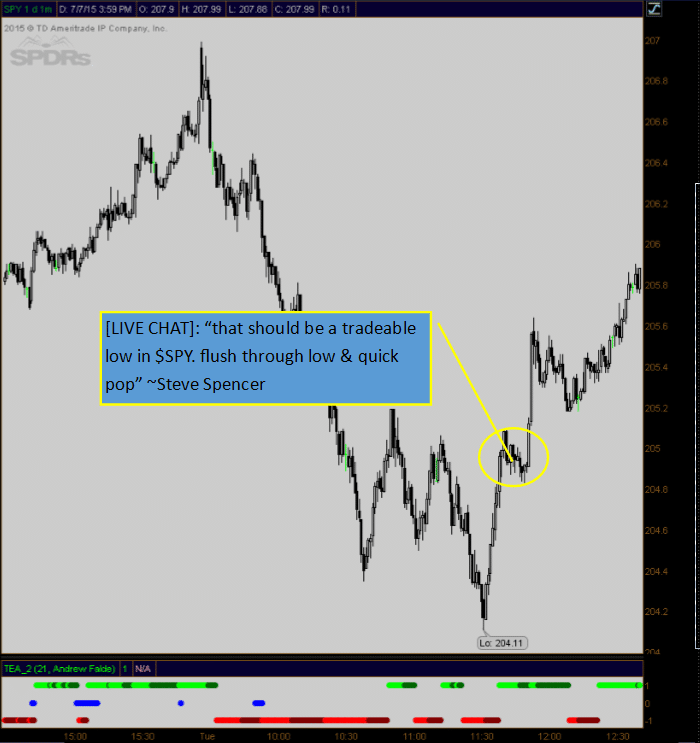

Study Price Action & Stop Being A Silly Troll

Back in April I tweeted a picture of a SPY chart that I thought was rather instructive. Here is the chart: A few things we can take away. The first is that the SPY 204.30 had been tested in February and then again in March. The bounce in March was very fast moving from the low to SPY 211 in … Read More

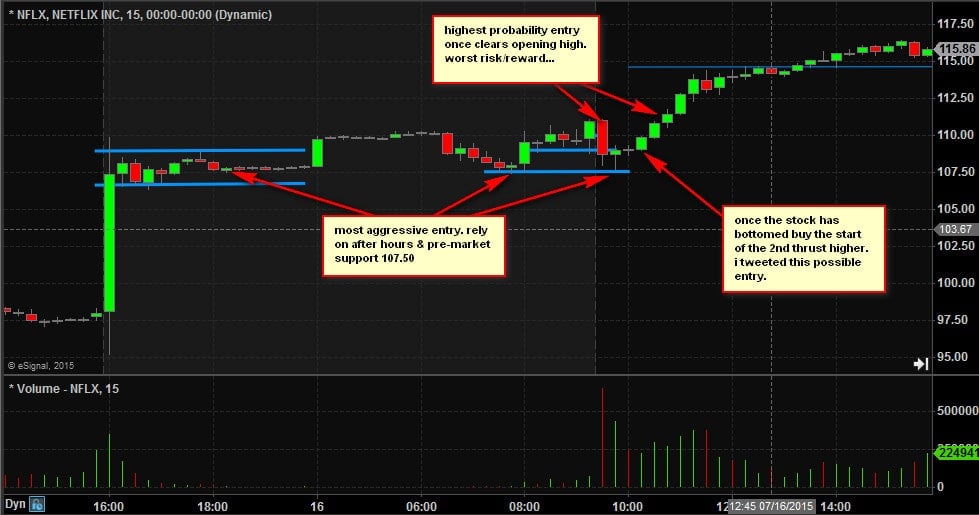

Netflix Reported Earnings–This is What Happened Next

I have been trading “momo” stocks for almost two decades. What makes stocks like NFLX, TSLA and FB so enjoyable to trade at times is the almost monolithic behavior of their large investors. This behavior greatly increases the risk/reward for short term trading setups. That is why I always spend time covering these stocks in detail in our AM Meeting … Read More

Why I’ll Be Trading Netflix Tomorrow

Netflix is the undisputed heavyweight champion of momentum stocks. Many have the false impression this makes it a great stock to trade on a daily basis. Oh contraire! For years its intra-day behavior has been quite erratic. But occasionally it sets up quite well. And when it does you should pay attention. Tomorrow, NFLX will begin trading split adjusted 7:1. … Read More

Today’s Trading Highlights

Here are some quick highlights from today’s trading. In the AM meeting, Steve talked about the 208 resistance level that $SPY had failed to hold above numerous times. This was a level to be short from. With the overnight session looking calm and almost strong, this flew in the face of price action at the moment. The level held once again … Read More